Posted on 10 Feb 2025

Rebar output among the 137 Chinese steelmakers that Mysteel tracks across the country grew for the second week over January 30-February 5, rising by 3.5% or 61,300 tonnes on week to reach 1.84 million tonnes, with most integrated mills maintaining production during the Chinese New Year (CNY) holiday over January 28-February 4, the weekly survey results showed.

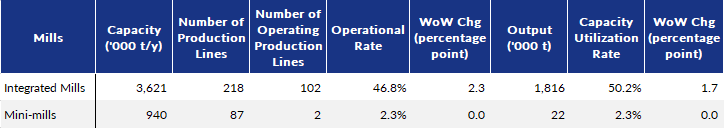

Some mills in East China's Anhui and Central China's Henan and Hubei had brought their blast furnaces back on stream at the end of January in response to remaining margins and expectations of better demand after the CNY holiday, though production among domestic mini-mills stayed at a low level, respondents said.

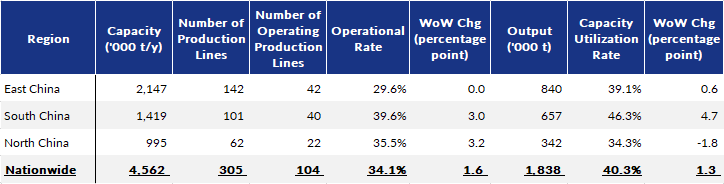

While steel producers in East, Central and South China posted on-week upticks in their rebar production during the latest survey period, mills in other regions of the country saw their output decline modestly from the previous week, according to the survey.

Both rebar rolling capacity utilization and the operational rates among the sampled 137 mills increased during the survey week, with the former rising by 1.3 percentage points on week to 40.3%, and the latter up 1.6 percentage points to 34.1%, Mysteel's data found.

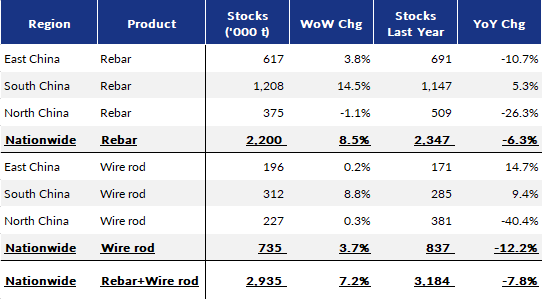

As such, rebar stocks at these 137 mills mounted for the third straight week, up 8.5% or 171,600 tonnes on week to 2.2 million tonnes as of February 6, since spot sales had stagnated due to the week-long holiday break. Meanwhile, the tonnage at commercial warehouses in the 35 Chinese cities under Mysteel's tracking registered a six-week rise, climbing by 7.8% or 350,900 tonnes on week to 4.9 million tonnes by February 6.

China's rebar prices have been largely stable after the CNY break, and by February 7, the national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at Yuan 3,481/tonne ($478/t) including the 13% VAT, higher by a small Yuan 7/t than the price on January 27, the last working day before the holiday.

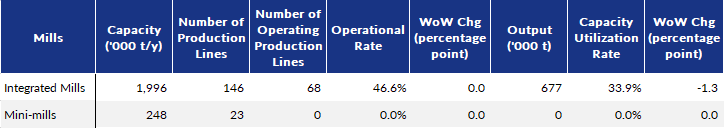

In addition, survey respondents expected most domestic electric-arc-furnace steelmakers to resume their operations around the Chinese Lantern Festival on February 12, and most traders will also return to the market after their long holiday breaks.

Table 1: Rebar Production Survey by Region by Feb 5

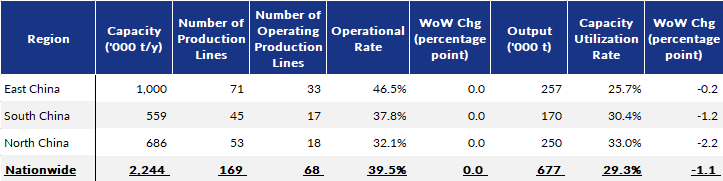

Table 2: Wire Rod Production Survey by Region by Feb 5

Table 3: Rebar Production Survey by Process by Feb 5

Table 4: Wire Rod Production Survey by Process by Feb 5

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Feb 5

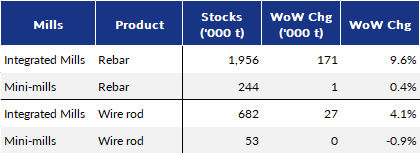

Table 6: Rebar and Wire Rod Stocks Survey by Process by Feb 5

Source:Mysteel Global