Posted on 30 Dec 2024

During this month, Chinese integrated steelmakers have reined in hot metal production through maintenance stoppages on their blast furnaces (BF), mainly in response to waning demand for steel from end-users. Given the ongoing winter lull for steel consumption, the production reduction among mills is expected to extend into January, Mysteel suggests in its latest monthly report on domestic BF operations.

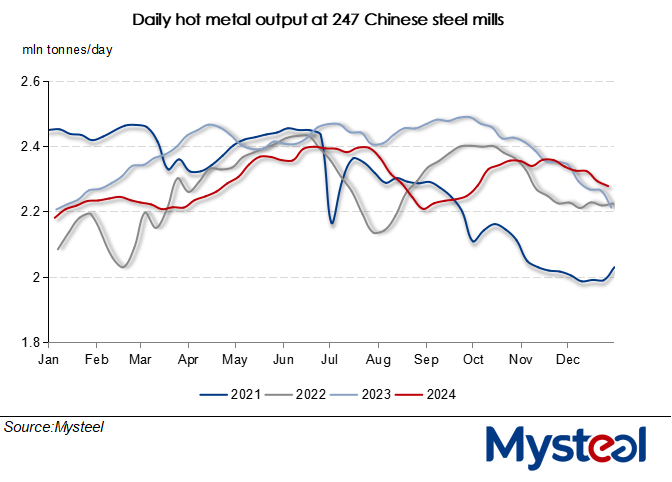

Daily hot metal output among the 247 Chinese BF steelmakers sampled in Mysteel's regular survey is estimated to average 2.3 million tonnes/day in December, 2.2% higher on year but down by 2% on month, the report shows.

Although a slew of policy stimulus plans unveiled by Beijing since late September had boosted mills' production enthusiasm compared with the same period in previous years, the cut in production was still inevitable, a Shanghai-based market watcher said, arguing that construction steel demand always cools in winter.

"Meanwhile, steel traders appear to be less active than expected in building up their steel inventories during this winter," she added. The traders usually accumulate steel stocks during winter to prepare for a seasonal rise in building activities in spring, but this year, the weak steel market has led them to be more cautious, fearing that a decline in steel prices after the stockpiling season ends would cause them losses, she explained.

Faced with tepid steel demand, many mills opted to stop their BFs this month, either for annual maintenance or to contain losses. In general, some 40 BFs at mills covered in Mysteel's survey were taken offline this month, while only 18 BFs were returned to production, according to the report.

As for mills' operations ahead, Mysteel's latest findings showed that so far, 11 BFs with a total pig iron capacity of 46,600 t/d are scheduled to be overhauled next month, while nine BFs will be brought back on stream, adding 60,000 t/d to the operating capacity.

However, more BFs could be suspended for annual maintenance in the coming month with the Chinese New Year approaching at end-January when steel demand is unlikely to improve, the report argues.

Therefore, the daily hot metal output among the 247 sampled mills is expected to drop by 1.9% on month to average 2.26 million t/d next month, Mysteel forecasts. Significantly, the forecast puts daily output still 2% higher on year, an increase Mysteel attributes to the mills' profit margins that are better than this time last year – even though margins have slimmed over the past few months.

Nearly half the 247 Chinese steelmakers under Mysteel's tracking said they could earn some profits on steel sales as of December 26, in stark contrast to only 28% a year ago, Mysteel's latest tracking showed.

Source:Mysteel Global