Posted on 06 Dec 2024

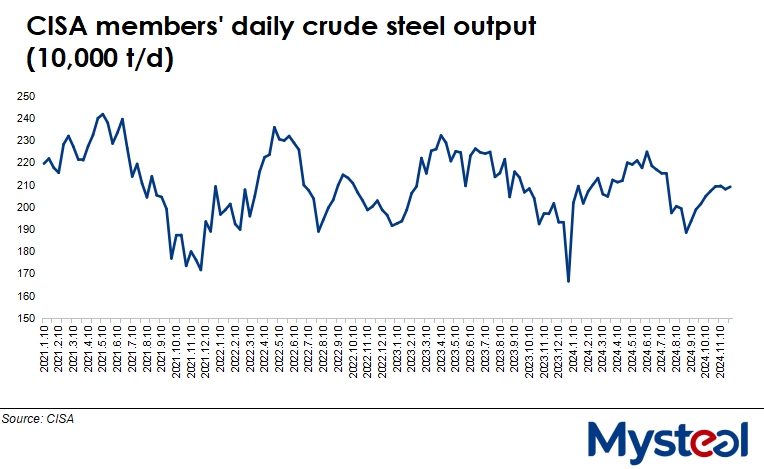

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) recovered during the last ten days of November, rising by a tiny 0.5% or 11,000 tonnes/day from November 11-20 to average 2.09 million t/d, according to the association's latest data released on Wednesday. Market sources suggested mills had maintained largely steady production over the period in order to chase sustained profits.

However, late November's daily crude steel output was lower by a small 0.2% from the same period last year, according to the release.

Based on the performance of its member mills, CISA also estimated the country's total daily crude steel output over November 21-30 at 2.65 million t/d, climbing by 0.5% from mid-November.

On the other hand, finished steel stocks at the association's member mills declined by 2.4 million tonnes or 15.4% from November 20 to settle at 13.2 million tonnes as of November 30. Behind the fall in mills' stockpiles was the rise in speculative buying activities among market players, sparked by the rebound seen in spot steel prices lately, sources explained.

The tonnage held by these mills had mounted by 190,000 tonnes or 1.5% from the corresponding period last year though, the CISA data indicated.

As of December 4, China's national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, had strengthened for a fourth working day by a total of Yuan 56/tonne ($7.7/t) to reach Yuan 3,486/t and including the 13% VAT, according to Mysteel's assessment.

Domestic steel prices had won some support from higher raw materials prices, despite weak actual demand keeping the rise in check, Mysteel Global notes. By December 4 for example, Mysteel SEADEX 62% Australian Fines had gained by $5.1/dmt from the price on November 20 to reach $106.65/dmt CFR Qingdao, a 1.5-month high.

Mysteel's weekly survey among the 247 steel mills nationwide it regularly monitors showed that by end-November, more than half of the mills sampled said they were still earning positive margins on their steel sales – a fair proportion given the winter slowdown in demand.

Source:Mysteel Global