Posted on 06 Feb 2025

Introduction

The global steel industry is a critical sector in modern economies, supporting infrastructure, construction, and manufacturing. However, its environmental footprint is substantial, contributing over 7% of global greenhouse gas (GHG) emissions and 11% of global CO2 emissions.

As industries strive to align with climate goals, the need for decarbonizing steel production has become urgent. Hydrogen-based technologies, particularly the Hydrogen Direct Reduced Iron (H2 DRI) coupled with Electric Arc Furnace (EAF), offer a promising pathway to green steel production.

This article is based on an interesting paper by Hasanbeigi, Ali, et.al (Jul 2024)[1], examining the role of hydrogen in green steelmaking, the factors influencing its feasibility, and the implications for downstream sectors like automotive, construction, and shipbuilding.

A. Hydrogen in Steelmaking

The Role of Hydrogen in Green Steel Economics

Hydrogen is pivotal in the transition to green steelmaking as it replaces carbon-heavy reductants like coke and natural gas in the iron reduction process. When produced using renewable energy, hydrogen emits negligible CO2, enabling a 94%-97% reduction in emissions compared to traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) methods. H2-DRI-EAF technology is not only environmentally significant but also positions countries and industries to meet stringent climate targets.

Hydrogen's importance extends to its potential to decouple steel production from fossil fuels, thereby stabilizing energy costs over time. However, the adoption of H2-DRI-EAF technology is currently hindered by high hydrogen production costs, technological limitations, and infrastructure constraints.

Competitiveness Among Countries – Conventional Systems

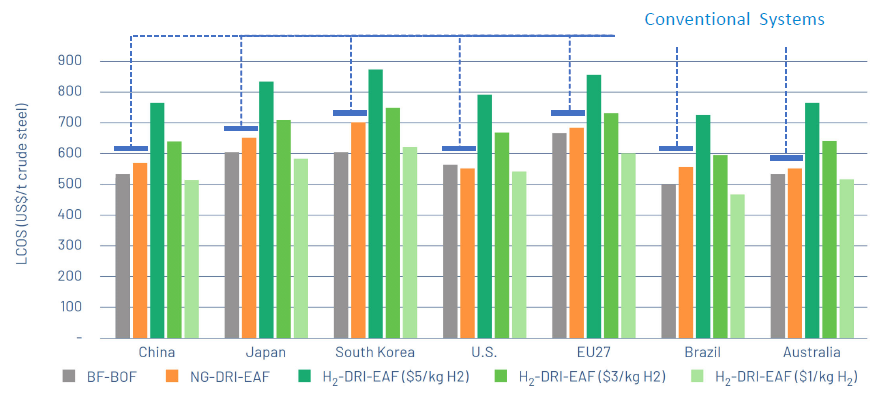

Based on Figure 10 of the study, reproduced below, the following insights on conventional steelmaking systems are:

Figure 10: Levelized Cost of Steel ($/t crude steel) for BF-BOF, NG-DRI-EAF and green H2-DRI-EAF in countries studied

Competitiveness Among Countries – Using Hydrogen in Steel Making

Again, based on Figure 10 of the study, shown above, the following insights are found while observing the use of H2-DRI-EAF systems:

Impact of Hydrogen Prices on Competitiveness

Hydrogen prices are the most significant determinant of the competitiveness of H2-DRI-EAF technology. The cost of green hydrogen, which is derived through electrolysis using renewable electricity, is currently higher than that of natural gas-derived hydrogen (grey hydrogen) or fossil fuels. The summary by country is as follows:

Carbon Pricing and Its Role

Carbon pricing is a critical enabler for H2-DRI-EAF technology. By imposing costs on emissions-intensive production methods like BF-BOF, carbon taxes create a financial incentive to adopt greener alternatives. For instance:

Timeline for Competitiveness

Projections indicate that H2-DRI-EAF technology will become competitive in most markets by 2030, as green hydrogen costs decline to $1-$2/kg due to advancements in electrolyzer technology and economies of scale. Supportive policies and investments in renewable energy infrastructure will further accelerate this timeline.

B. Impact of Steel Price Premium on End Customers

The adoption of hydrogen for steelmaking introduces a green premium, affecting the cost of final products in key sectors.

Automotive Sector

In Japan, at $5/kg H2, the green premium for steel adds approximately $208 to the cost of a passenger car. This represents less than 1% of the average car price, a manageable increase for both manufacturers and consumers. As hydrogen costs decline to $1.3/kg, this premium is expected to disappear. In the U.S., similar impacts are observed, with minimal price increases for climate-conscious buyers.

Construction Sector

In China, at $5/kg H2, the green premium adds $563 to the cost of a 50m² residential unit. Given the high overall costs of construction, this represents a small percentage increase, which can be mitigated by government subsidies or carbon pricing. In Brazil, the impact is even lower due to competitive green hydrogen costs, making it a model for green construction.

Shipbuilding Sector

The shipbuilding industry faces a more significant impact due to the high proportion of steel in ship costs (~95%). For a 40,000 DWT ship, the green premium is approximately $3 million, representing a 10% cost increase at $5/kg H2. Adoption in this sector will depend on regulatory pressures and demand for low-carbon shipping solutions.

Conclusion

The feasibility of using hydrogen in steelmaking hinges on reducing hydrogen costs, implementing robust carbon pricing mechanisms, and fostering technological advancements. The following actions are recommended:

Governments and Policies

Steel Producers

Steel Consuming Industries

By aligning efforts across stakeholders, the transition to green steel can be accelerated, enabling a sustainable and low-carbon future for the global steel industry.

*****

Stay Healthy. Stay Safe.

See You at SEAISI Events.

*****

[1] Hasanbeigi, Ali; Zuo, Bonnie; Kim, Daseul; Springer, Cecilia; Jackson, Alastair;

Heo, Esther Haerim (July 2024). Green Steel Economics. Global Efficiency Intelligence, TransitionAsia,

Solutions for Our Climate.

Source:SEAISI