Posted on 10 Apr 2025

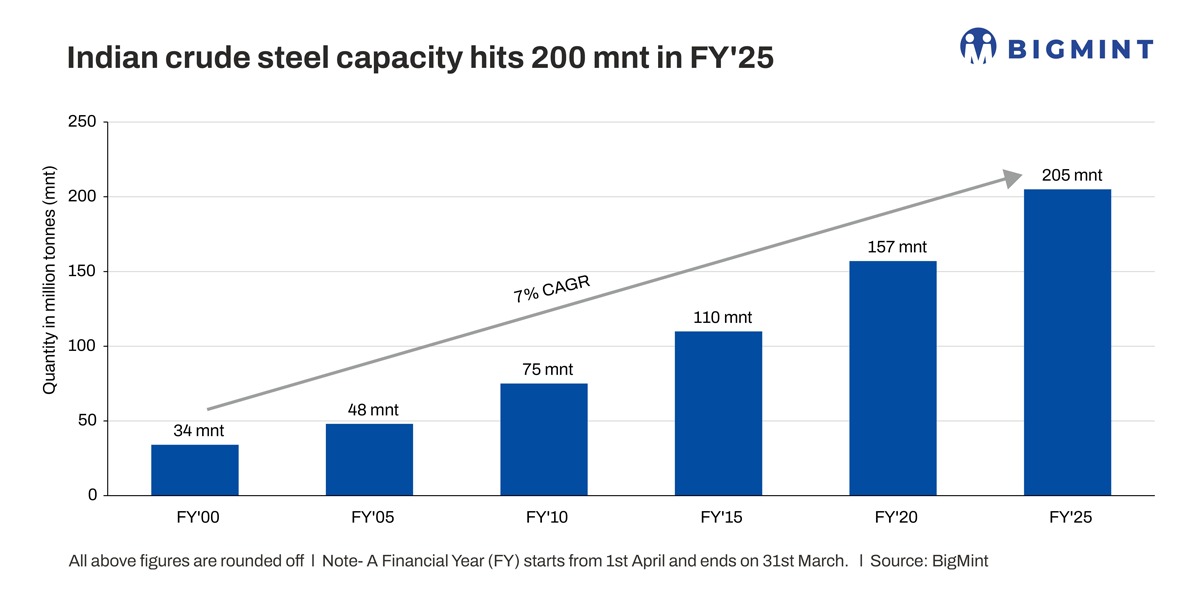

Morning Brief: India's crude steel production capacity increased by over 10% y-o-y in FY'25 to reach 205 million tonnes (mnt) as against 186 mnt in FY'24, according to provisional data maintained with BigMint. Capacity has almost doubled in the last 10 years from 109 mnt in FY'15.

This phenomenal surge in capacity aligns with fast-paced economic growth and urbanisation, government spending on infrastructure, as well as raw material self-sufficiency to an extent. Expansion in capacity has happened in both the private and public sectors, with major producers such as JSW, Tata Steel and SAIL witnessing rapid growth in production capacities required to meet increasing demand.

BigMint data show that combined capacity addition by the primary mills was around 13 mnt in FY'25 compared with the preceding fiscal. JSW, Tata Steel, JSPL and AM/NS India have ambitious expansion plans in the coming years. SAIL has announced an investment pipeline of over INR 100,000 crore to raise capacity to 35 mnt by 2030.

Route-wise capacity growth

Provisional data show that capacity expansion in the dominant steelmaking routes has been quite sharp over the last couple of years. BF-BOF-based capacity has witnessed the sharpest uptick of over 17% y-o-y to reach 88.5 mnt in FY'25.

On the other hand, induction furnace-based steelmaking capacity increased by 9% y-o-y to 74 mnt, while EAF-based capacity remained largely stable at around 43 mnt.

Engines of steel capacity expansion

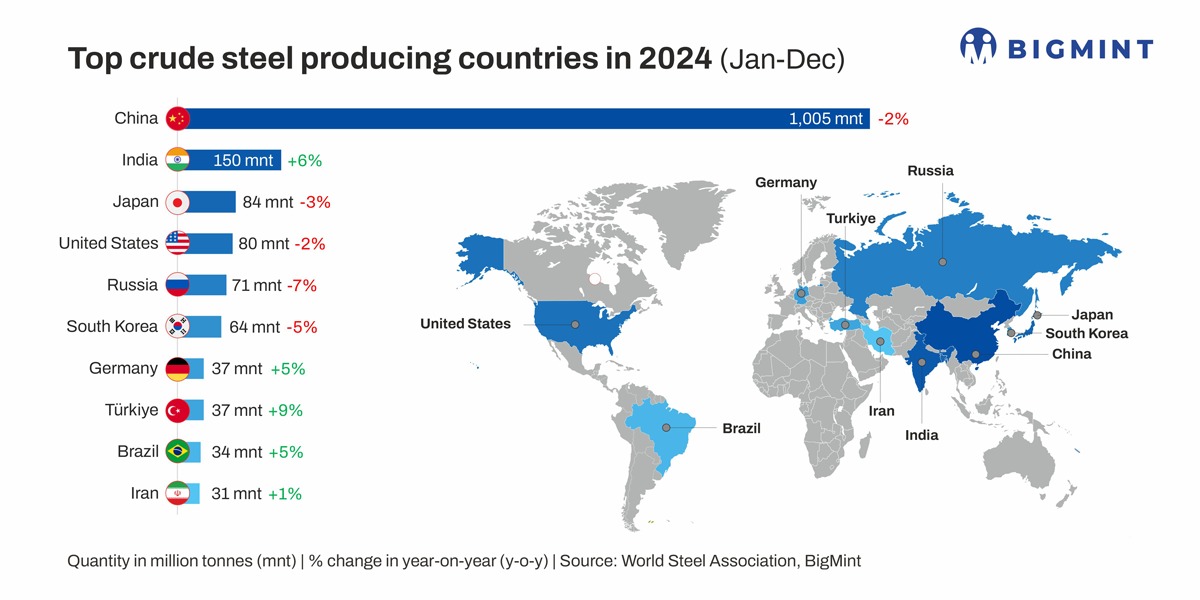

Infra growth driving steel production: India's crude steel production is projected to have increased by 6% y-o-y in FY'25 to reach 152 mnt, as per data, from 144 mnt in the preceding fiscal. Crude steel output growth has been consistent, around 50 mnt since FY'18 when production stood at roughly 103 mnt.

The massive public spending announced in Budget 2025 for large connectivity projects and urban development, with an allocation of over INR 11.5 lakh crore for capital expenditure to propel infrastructure, is driving steel consumption. Major government initiatives such as housing for all, Bharatmala, Sagarmala, dedicated freight corridors of the Indian Railways, civil aviation and airports, metro railways, etc. account for rising steel consumption and production.

GDP growth & steel production: Generally, growth in steel production and consumption closely tracks GDP growth. However, the steel demand surge has outpaced GDP growth especially in the post-COVID period, with GDP bouncing back to over 7.5% growth in FY'22 from de-growth in FY'21, while steel consumption growing at a CAGR of 10-12%.

Govt policy push: The National Steel Policy envisages crude steel capacity to touch 300 mnt by 2030. The National Manufacturing Policy aims to raise manufacturing's share in GDP to at least 25%. The National Logistics Policy (NLP), 'Make in India' and the PLI scheme are set to boost domestic steel production.

Moreover, the government has cut import levies on critical steelmaking raw materials such as ferrous scrap to zero and introduced landmark changes in the MMDR Act to facilitate auctions of mineral resources leading to greater production of steelmaking raw materials such as iron ore, coal, limestone and ferro alloys.

Outlook

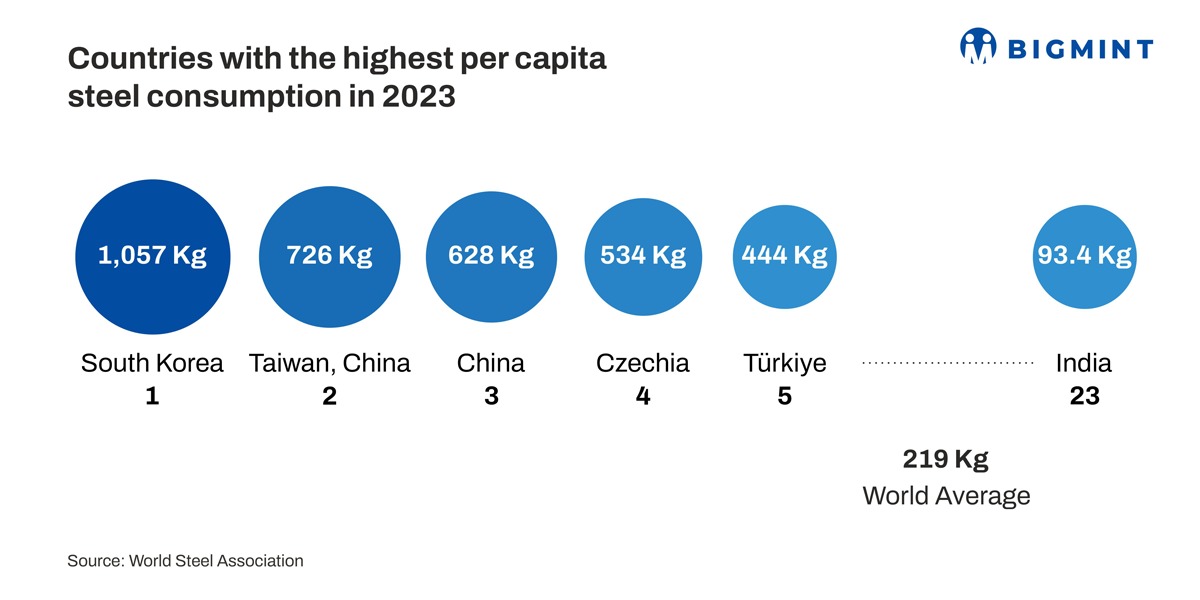

As per provisional data available with BigMint, India's steel consumption is expected to be around 149 mnt in FY'25. Per capita steel consumption in 2023, as per WSA data, was 93.4 kg, which is expected to have increased since then. However, the global average is around 220 kg, while consumption is far higher in the developed economies.

Domestic capacity expansion seems to have outpaced consumption and crude steel production in FY'26 may be higher than domestic consumption. Such a scenario may lead to oversupply, thereby pressuring prices and producer margins.

Channelling higher domestic production into the export markets is an option; however, global trade protectionism and tariff wars, oversupply, inflation and weak demand in the advanced economies and China, are weighing on prices and export prospects.

Even as the EU has tightened its steel safeguard mechanism, the US, Vietnam, Malaysia and other countries have come up with tariffs and levies. India's steel exports are expected to drop sharply by 30% y-o-y in FY'25.

Therefore, a demand-supply imbalance is likely to appear in the market which could impact prices and the industry adversely. How will the demand-supply balance evolve in FY'26? What might be its impact on prices and steel supply chains?

Source:BigMint