Posted on 17 Dec 2024

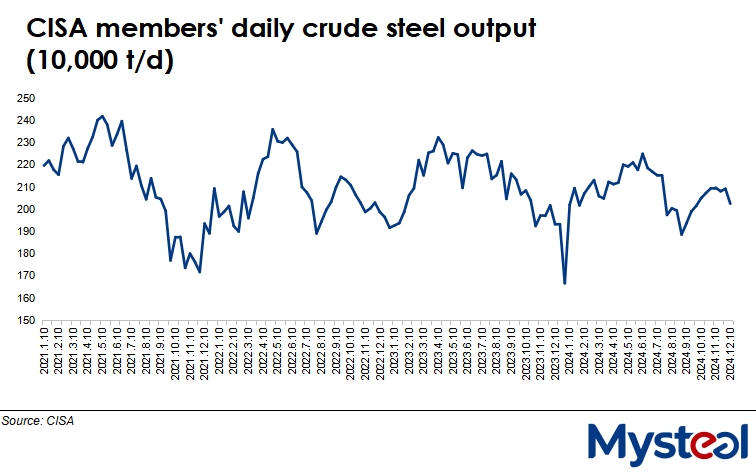

During December 1-10, daily crude steel production among the member mills of the China Iron and Steel Association (CISA) declined from the late November result, falling by 3.2% or 67,000 tonnes/day to average 2.02 million t/d, a two-month low, according to the association's release on December 14.

The average daily output during early December was higher by 1.5% on year though, CISA notes.

Based on its member-mill results, CISA also estimated that the country's daily crude steel output averaged 2.57 million t/d during the first ten days of this month, down 3% from November 21-30.

Market sources attributed the decline in daily steel output to the fact that steelmakers slowed their production during the ten-day period as their profitability had weakened. Some mills in northern China had also suspended operations to meet directives issued by local authorities to ease air pollution.

Meanwhile, finished steel stocks at the association's member mills mounted by 7.8% or 1.03 million tonnes from November 30 to settle at 14.18 million tonnes as of December 10, or higher by 0.6% on year. The uptick in stocks reflected the low demand from end-users as December usually sees steel consumption in China slow for winter.

During early December, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's tracking had averaged 115,028 tonnes/day. Despite a 3.1% uptick from the average recorded in late November, the daily transaction volume was still low, survey respondents said.

On the other hand, Chinese finished steel prices strengthened moderately in early December, as market sentiment was bolstered by positive messages from the Politburo's meeting on December 9 when top policymakers pledged to roll out more proactive macro policies to stimulate economic growth, as reported.

As of December 10, the spot price of HRB400E 20mm dia rebar in the Shanghai market, for example, had gained Yuan 20/t ($2.7/t) from November 29 to reach Yuan 3,470/t including the 13% VAT, according to Mysteel's assessment.

For steelmaking raw materials, their prices remained resilient in early December, Mysteel Global notes. For example, by December 10 the Mysteel SEADEX 62% Australian Fines index stood at $106.2/dmt CFR Qingdao, edging up $1.15/dmt from the price on November 29.

Source:Mysteel Global