Posted on 20 Feb 2025

Morning Brief: India's primary aluminium production in 2024 remained largely stable y-o-y, with a negligible increase to 4.15 million tonnes (mnt) from 4.13 mnt in 2023. This steady performance can be attributed to contributions of major producers such as Vedanta, Hindalco, BALCO, and NALCO, which collectively maintained consistent output, despite fluctuating market conditions, showcasing resilience and a commitment to meeting industry demands.

India's aluminium production is expected to remain stable in 2025, with a slight increase as major producers -- Vedanta, Hindalco, BALCO, and NALCO -- continue to expand operations. Recent investments, such as Vedanta's INR 1 lakh crore plan for an alumina refinery and green aluminium plant in Odisha, highlight the industry's long-term growth potential.

With new capacities coming online, the country's total aluminium production capacity could reach 6-6.5 million tonnes per annum (mntpa) by end-2025.

Consumption stable last year

India's primary aluminium consumption stood at around 4.5 mnt in CY 2024, up by 1.55% y-o-y. India imported around 2.45 mnt of alumina in 2024. Alumina prices skyrocketed by over 70% in 2024, driven by disruptions in Australia, Brazil, and Guinea. This put immense pressure on the raw material supply chain. However, there's light at the end of the tunnel: with China adding 13 mnt of capacity by 2025 and expansions by Vedanta and EGA, the market is expected to swing into surplus by next year.

High volatility in LME aluminium prices

The aluminium market experienced significant price volatility on the London Metal Exchange (LME), causing buyers to adopt a cautious approach. In January 2024, aluminium prices hovered at around $2,300/tonne (t), climbing to $2,700/t in May due to Russian sanctions, before falling back to $2,200/t in July. However, following China's recent export rebate cuts, prices again surged to $2,700/t, but cut back to $2,500/t levels by year-end. This volatile scenario held back Indian buyers from procuring scrap from overseas.

Japanese aluminium premium

Additionally, Japanese premium for Q1CY'25 increased due to alumina shortage. Since they are the largest buyers, they were willing to pay higher. Japanese aluminium buyers agreed to a premium of $228/t over the LME benchmark for Q1CY'25 shipments, marking a 30% increase from the last quarter. This is the highest premium since 2015, despite being lower than the initial offers of $230-260/t. The negotiations were influenced by tight aluminium supply, China's tax changes, and reduced production from major global players.

Secondary market scenario

In India, the secondary market for aluminium was pegged at around 2-2.2 mnt till 2024, taking India's overall capacity to 6-6.2 mnt, with the balance over 4 mnt coming from the primary route.

Scrap imports dip: In India more than 3/4th or 80% of aluminium scrap is imported primarily due to limited generation of the same scrap in the domestic market.? This is because, historically, India's aluminium consumption has been relatively low, resulting in insufficient scrap generation for meeting the demand in the secondary market.

In 2024, India's aluminium scrap imports totalled 1.75 mnt, marking a 5% decrease from the previous year's 1.85 mnt. This reduction indicates a slight contraction in the demand and supply of aluminium scrap, potentially driven by changes in market conditions, and recycling capacities.

Scrap imports decreased owing to the Red Sea issue, with the EU and Middle East most affected.

Semis imports rise: With scrap imports impacted, direct imports of semi-finished material started.

As a result, there was a 45% surge in cheaper aluminium alloyed ingot imports in 2024, to 240,000 tonnes, compared to relatively low levels a year ago. Among these, ADC12 accounted for 24,300 t, while A356 made up the balance 125,300 t.

This growth was fuelled by the cost advantage of imported ingots, which proved more economical for manufacturing finished products via semis, reducing reliance on scrap imports. Additionally, the increase in imports coincided with weak export demand, as major markets like Japan remained sluggish. Together, these factors significantly shifted market dynamics compared to the previous year.

Additionally, with demand for semi-finished products cooling in China and Japan, producers from Malaysia and the Middle East capitalised on India's expanding market. They redirected surplus production to India, taking advantage of competitive import pricing and duty-free benefits under Malaysia's FTA provisions.

Sharp decline in semi-finished exports: India's semi-finished aluminium exports saw a dramatic 83% drop in 2024 to just 7,500 t, significantly affecting consumption of imported scrap- a raw material.

This decline is largely attributed to an oversupply of ADC12 alloyed ingots in the domestic market, driven by weakened overseas demand, particularly in Japan, India's largest export destination. Domestic suppliers increasingly opted for local scrap due to its cost advantage over imported material. This shift, coupled with reduced export demand, resulted in a surplus of ADC12 ingots within India.

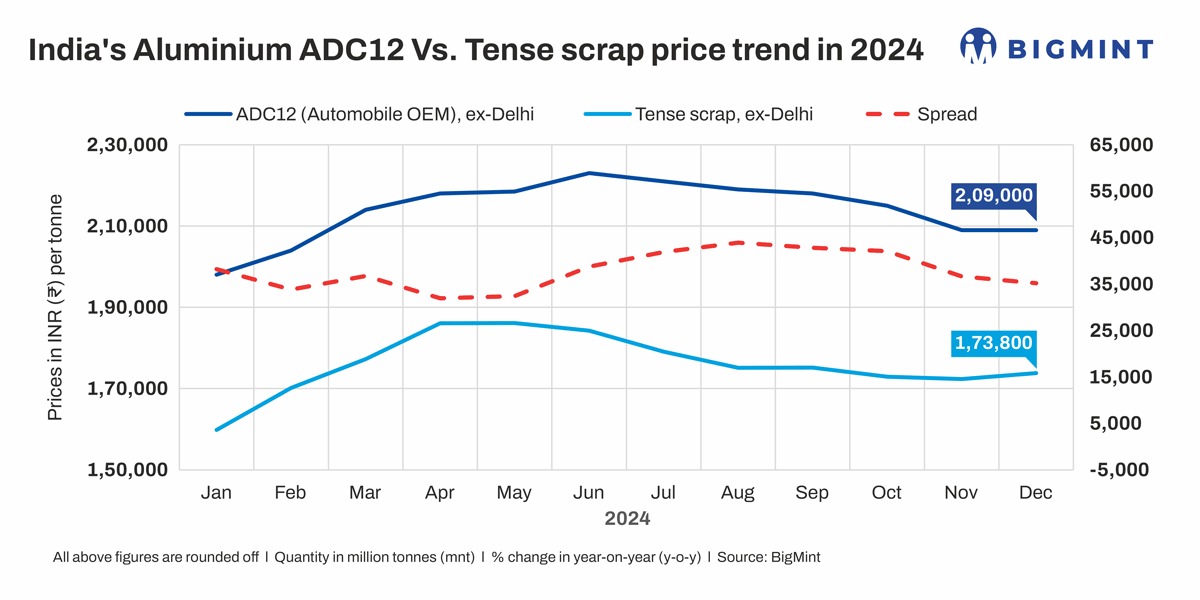

Prices of aluminium ADC12 alloyed ingots fell m-o-m across southern India, with BigMint's benchmark monthly assessment placing the OEM-approved grade at INR 209,000/t in Chennai -- its lowest level in 10 months, last recorded in February 2024, driven by persistently weak demand in the automotive sector and a sluggish export market.

Similarly, prices in northern India reached a six-month low, with the OEM-approved grade recorded at INR 210,000/t in Delhi NCR.

This drop can be attributed to a decline in India's largest automaker's price settlements in CY'24. The latest price for January was settled at INR 208,000/t, sources informed BigMint.

Additionally, auto OEMs, saddled with surplus inventory, scaled back their aggressive procurement of alloy ingots, further driving down prices of ADC12 (OEM-approved). The fall in ADC12 prices naturally impacted its production and thus consumption of scrap, a raw material.

Imported scrap moves up, local prices follow

In 2024, prices of major imported aluminium scrap grades, including Tense, Taint/Tabor, Extrusion, Zorba, and Wheels, displayed a consistent upward trend of around 12% y-o-y. Similarly, domestic aluminium scrap prices in the northern region of India also increased by up to 11%.

US imports fall

US imports fell to 421,989 t (-18%) as new rolling mills and aluminium plants boosted local scrap demand.

China ends 13% export tax rebate on aluminium semis

Effective 1 December, 2024, China scrapped export tax rebates on aluminium and copper, raising costs for Chinese exporters. This move benefits Indian producers like Hindalco, Vedanta, and NALCO by reducing competition and potentially driving up global aluminium prices.

Outlook 2025

Looking ahead, the Aluminium Association of India (AAI) has proposed raising import duties on primary and secondary aluminium products from 7.5% to 10% to promote self-sufficiency and attract investments. Given the current scenario, raw material requirements are set to rise with nearly 5 lakh tonnes of new capacity expansions and plants expected to be fully operational by mid-2025. This growth will drive increased demand for inputs, particularly in the non-ferrous sector.

Additionally, with primary players shifting to production via the scrap route, with a pronounced focus on aluminium beverage cans scrap etc on the horizon, demand for scrap is expected to surge, further strengthening the market.

US tariffs impact: India's aluminium market will face minimal direct impact from the US tariffs, as a 10% duty is already in place since 2018. Also, only 0.15 mnt of India's 2.4 mnt aluminium exports go to the US. However, rising US domestic demand for aluminium scrap may reduce scrap availability in India, increasing raw material costs. Canada's aluminium may flood Europe, lowering European premiums. India's dependency on scrap imports poses challenges, but domestic scrap policies may help mitigate the impact.

Source:BigMint