Posted on 10 Dec 2024

On December 4, China's National Development and Reform Commission (NDRC) released the results of its latest steel-sector survey that revealed widespread pessimism regarding domestic steel prices for December. The survey covers key wholesale steel markets in South China, Shanghai, and Tianjin, and the results showed a notable decline in the market outlook.

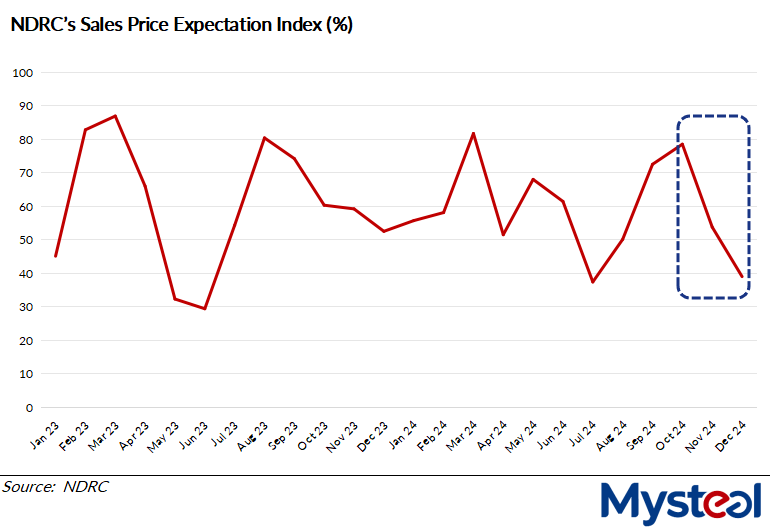

The survey measured six key indices and revealed that both the Sales Price Expectation Index and the Purchase Price Expectation Index for December stood at 38.9% and 35.3%, respectively. These figures represent significant drops of 14.8 and 18.2 percentage points compared to November and marked the second consecutive month of decline.

Notably, both indices fell below the critical 50% threshold, signalling an expectation of weaker steel prices for December, according to the NDRC.

Mysteel Global notes that the last time the Sales Price Expectation Index was this low was during the transition to the new rebar standard in July, when steelmakers and traders were forced to slash prices to clear out old-standard stocks and resulting in the largest price drop of the year.

The NDRC's report highlights the underlying factors contributing to this "harsh winter" for the steel market, particularly the decline in demand. The Sales Volume Expectation Index for December plummeted to 31.3%, down 12.8 percentage points from November. This reflects the traditional off-season for steel consumption, which continues to exert pressure on the domestic market.

As the weather turns colder across China, with blizzards and cold spells significantly affecting construction activity – particularly in northern China, the NDRC expects a further weakening of demand. Despite recent stimulus policies aimed at reviving China's flagging property sector, steel demand is expected to rise only gradually as new construction projects take time to materialize.

In response, steel inventory levels are expected to increase in December, with the Inventory Expectation Index rising to 57%, up 10.6 percentage points from November. The overall sentiment in the market remains cautious, as market participants anticipate lower sales and rising stockpiles.

Given the forecasted weak demand and mounting inventories, the NDRC report raised concerns over the profit outlook for steelmakers. While lower production costs are anticipated, the report noted that profit margins may still come under pressure. The Sales Cost Expectation Index fell to 42.4% for December, while the Sales Profit Margin Expectation Index dropped to 32%, reflecting a decline of 8.1 and 8 percentage points, respectively, from the previous month.

Source:Mysteel Global