Posted on 05 Mar 2025

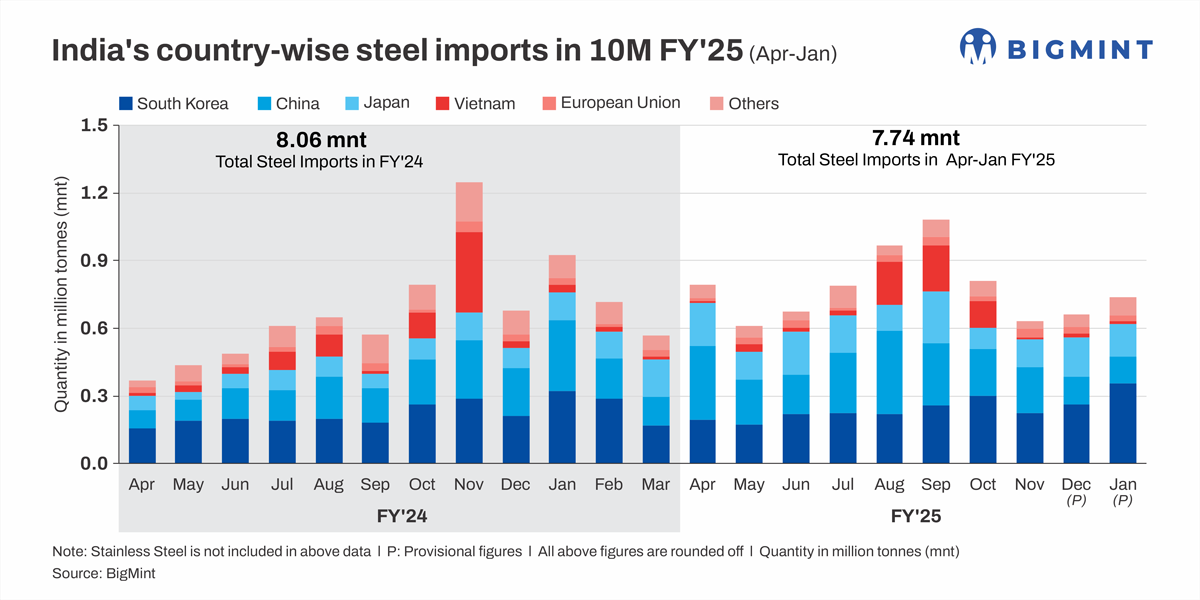

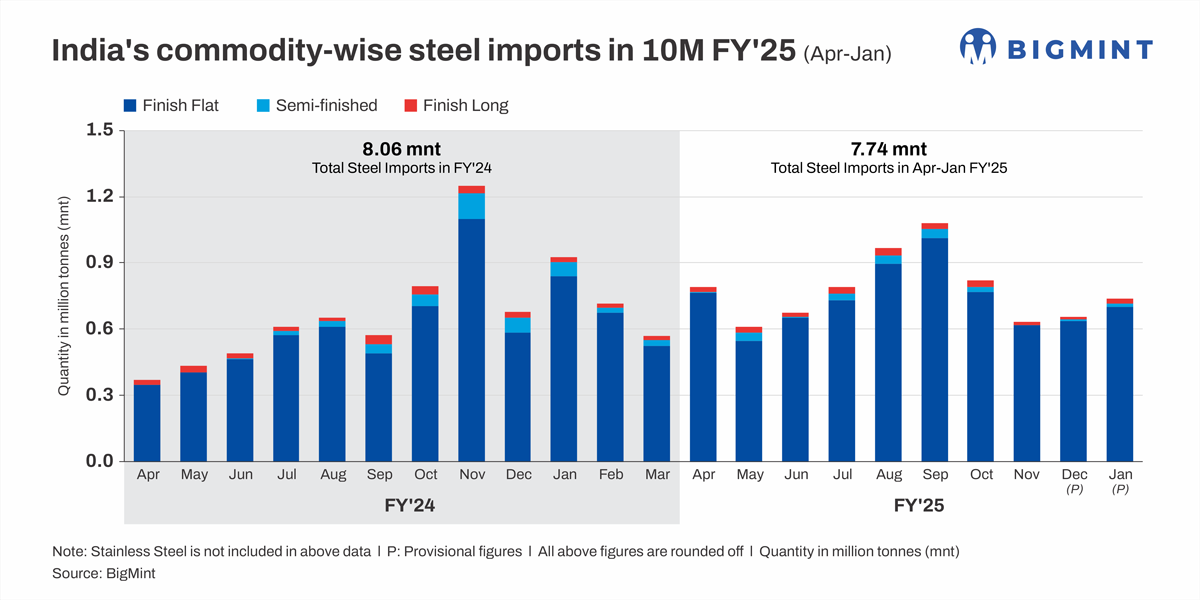

Morning Brief: Steel imports by India, including finished and semi-finished steel, rose by 12% m-o-m to reach around 740,000 tonnes (t) in January 2025 compared with over 660,000 t in December 2024, as per provisional data available with BigMint. Even as frenzied speculations about a proposed safeguard duty were rife, India's steel imports increased considerably m-o-m in January.

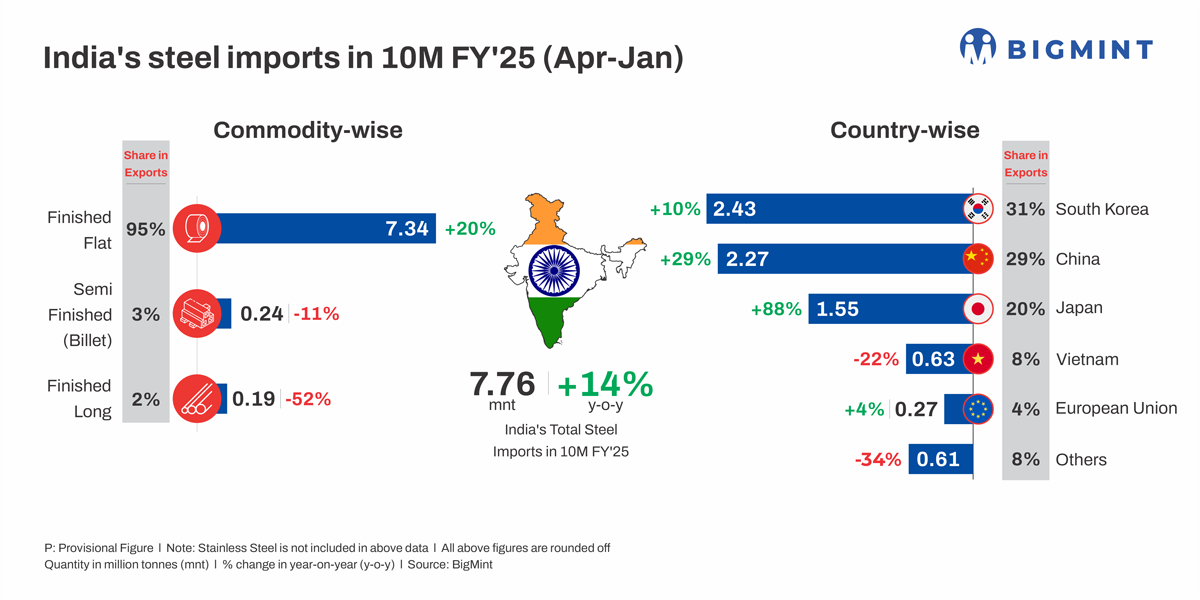

In April-January of FY'25, India's steel imports are assessed at roughly 7.76 million tonnes (mnt), an increase of 14% y-o-y.

The share of finished flat steel imports stood at an overwhelming 95% in 10MFY'25, while the rest was semi-finished and finished longs, which recorded a decline in imports y-o-y. In contrast, imports of flat products increased by 20% y-o-y.

Key steel exporting countries

Notably, over 82% of total steel imports in January came from South Korea, Japan and China, comprising predominantly of flat products. In 10MFY'25, South Korea shipped around 2.43 mnt of steel to India, which comprise about 31% of total imports.

In comparison, imports from China were assessed at around 2.23 mnt, an increase of nearly 30% y-o-y. With total shipments at 1.55 mnt, imports from Japan increased by a mammoth 88% y-o-y in April-January of the current fiscal.

What's driving steel imports?

Aggressive exports by China: Throughout the better part of this fiscal, Chinese steel exports have increased rapidly touching over 111 mnt in CY'24. This aggressive stance stems from shrinkage in domestic demand in China with the implosion of the real estate and construction sector in that country, which has been the mainstay of steel demand in China. Volumes from China increased by 29% in 10MFY'25 as Chinese mills wanted to make the most of their Bureau of Indian Standards (BIS) licences before expiry. BigMint data show that Chinese HRC export offers on average fell 12% in 2024 to $519/t CFR against $593/t in 2023. Therefore, the landed cost of HRC from China remained extremely competitive as against domestic prices.

Higher shipments from FTA countries: India has free trade agreements (FTAs) with South Korea and Japan and thus mills from these countries need not pay customs/import duties which act as a huge boost for exports. Korean companies based in India also buy steel from that country for further processing. As per Ministry of Steel estimates, around 62% of steel imports are landing from free trade agreement countries at nil duty.

Surge in Japanese exports: Due to decelerating demand for steel in Japan, producers in that country are eyeing higher exports of steel. Japanese mills have thus taken advantage of the FTA with India. Japan's exports of automobiles and engineering goods have been hurt due to subdued global demand amid inflation, while its domestic construction sector has been hit by manpower shortage, rising material costs, etc. Therefore, Japanese mills have targeted India as a preferred destination for steel exports.

Outlook

Indian steel imports recorded a brief phase of decline in November and December on domestic prices getting more attractive than the landed cost of steel, delays in port Customs clearances and a buzz in the market about non-BIS accredited steel products attracting a penalty. However, volumes have again edged up in January. BigMint recently reported HRC deals being concluded from Japan and South Korea, which underlined the continued reliance on imports.

Meanwhile, the Indian government has renewed the BIS licence of Vietnam's steel major Hoa Phat, enabling the company to continue exporting hot-rolled coils to India till 5 February 2026. Another Vietnamese major, Formosa, has been allowed to import HRCs, with its BIS licence being extended till 4 December of this year. This could mean continued pressure of HRC imports in the domestic market.

That said, the proposed safeguard duty, if implemented, will gradually lead to a tapering off of imports in the mid-term. However, dependency on imports for certain special grades for high-end applications is likely to persist for some more time.

Source:BigMint