Posted on 16 Oct 2024

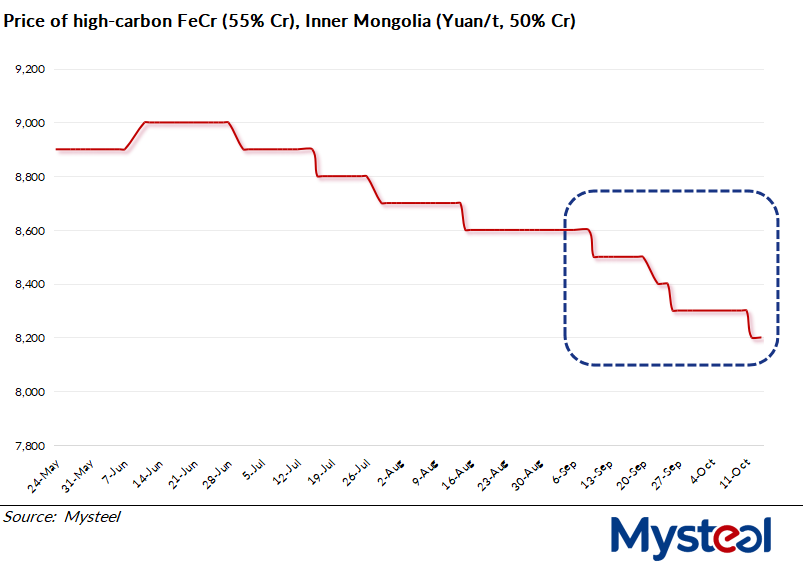

China's ferrochrome (FeCr) market has endured a challenging autumn, with prices consistently declining during the past month, Mysteel's assessments show. Nevertheless, despite this downturn, domestic FeCr prices may stabilize this month as market sentiment and fundamentals are expected to improve, say market insiders.

As of October 14, the price for high-carbon FeCr (with 55% Cr content) in North China's Inner Mongolia – a key benchmark for the domestic market – had dropped by Yuan 300/tonne ($42.20/t) compared to the previous month to settle at Yuan 8,200/t, a new low since December 2022, according to Mysteel's assessment.

The primary catalyst for this price decline was the steep reduction in bidding prices announced by China's leading stainless steel manufacturer, Tsingshan Group, in September for FeCr products. Market sources note that Tsingshan, headquartered in Wenzhou in East China's Zhejiang province and the country's largest stainless steel producer, often influences domestic spot prices of FeCr through its monthly bids.

On September 20, Tsingshan had announced its October tender price for high-carbon FeCr (50% Cr) at Yuan 8,295/t, including delivery and tax – Yuan 400/t lower than its previous bid in August. In addition, the Zhejiang maker cut its purchasing price at Tianjin port by another Yuan 150/t compared with the previous month. The group has now lowered its prices for three consecutive months, as tracked by Mysteel Global.

The profitability struggles experienced by domestic stainless steelmakers during September further contributed to their weakened demand for FeCr. With margins being razor-thin at best, stainless producers were reluctant to offer higher prices for raw materials, including FeCr, when procuring.

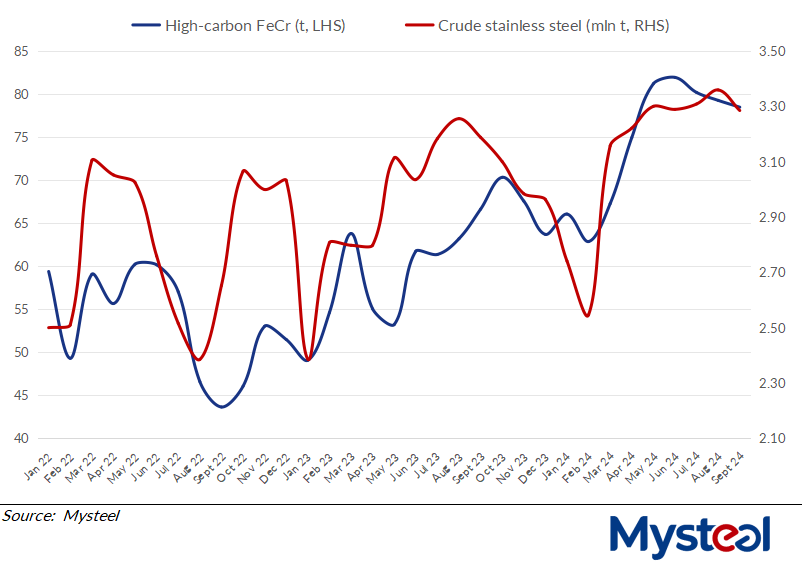

Chinese stainless producers also curtailed production in response to these unfavourable market conditions. Mysteel's latest monthly survey of 43 stainless steelmakers showed a 2.1% decrease in total stainless output to 3.29 million tonnes as of September 30.

Mysteel's monthly survey, which covers 95% of domestic FeCr smelters, showed that output of high-carbon FeCr in September dipped slightly to 784,700 tonnes from 792,600 tonnes in August.

Adding to the pressure, the cost support of FeCr was eroded further last month as prices of chrome ore, a crucial raw material, continued to slide. Over the period from September 14 to October 14, the price of chrome concentrate imported from South Africa had dropped by Yuan 4.5/dmtu to Yuan 57/dmtu at Tianjin port, according to Mysteel's daily survey.

Adding to the pressure, the cost support of FeCr was eroded further last month as prices of chrome ore, a crucial raw material, continued to slide. Over the period from September 14 to October 14, the price of chrome concentrate imported from South Africa had dropped by Yuan 4.5/dmtu to Yuan 57/dmtu at Tianjin port, according to Mysteel's daily survey.

On a positive note, the inventory pressure that has been mounting in recent months has begun to ease slightly this month, potentially providing some support to chrome ore prices. As of October 11, total chrome ore stocks at Chinese ports stood at 2.18 million tonnes, down from 2.27 million tonnes recorded on September 13, Mysteel's weekly survey showed.

Another factor that may alleviate cost pressures for FeCr smelters is the rebound in metallurgical coke prices over the past month. As of October 14, China's national composite coke price, as assessed by Mysteel, had risen by Yuan 240/t since mid-September to reach Yuan 1,785/t.

The outlook for October suggests that FeCr production may continue to decline in line with the reduction in stainless output. "A further decline in FeCr output in October is basically anticipated, as stainless production is expected to fall further this month," a Wuxi-based analyst predicts, adding that a decrease in supply could help alleviate the supply-demand imbalance seen in previous months and support FeCr prices.

Mysteel expects that crude stainless steel output among the 43 surveyed mills to dip again this month, decreasing by another 1.4% month-on-month to 3.24 million tonnes.

Source:Mysteel Global