Posted on 10 Apr 2025

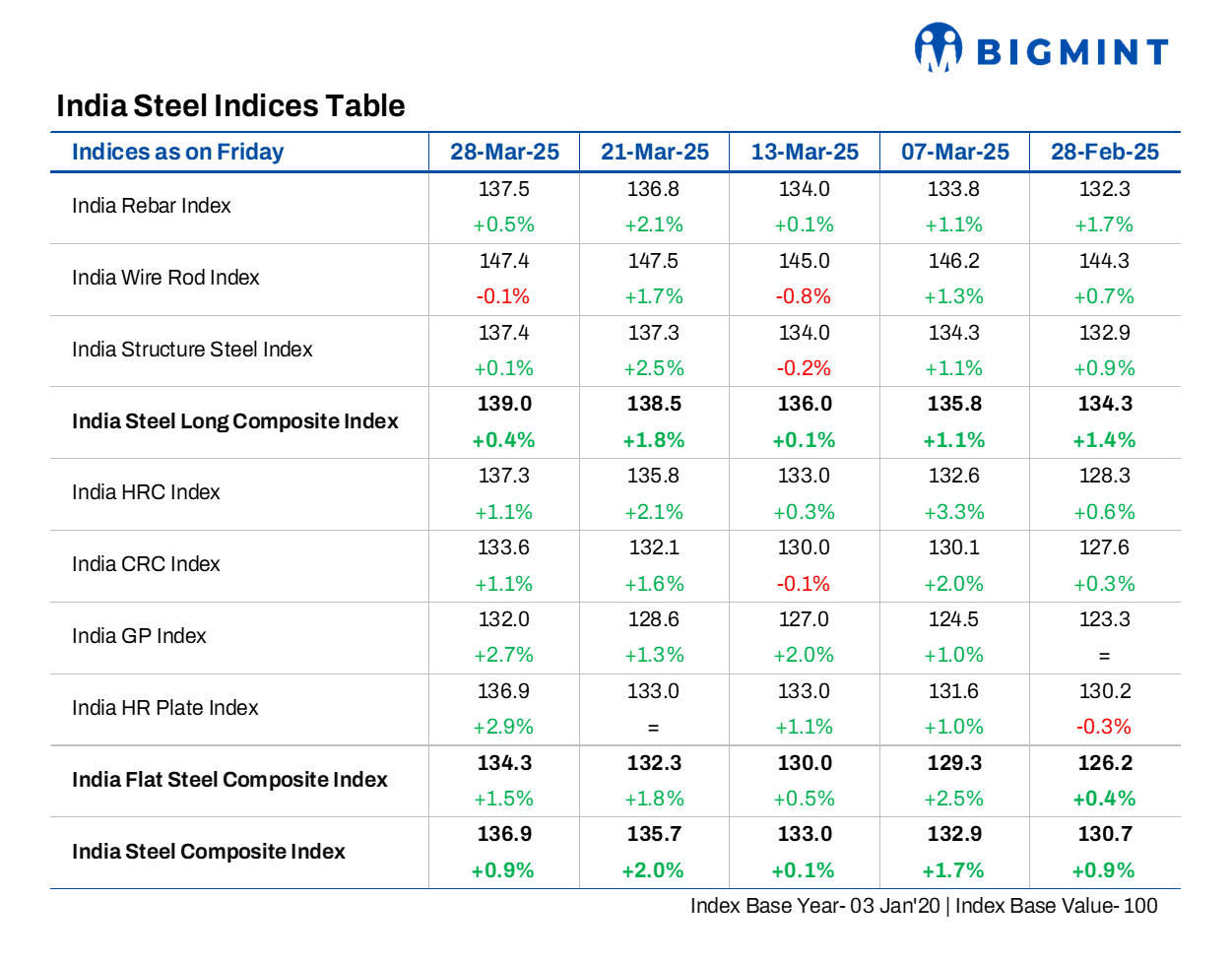

Morning Brief: BigMint's India Steel Composite Index climbed up by 0.9% w-o-w to a nine-month high of 136.9 points on 28 March 2025, as prices continued to rally following the safeguard duty recommendation. Supply shortages also pushed up prices in certain segments.

Both the longs and flats sub-indices moved higher last week. Longs recorded a more modest growth of 0.4% w-o-w to reach 139 points, a five-month high. Meanwhile, flats stood at a seven-month peak of 132.3 points, up by 1.5%. Hot-rolled (HR) and galvanised plates (GP) were the biggest gainers last week, surging by 2.9% and 2.7%, respectively.

Factors impacting index

HRC prices rise as supply crunch emerges

Domestic hot-rolled coil (HRC) prices continued their uptrend last week as well, with BigMint's benchmark assessment for HRCs (IS2062, Gr E250, 2.5-8 mm/CTL) increasing by INR 1,350/tonne (t) ($16/t) w-o-w to INR 52,000/t ($608/t) ex-Mumbai on 28 March.

The surge was driven by three factors:

a) Tight supply in the domestic market allowed suppliers to raise their offers.

b) With imported HRCs being scarce, buyers turned to domestic material. Notably, India's bulk imports of HRCs and plates stood at 319,404 t as of 24 March, based on vessel line-up data, with another 26,977 t expected to arrive by the month-end.

c) A buoyant export market, especially in the EU, where India's offers rose $20-25/t w-o-w, supported the upward momentum in prices. However, demand was slow, as high prices kept buyers hesitant about raising their raw material costs. Trades were also slow due to the FY-end approaching.

Meanwhile, cold-rolled coil (CRC) prices surged by up to INR 1,300/t ($15/t) w-o-w to INR 56,000-59,000/t ($655-690/t) across locations. However, they were stable w-o-w at INR 57,600/t ($673t) ex in Mumbai.

GP prices moved up by INR 1,400/t ($16/t) w-o-w to INR 63,000/t ($736/t) in Mumbai, while rising by INR 1,300-2,300/t ($15-27/t) in other locations. While optimism around the safeguard duty has been a key factor behind the recent rise in GP prices, supply disruptions, following AM/NS's Corex facility going offline, have also contributed to the uptrend.

HRC exports to EU gain momentum

India's HRC export offers to Europe climbed up by $20-25/t w-o-w to $630-635/t CFR Antwerp. This rise comes amid stronger European domestic prices and India's exemption from the EU's anti-dumping duties.

Conversely, in the Middle East and Vietnam, Indian mills remained reserved in their offers, with market activity in the Middle East on pause due to Eid and subdued domestic demand in Vietnam.

BF rebar tags surge on list price hikes

Trade-level blast furnace (BF) rebar prices also increased, up by INR 1,000/t ($12/t) w-o-w to INR 56,000/t ($655/t) exy.

Major mills raised list prices by INR 500-1,000/t ($6-12/t) to INR 54,500-55,500/t ($637-649/t) on landed basis, BigMint learnt. Notably, mills have raised list prices a couple of times over this past month.

Supply dwindled in the market, permitting distributors to charge higher. There were supply disruptions from mills, and certain sizes were out of stock.

In the projects segment, prices remained high at around INR 54,500-55,500/t ($637-649/t) FOR Mumbai. There was robust demand, with project completion deadlines approaching before the closure of the financial year.

IF rebar prices volatile amid limited trades

Trade prices of induction furnace (IF) rebars experienced mixed movements w-o-w, with tags in Mumbai at INR 49,300/t ($576/t) exw on 28 March, down INR 100/t ($1/t) w-o-w.

Last week saw need-based purchases, as buyers had already secured sufficient volumes earlier. Lifting of material was smooth, though a few traders reported delays in receiving orders, as some mills faced logistical challenges due to a significant backlog.

Although mills received fewer orders at higher prices, there was no selling pressure, with inventory idling time standing at seven to eight days. As a result, they either adjusted their discounted offers or marginally reduced prices for certain sizes.

Outlook

Despite buyers showing some resistance, HRC and CRC prices may hold firm, supported by supply shortages and declining imports. Mills are expected to announce HRC price hikes of INR 1,500-2,000/t ($17-23/t) for next month.

In tandem, suppliers in Mumbai are also keeping offers on the higher side, though they have not accepted orders yet, having closed their sales for this fiscal. Prices in north India's Faridabad may face pressure as suppliers focus on clearing stocks. Chennai is likely to see stability as market participants do not foresee a substantial impact from the safeguard duty.

Notably, AM/NS's Corex has resumed operations. This will help normalise supply, especially in the GP market, which has seen prices skyrocket by INR 4,500/t ($53/t) over the past month. However, in the near term, GP prices will remain elevated, buoyed by further list price hikes.

BF rebar prices may remain steady in the short term due to limited availability. Mills have hinted at an increase in their list prices for April dispatches, which is also expected to boost prices. IF rebar prices may see positive trends amid favourable market sentiments.

Moreover, the outlook for the Indian HRC export market remains strong. Material flow to the EU is expected to be robust, with trade dynamics shifting in India's favour following the European Commission's recommendation of anti-dumping duties on Egypt, Japan, and Vietnam. Additionally, the Middle East market may see restocking activity as Ramadan comes to an end.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint