Posted on 20 Dec 2024

The price spread between cold-rolled coil (CRC) and hot-rolled coil (HRC) in China has widened this month due to the firming prices of CRC underpinned by steady demand from downstream sectors like automobiles and home appliances, Mysteel Global has learned.

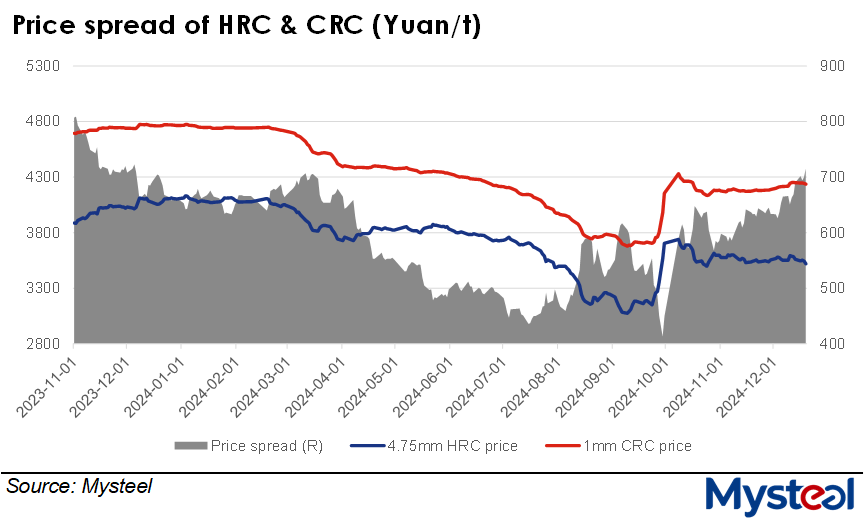

As of December 19, the spread between national average prices of 1mm CRC and Q235 4.75mm HRC under Mysteel's assessment came in at Yuan 716/tonne ($98/t), marking a significant rise compared with the gap of Yuan 633/t recorded one month earlier.

The widening price spread is mainly due to the overall strengthening of China's CRC prices in the physical market this month, while spot prices for HRCs have been trending downward, Mysteel Global notes.

As of December 19, the national average price of 1mm CRC was assessed by Mysteel at Yuan 4,236/t including the 13% VAT, higher by Yuan 59/t from one month before. During the same period, the national average price of Q235 4.75mm HRC under Mysteel's assessment slipped by Yuan 24/t on month to reach Yuan 3,520/t including the 13% VAT.

Domestic demand for CRCs remains firm with the better performance in major downstream industries of automobiles and white goods thanks to the country's trade-in incentives. This has offered solid support to the CRC prices, Mysteel Global finds.

Statistics of the China Association of Automobile Manufacturers (CAAM) show that the country's auto production touched a record high of 3.44 million units in November, rising by 14.7% on month or higher by 11.1% on year.

Also, China's production of four major home appliances - air-conditioners, refrigerators, washing machines and televisions - all logged on-year growth last month, with the output of air-conditioners posting the sharpest on-year rise of 27% to reach 19.68 million units, according to the latest data from the country's National Bureau of Statistics (NBS).

In line with better downstream demand, inventories of CRCs held by Chinese traders have emptied steadily to very low levels, which has provided domestic mills and traders more confidence to uphold their offering prices for the flat steel item.

Mysteel's latest weekly survey showed that as of December 19, CRC inventories at the 182 warehouses in 29 Chinese cities under its regular tracking came in at 1.68 million tonnes, down for the ninth consecutive week by another 2.4% on week and marking the lowest since mid-February 2021.

Source:Mysteel Global