Posted on 20 Nov 2024

With a growing interest in reducing carbon footprint in the steelmaking process, the market is paying a lot more attention to steel products produced using low-carbon or renewable fuels. The Middle East, given its low energy costs, is uniquely positioned to become a major production and trading hub for high-grade pellet, direct-reduced iron and hot-briquetted iron in the near term.

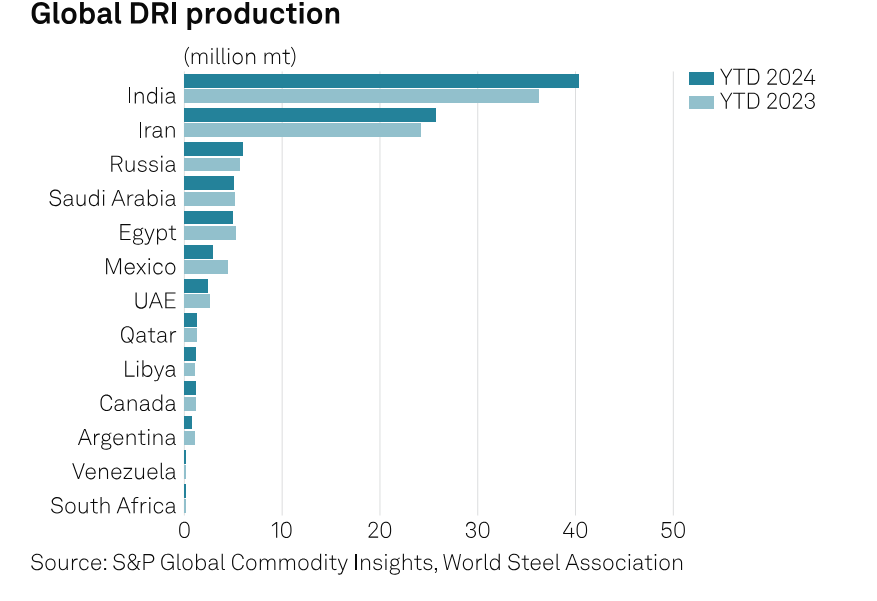

According to the World Steel Association, the region produces around 37.5% of the global DRI. Although most pellets, DRI and HBI produced are currently utilized domestically, Middle East is expected become an active exporter with multiple projects currently under progress.

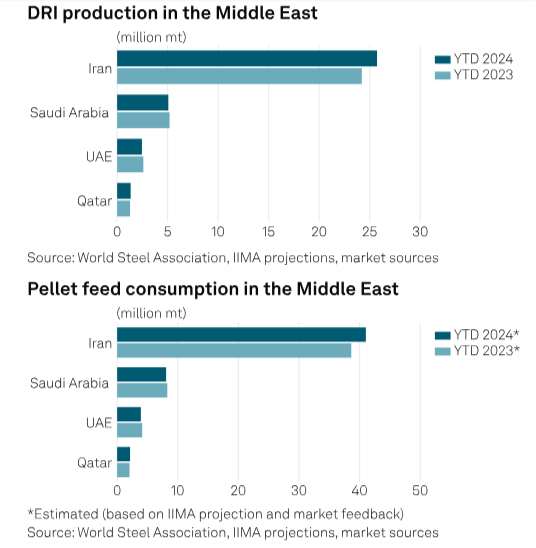

Among Middle Eastern DRI producers, Iran produced 25.7 million mt during the first nine months of 2024, 1.5 million mt more than the same months a year ago, according to the latest World Steel Association data. During the same period, Saudi Arabia lowered its DRI production by around 121,000 mt to approximately 5.07 million mt and the United Arab Emirates saw a decline of about 138,000 mt to approximately 2.5 million.

Considering pellet feed is a key feedstock for DRI production in the region, based on International Iron Metallics Association estimates and market feedback, the World Steel data suggested that pellet consumption in Iran indicated a 2.1 million mt increase, while pellet feed consumption rose by 2.4 million mt during the first nine months, compared to the same period in 2023. For Saudi Arabia, over the same period, the pellet consumption decreased by 176,000 mt, while pellet feed consumption was calculated to have fallen by 193,000 mt.

The Middle East has seen significant interest from major market participants around the globe in recent years. Japan-based Itochu and JFE Steel partnered with UAE-based EMSteel for a pellet plant, direct reduction plant and other relevant infrastructure.

Japan-based Mitsui and Kobe Steel are exploring a low-carbon iron metallics production plant in Oman, while China-based Baosteel is exploring a DRI and steel plant in Saudi Arabia in partnership with Saudi Aramco. India-based Essar Group also plans to construct a DRI and steel plant in Saudi Arabia.

The new projects are expected to increase the total DR pellet, DRI and HBI production in the region by an estimated 40 million mt in the next few years, according to company announcements.

Demand-supply overview

With high-grade DR pellet, DRI and HBI production in the Middle East region expected to increase significantly over the near term, market participants have expressed concerns regarding near-term high-grade pellet feed quality and supply. Market feedback suggested global DR pellet demand to increase from 40 million mt to 70 million mt over the next five to 10 years.

"The market does not get the proper blend of pellet feed," one miner said, "Pellet feed availability is the big issue especially for high-grade material."

Sources are also expecting new suppliers in the near term.

"There will be a supply gap once the projects come online," one international pellet producer said, "Currently, Anglo American is the largest supplier to the Middle East, but the gap could be filled by Champion Iron in Canada and probably Australia."

Sources also indicated that pellet producers might mix DR-grade pellet feed with Blast Furnace-grade feed to deal with supply constraints. Meanwhile, premiums are expected to increase for high-grade pellet feed amid limited supply.

Current major suppliers to the Middle East include Anglo American, Vale, Cargill, and Compañía de Acero del Pacífico.

Major consumers in the region include Bahrain Steel and Vale Oman, which utilize their own pellet feed. Other pelletizing plants like Jindal Shadeed in Oman and Al Ittefaq Steel in Saudi Arabia are expected to come online in the near term.

Possible export opportunities

With the ongoing projects in the Middle East, market participants expect to see pellets and HBI exports to countries in Europe in the near term.

"European Union DRI production capacity is expected to reach 39.8 million mt per year by 2030, provided that all announced projects are successfully completed," analysts at S&P Global Commodity Insights said. "Nearly all of this DRI capacity will come from captive plants feeding their own electric arc furnaces (EAFs), but any additional demand could be met by imports from regions capable of producing lower carbon content DRI, such as the Middle East."

In addition, some sources suggested India as a possible market until the country's decarbonization efforts come into effect.

"It makes sense for Middle Eastern producers to sell to India in the long run," an India-based source said, "if port-based plants need high grade material, they can get high-grade pellets at prices that make sense."

The pellet feed trading market is still evolving in the Middle East as most trades happen on a long-term contract basis. The overall trading activity for seaborne pellet feed is deeply impacted by developments in China, which is the biggest spot market buyer for the cargoes.

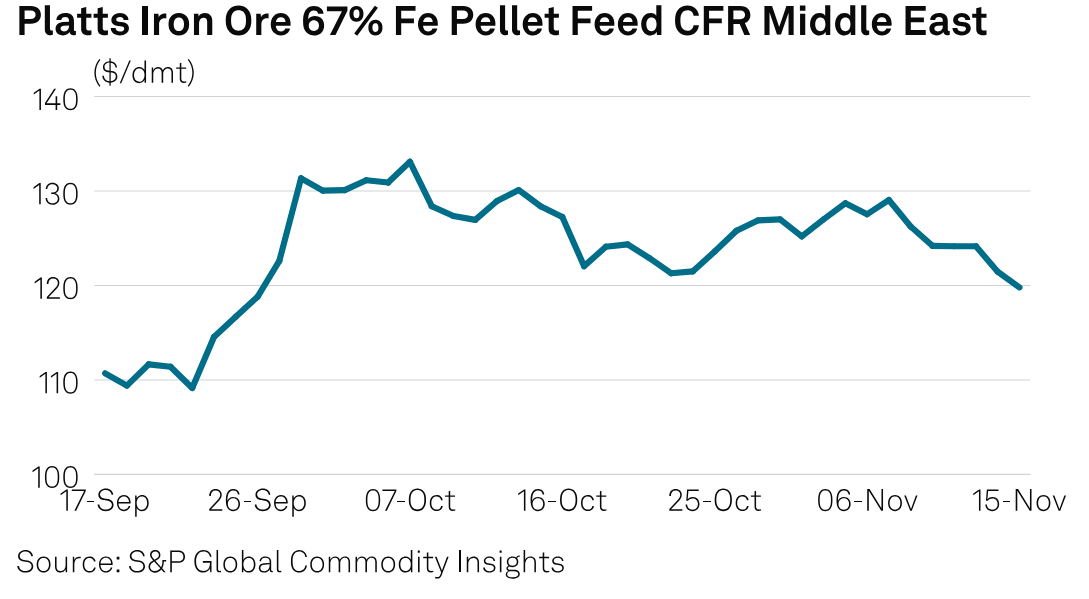

Platts daily high-grade pellet feed assessment on CFR Middle East basis, launched by Commodity Insights on Sept. 16, showed that the overall seaborne pellet feed market has been under pressure amid weak steel demand, particularly in China.

The seaborne pellet feed market saw a significant boost in sentiment by the end of September as the Chinese government announced macroeconomic policies to boost the economy and property market. However, the outlook for the seaborne market has been dampened as China's macroeconomic policies fell short of expectations.

As the winter season approaches, supply constraints are expected to hit the Chinese domestic market, the seaborne market could experience another boost in prices.

Source:Platts