Posted on 05 Mar 2025

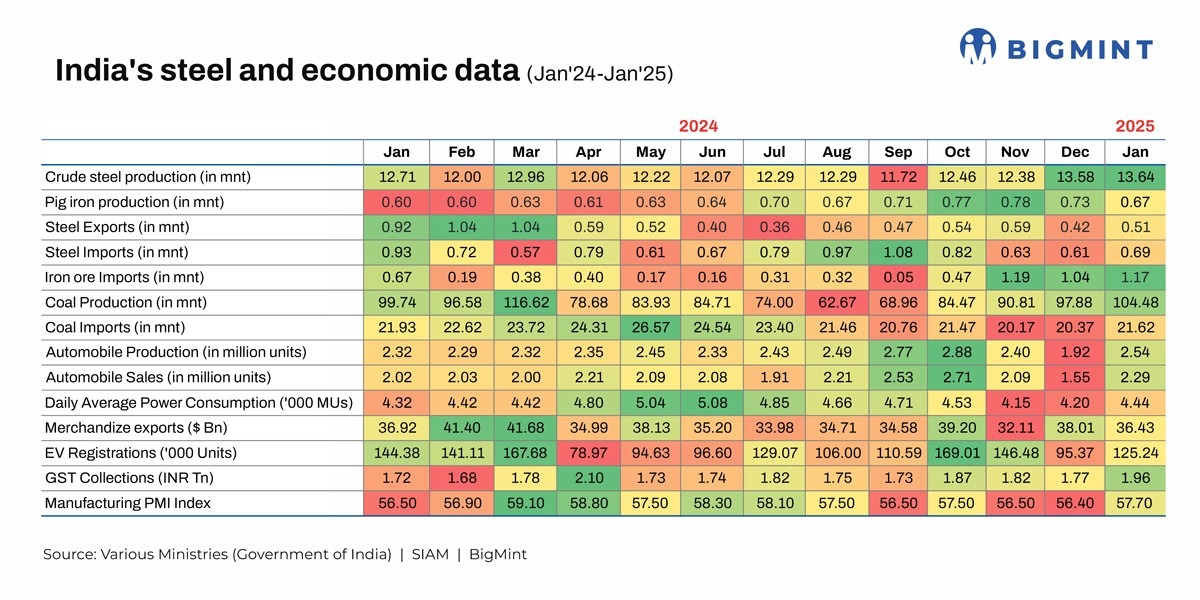

Morning Brief: India's macroeconomic indicators logged steady growth across segments in January 2025, as compared to December 2024, indicating a promising start to the year despite apprehensions of weaker performance.

For instance, India's crude steel output was stable, while coal and auto production recorded upswings. Parallelly, steel exports, auto sales, electric vehicle (EV) registrations, GST collections, power consumption, and manufacturing also improved.

The auto sector was certainly the star of the show, with both production and sales witnessing a surge, as well as EV registrations. However, merchandise exports declined while imports increased, widening the trade deficit by $1 billion.

BigMint goes behind the scenes:

Crude steel production rises

Crude steel production edged up by 0.4% m-o-m to 13.64 million tonnes (mnt) in January against 13.58 mnt in December, driven primarily by stable steel consumption.

Additionally, expectations of a demand recovery during the winter, amid speculation over safeguard and anti-dumping duties, encouraged mills to boost output.

Subdued sales force pig iron output cuts

Pig iron production declined by 8.2% m-o-m in January to 0.67 mnt, extending the downtrend seen since November. Amid subdued demand, steelmakers struggled with slow lifting of inventories. This pushed mills to minimise their pig iron production.

Steel exports rebound, volumes to EU jump

Steel exports climbed up by 21.4% m-o-m to 0.51 mnt, driven by a surge in volumes to the EU. Indian exporters took advantage of the EU's quarterly quota reset to send across larger volumes amid concerns regarding the outcome of the anti-dumping investigation and the steel safeguard measures review. However, steel exports plunged by 44.6% y-o-y.

Increased shipments from South Korea boost steel imports

Worryingly, steel imports were also higher by 13.1% m-o-m though down by 25.8% y-o-y at 0.69 mnt in January. The influx of Chinese steel continued at a stable pace, while shipments from South Korea soared.

High domestic iron ore pellet, lumps prices push mills to turn to imports

Iron ore imports recorded a notable rise of 12.5% in January 2025, to 1.17 mnt. Lumps and pellet tags were comparatively high in the domestic market and certain grades were in short supply, which prompted some Gujarat-based steel mills to source pellets from the MENA region, a first in the past four years. This contributed to the uptrend in iron ore imports to India.

Additionally, iron ore production grew 10.2% to 28 mnt in January compared to 25.4 mnt in December, as per provisional data. Conversely, iron ore exports fell 5% m-o-m to 2.04 mnt amid lacklustre demand from China.

Coal output rises; coking coal imports surge

Coal production in India climbed up by 6.7% m-o-m to 104.5 mnt in January 2025 in keeping with rising demand for the dry fuel. Coal India Limited (CIL), the leading producer in the country, saw its output increase by 7.5% to 77.79 mnt against December's 72.37 mnt.

January's coal imports stood at 21.62 mnt compared to 20.37 mnt in December, reflecting an increase of 6.1%. Notably, due to the implementation of quantitative restrictions (QRs) on the import of low-ash metallurgical coke, steelmakers were forced to source coking coal in larger volumes - a 46% surge, as per BigMint's data. Meanwhile, non-coking coal inventories at Indian ports were also 5% higher in January compared to December.

Auto sales surge on fresh launches, discounts

The automobile segment made a strong comeback in January, with production and sales surging by 32.3% and 47.7% m-o-m to 2.54 and 2.29 million units, respectively. In December, both were at an intra-year low.

Factors such as the launch of new models, the onset of the wedding season, and heavy New Year discounts boosted sales. Similarly, EV registrations moved up by 31.3% to around 125,240 units, recovering from a subdued performance in December.

Winter chill keeps power consumption up

Daily average power consumption increased 5.7% in January, in the wake of increased manufacturing activity and higher heating requirements during winter.

Merchandise exports dip, trade deficit widens

Merchandise exports experienced a 4.2% m-o-m dip to $36.43 billion, weighed down by a marked drop in shipments of petroleum products amid weak demand. However, this was partially offset by strong growth in electronic goods, drugs and pharmaceuticals, and rice, among other commodities. Conversely, merchandise imports climbed up by 10.3% over the same period to $59.42 billion. This put India's trade deficit at roughly $23 billion, wider m-o-m by around $1 billion.

Manufacturing activity rises on strong demand, slowing inflation

The manufacturing purchasing managers' index (PMI) expanded by 2.3% in January 2025 due to (1) strong growth in new orders, (2) slowing input cost inflation, (3) higher price realisations, and (4) a sharp uptick in exports.

Notably, the Wholesale Price Index (WPI) inflation softened to 2.31% in January against 2.37% in December as prices of food articles fell, though crude petroleum and natural gas, minerals, oil, and electricity became costlier.

Additionally, GST collections hit a 9-month peak in January, increasing by a robust 10.7% to INR 1.96 trillion.

Outlook

Uncertainty shrouds February's figures amid the steady currency depreciation and the announcement of US steel tariffs. These might halt the decline in WPI inflation as well as lead to a slowdown in manufacturing activity. To illustrate, data shows that India's manufacturing PMI in February stood at 56.3, a sharp drop from 57.7 in January. This also marks the slowest growth since December 2023, attributed to subdued sales and output volumes.

Source:BigMint