Posted on 17 Jan 2025

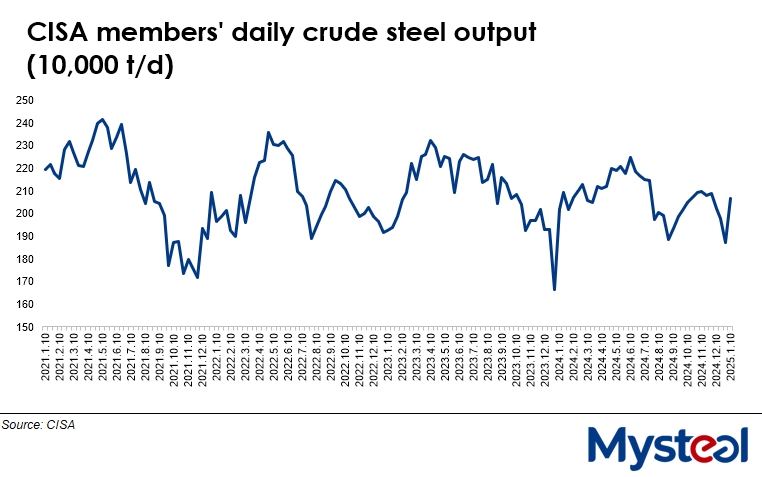

Daily crude steel output among the member mills of China Iron and Steel Association (CISA) recovered during the first ten days of January after declining for the previous three 10-day periods, according to the latest figures released on January 15 by the association.

The member mills' daily output for early January reached an average of 2.07 million t/d, the CISA data showed, with their output rising by a large 10.3% or 193,000 tonnes/day from late December's average, as against the 5.3% fall during the prior period. The daily average was also 4.2% higher than the corresponding period last year.

"Due to production adjustments by some extra-large steel groups and the resumption of production lines that underwent maintenance stoppages last year, member mills' daily crude steel output during these ten days saw a significant increase," CISA explained.

An industry watcher commented that some steel producers resumed operations on steelmaking facilities after their profitability had improved, leading to a large rebound in daily steel output during early January.

This view was in line with the results of Mysteel's survey, which showed that among the 247 Chinese mills it tracks nationwide, 125 could earn some profits on steel sales as of January 9, more than the 119 in the previous week who said they were earning money.

Based on its members' output, the association estimated China's national daily crude steel output over January 1-10 averaged 2.62 million t/d, up 10.3% from late December.

CISA noted that member mills in regions such as North, East and South-central China recorded increases in daily crude steel output during this ten-day period. In fact, mills based in North China's Hebei province saw their daily output swell by 26.6% or 104,000 t/d from late December.

In contrast, member mills in Northeast, Northwest and Southwest China reported declines in daily output during early January, particularly those in Southwest China where the daily output slumped by 10.8% or 15,000 t/d from late December.

Meanwhile, finished steel inventories held by CISA's member mills mounted by 1.8% or 220,000 tonnes from the end of December to reach 12.59 million tonnes, according to the release. This was lower by 12.5% or 1.8 million tonnes from the same period of last year, though.

In parallel with the uptick in output, Chinese finished steel prices had lost ground in early January. As of January 10, the country's national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at Yuan 3,420/tonne ($466/t) including the 13% VAT, falling by Yuan 75/t from that on December 31 last year.

On the other hand, spot sales of rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's tracking also shrank by 16.4% or 17,638 t/d from late December's average to only 90,175 t/d on average for early January.

Source:Mysteel Global