Posted on 03 Apr 2025

The pessimism that undermined China's steel market performance in March is expected to continue dragging on the country's steel prices in April, Mysteel's Chief Analyst Wang Jianhua predicts in his latest monthly market outlook. But resilient demand from steel end-users may offer some support later in the month, he suggests.

During March, China's average composite steel price was assessed by Mysteel at Yuan 3,556/tonne ($489.1/t) including the 13% VAT, lower by some Yuan 44/t from the average price in February.

The frequent antidumping actions brought against Chinese steel products in the international market had fuelled anxiety among domestic market players last month and weighed on steel prices, Wang noted. Entering this month, "the growing number of tariff increases imposed by the US could further intensify the bearish sentiment in the Chinese market," he warned.

For example, Washington's 25% import tariff on automobiles and auto parts is set to take effect on April 2, and more tariffs are in the works regarding more commodities, as Mysteel Global reported.

If additional tariffs are imposed on industries where steel intensity is substantial such as in the machinery, transportation, and household appliance sectors, China's steel production will inevitably be affected, especially considering that the country's steel exports remain high, according to Wang.

Moreover, future restrictions on China's steel exports will not only stem from the trade policies of other countries, but also from tighter controls imposed by the domestic government, Wang stressed.

On March 28, five Chinese government departments jointly issued an announcement, clarifying that taxable steel exports will be subject to the same value-added tax (VAT) and consumption tax as if sold domestically, as Mysteel Global reported. This policy reflects the authorities' commitment to combat tax evasion in China's steel exports, Mysteel Global noted.

"Currently, around one million tonnes of steel are exported each month that bypass the value-added tax," Wang explained. "Once this portion of steel can no longer be exported, steel supply for domestic users will further expand, exerting downward pressure on steel prices," he cautioned.

Nevertheless, this month China's steel market is still in the traditional peak season for steel consumption in spring, and market fundamentals is expected to improve further supported by the resilient domestic demand, according to Wang.

"Although there is a common perception of an oversupply of steel in the domestic market, the low steel inventories suggest that supply has been effectively absorbed by end-users," he pointed out.

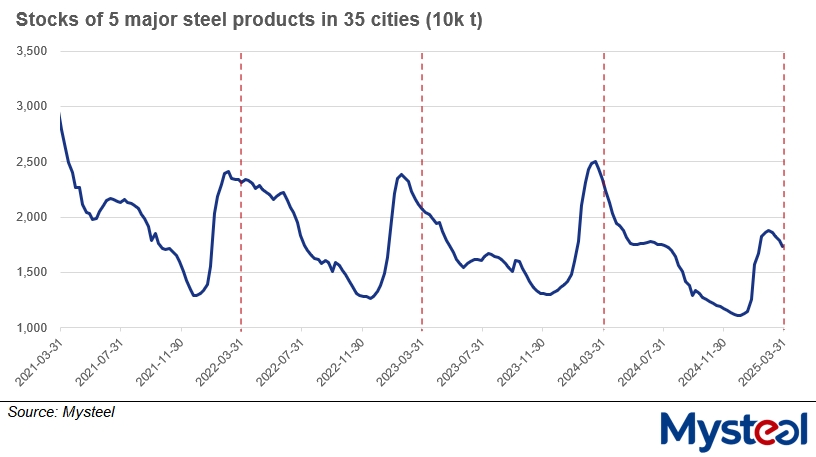

By the end of March, the total inventories of the five major carbon steel products held by steelmakers and trading houses across the 35 cities under Mysteel's monitoring had dropped by 7.5% on month to reach 17.4 million tonnes, which was also 22.4% lower from the same period last year.

The decline in steel inventories was significant despite the ongoing production ramp-up among steel mills, with the total hot metal output among the 247 blast furnace steelmakers under Mysteel's survey averaging 2.34 million tonnes/day in March, higher by 2.5% from February.

For April, the increases in China's Purchase Managers' Index – especially the indices for new orders for manufacturing and business activity in the construction sector –indicate that steel demand is likely to continue growing, Wang said.

Mysteel estimates that the total consumption of the five major carbon steel products will rise by 1.5-2 million tonnes in April, leading to a decline of 1-1.5 million tonnes in the total steel inventories by the end of the month.

"The improving fundamentals are expected to offset the pessimism that will haunt the steel market in early April, potentially allowing steel prices to bottom out and recover later this month," Wang believes.

Source:Mysteel Global