Posted on 05 Mar 2025

US tariffs may cut its steel imports by 85%; EU sees challenges, India faces dumping risks

- Aggressive, cheap steel Chinese exports likely to continue

- India may tap alternate aluminium markets like Africa

- The US unlikely to grant exemptions, feel experts

Morning Brief: US President Donald Trump, on 10 February, slapped a 25% tariff on steel and aluminium products across its trade partners, with effect from 12 March. BigMint organised a webinar on the topic, "US Tariffs Impact on the Global Steel and Aluminium Trade" to get a better understanding of the implications of these measures on exporting countries, including India.

The move means withdrawal of all country-specific exemptions on steel imports given under Section 232 of the Trade & Expansion Act of 1962 and all exporting countries to the US will come under this 25% levy.

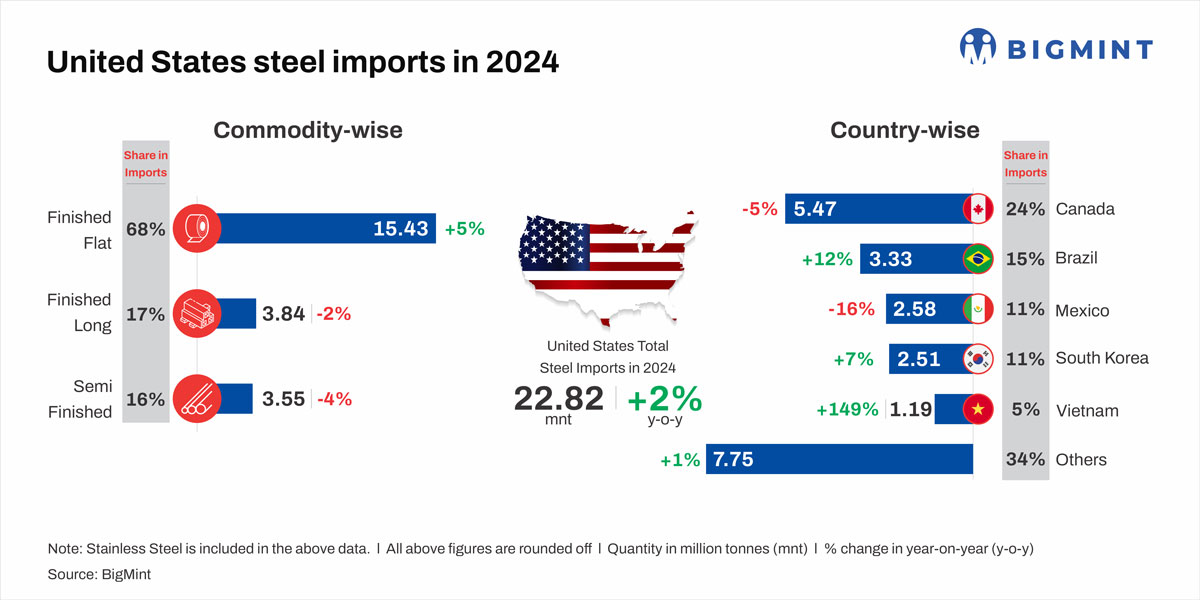

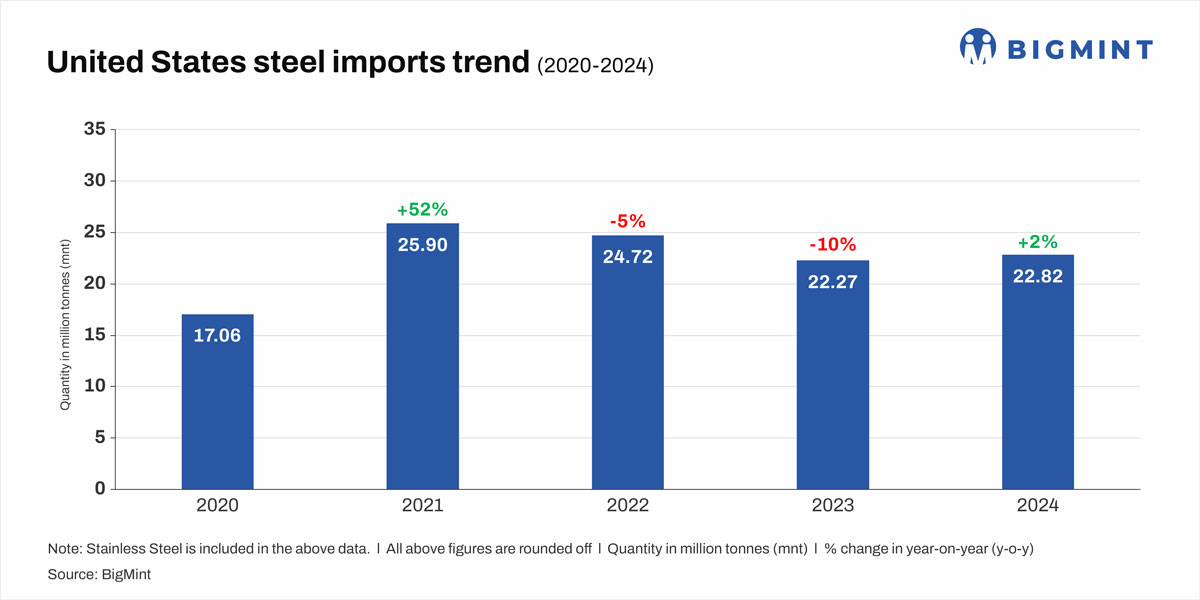

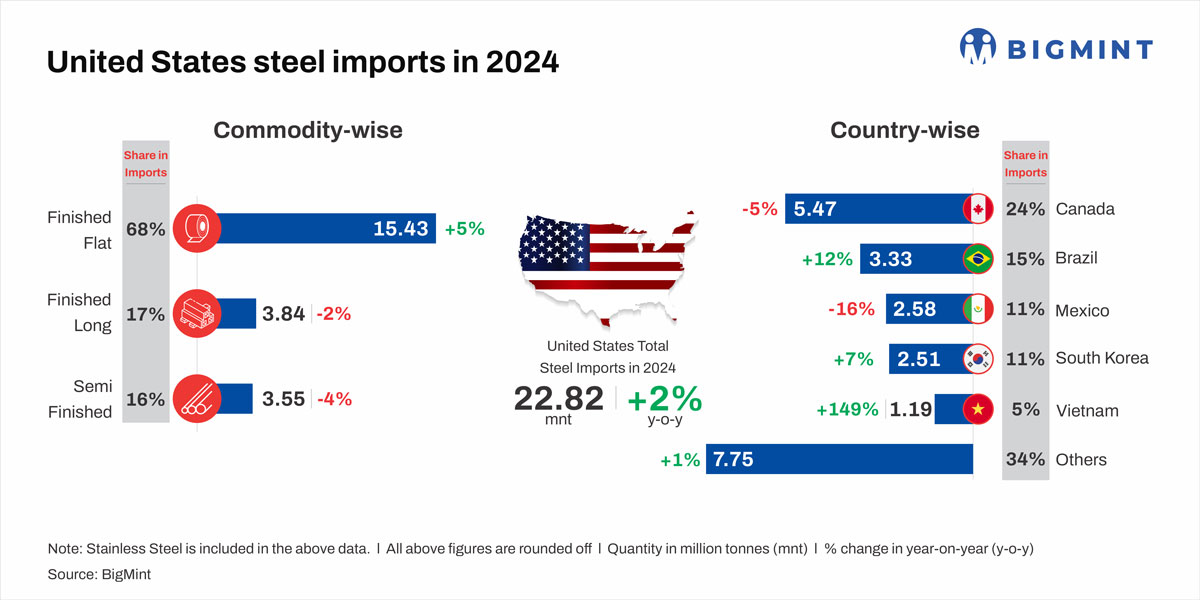

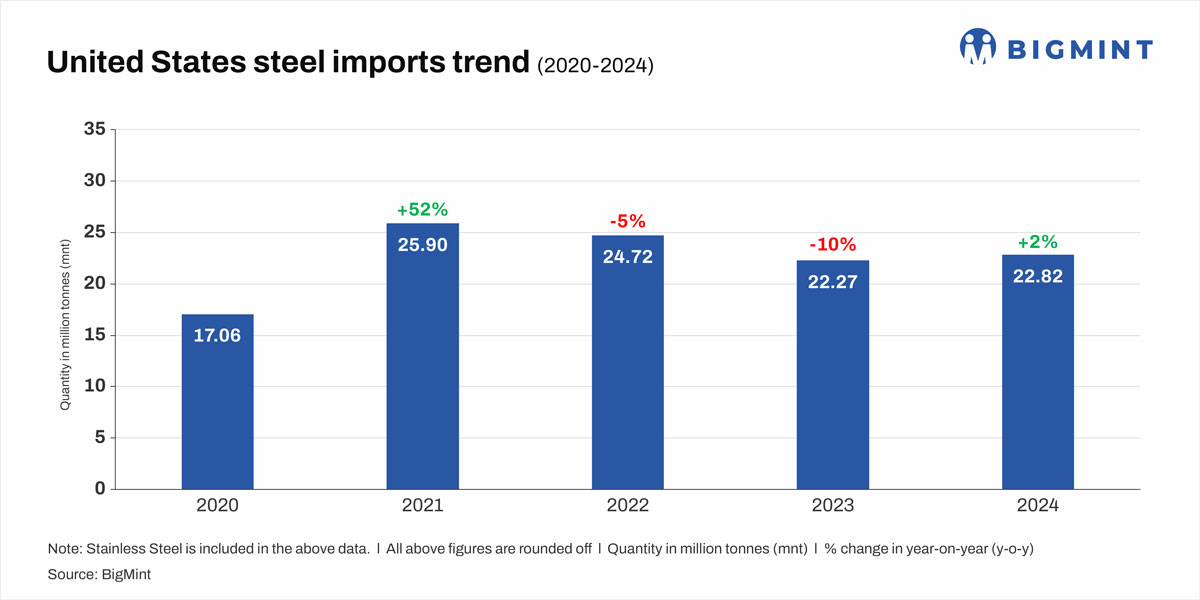

The US is actually one of the largest consumers of steel, with demand expected to reach around 90 million tonnes in 2024 while it exported around 9 mnt in 2023 as per BigMint' assessment. But, interestingly, domestic production is only at 80 million tonnes, as per worldsteel data. To bridge the demand gap, which includes exports, the US relies considerably on imports -- which are expected to touch around 22 million tonnes in 2024 in the total global steel trade of 350-400 mnt.

On the other hand, as per some sources, the US is around 50% dependent on its foreign suppliers for much of the aluminium it uses. In 2024, the United States consumed 4.3 mnt of aluminium -- an increase from 2023's 4.15 mnt.

Key takeaways from the webinar

- Speaking at the webinar, Alessandro Sciamarelli, Director of Economic Studies & Market Analysis at EUROFER, said, weak consumer purchasing power will further dampen demand. He feels that US tariffs may not be the right direction for the EU market. The US accounts for 12% of EU steel exports, but volumes have been shrinking over the years.

- The EU steel industry is facing significant challenges --production and consumption have sharply declined post-2022 due to geopolitical tensions, war, and high energy costs.

- Steel-consuming sectors like construction remain weak due to high interest rates and inflation. The European automotive sector is under pressure from foreign competition, particularly China.

- EUROFER sees a very competitive steel industry environment over the next few months and hopes for a slight improvement in 2025. Apparent steel consumption may drop 2.3% in 2024, and recover a modest 2.2% in 2025.

- EUROFER observes a significant trade deficit from Asia. Exporting steel to third countries is becoming more difficult due to rising competition.

- Commenting on the possible retaliation from the EU, Kapil Mantri, President and Global Head, Group Strategy and M&A, Jindal Steel & Power Group, said there could be WTO legal action, whereby the EU could challenge tariffs as trade barriers. Secondly, there can be safeguard measures -- the EU might implement protective measures on products the US relies on.

- Speaking on the possible impact on Indian steel industry, Mantri said loss from this 25% tariff will be negligible compared to India's domestic steel production which is estimated to be 125 mnt in the first 10 months of this fiscal.

- However, there are indirect tariff implications. Other countries will possibly direct their exports to India. The US, in 2024 imported $33 billion of steel. China, South Korea and Japan were key players, apart from Canada and Mexico. There could be an 85% reduction in steel exports to the US and these countries are likely to find new geographies and India is a suitable destination, especially for Japan and Korea because of the FTAs. Dumping risk intensifies and steel prices, already at four-year lows, can further head downwards.

- A 5-6 mnt of import deficit could arise if tariffs significantly impact trade.

- Depressed steel prices, shrinking margins are posing a challenge to steel mills since they have huge capex plans in place with an eye on 300 mnt capacity by 2030.

- India is advocating a 25% safeguard duty to prevent flooding its market with cheap Chinese steel redirected from the US and is expected to take steps against tariff impacts and low-cost imports.

- CBAM taxes add another challenge for Indian steel exports to the EU. Enhancing competitiveness is key if India aims to expand in the European market under CBAM norms.

- An FTA with the EU is a long-term solution but remains unlikely, said Mantri.

- Yasin Kanbur, General Manager, Middle East Office, at Hangzhou CIEC International, said in 2024, China will produce ~50% of the world's steel and 60% of its aluminium.

- China's share in US steel imports is just 3-4%, and aluminium below 10%. Since 2018 tariffs, China redirected its exports to the Middle East and Africa.

- He further said, new tariffs will add pressure on Chinese exports to the US but may not significantly impact overall volumes unless Asian buyers impose further restrictions.

- The US is strategically disrupting China's market, Kanbur indicated but added, US inflation has reduced imports by 30% over the last decade.

- Instead of reducing production, China is investing in green steel and automation to lower costs.

- Aggressive, low-priced steel exports are likely from China.

- China may announce domestic market support in March 2025. A planned (unconfirmed) 50 mnt of steel production cut may create room for some adjustments.

- Kapil Agrawal, General Manager, Jindal Aluminium, informed that India exports 1-1.5 lakh tonnes of aluminium, including downstream products (2-3%), to the US monthly.

Tariffs are unlikely to cause major price fluctuations for Indian exports. The UAE, Canada, and South Korea are key aluminium suppliers to the US.

- South Korea is negotiating a tariff exemption.

- India may explore alternate markets like Africa, which is in a growth phase.

- Tariffs have led to a $5-8/t freight reduction, adding pressure on freight rates. Further declines may be observed by March or April, Kanbur said.

- Could Canada, Mexico seek tariff exemptions? Yasin Kanbur feels the US is unlikely to grant exemptions, especially under Trump's policies, as pressure tactics will likely continue. As per Mantri, negotiations may be an option, but exemptions for Canada and Mexico seem unlikely.

Kapil Agrawal indicated that President Trump, known as a tough negotiator, would likely seek better trade-offs instead of outright exemptions.

Source:BigMint