Posted on 15 Oct 2024

|

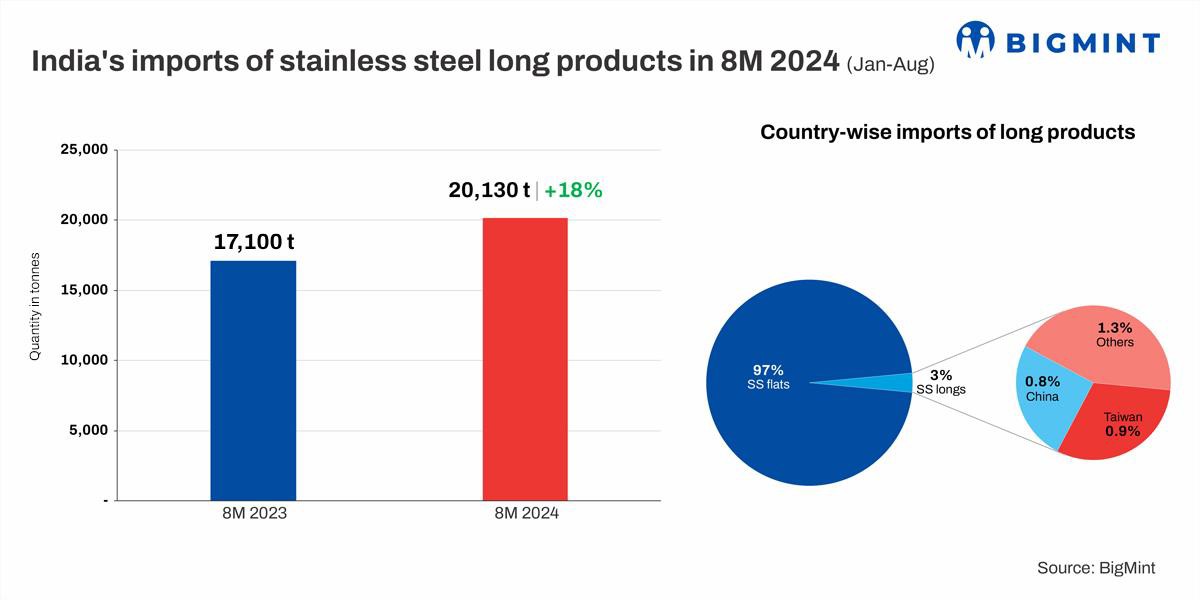

Morning Brief: India's imports of stainless steel (SS) long products rose nearly 20% in the first eight months of 2024 (8MCY'24) to about 20,130 tonnes (t) against the 17,100 t seen in the corresponding period last year (CPLY).

Meanwhile, India's overall imports of finished SS products remained stagnant at around 670,000 t during January-August 2024 from the previous year's 668,660 t. Longs comprise a miniscule 3% of the total with flats contributing the balance lion's share.

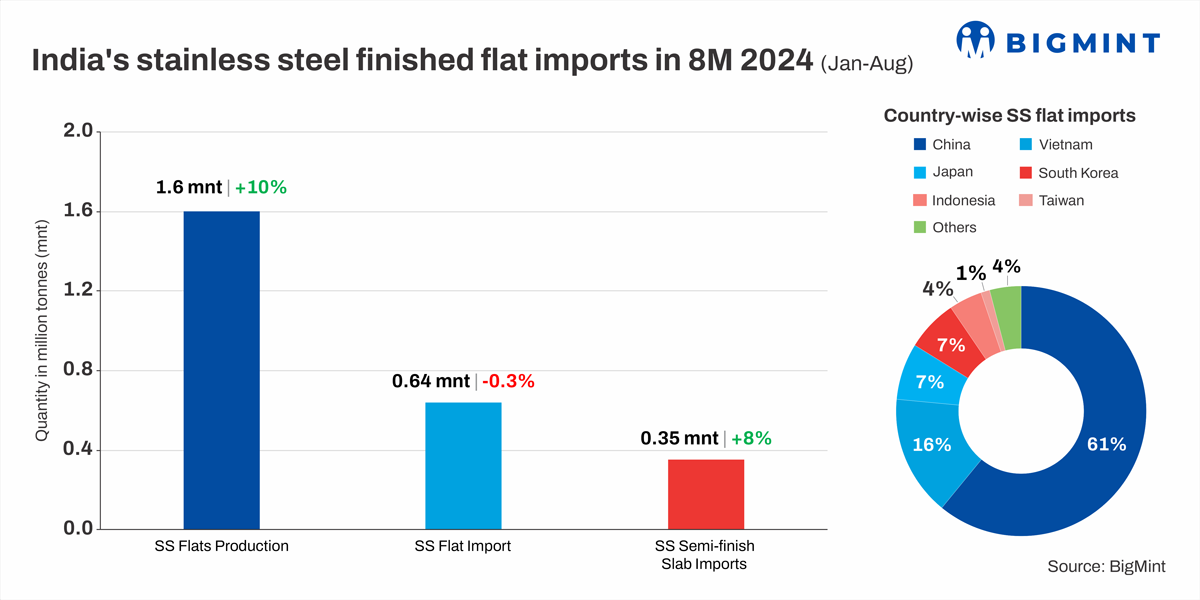

Notably, flats stainless steel imports, which account for 97% of the total finished imports, were stable in the January-August 2024 period under review, settling at 649,650 t from 651,560 t in CPLY. The marginal 2,000-t dip was due to a 10% increase in domestic production of SS flats in this period to 1.6 mnt from 1.46 mnt in CPLY. Additionally, imports of SS semi-finished slabs (300 series) from Indonesia also saw an 8% increase to 0.38 mnt in the first eight months, further supporting the increased production in domestic flats.

Additionally, exports of stainless steel flats from key supplying countries showed a decline in 8MCY'24. China's exports decreased by 7%, falling from 424,720 t to 395,780 t. South Korea experienced a similar drop of 4%, while Indonesia's exports to India declined by 10%. Notably, imports from Taiwan plummeted by 83%, decreasing from 43,040 t to just 7,410 t.

Influx of cheaper material: Furthermore, the rise in availability of competitively priced imported long products from countries like China and Taiwan has been notable. These imports are approximately INR 7,000-10,000/t cheaper than domestically produced materials. The primary factor contributing to this lower pricing is the more affordable raw materials in these countries. Additionally, they often use Nickel Pig Iron (NPI) as an cheaper alternative for nickel content. Exports from several European countries have also increased, largely because these nations have recently started importing significant quantities of NPI.

Domestic production of longs stagnant on scarce scrap: India's domestic SS longs production remained stuck y-o-y at around 688,000 t in 8MCY'24. This was mainly due to a 15% decline in imported SS scrap arrival to 737,090 t in 2024 from 865,780 t seen in CPLY. This decline impacted domestic production of SS long products, which rely heavily on scrap as a key raw material.

Several factors contributed to the tight imported scrap availability. The Red Sea crisis disrupted global trade, resulting in increased shipping costs and delays. Additionally, rising domestic preference for scrap, driven by elevated freight rates, reduced the reliance on imports. Thirdly, the volatility in nickel prices due to sanctions, coupled with local market challenges, further pressured profit margins. Consequently, mills prioritized local scrap sources, leading to stagnation in domestic SS longs production and a greater dependence on imports of the same.

Rise in SS billet imports: India significantly increased its stainless steel billet imports in 2024, from just 6,160 t in January-August 2023 to 109,800 t in the same period of 2024, as per the provisional data maintained by BigMint. Sweden was the largest supplier in 2023, while volumes from Indonesia were at nil. However, by 2024, Indonesia had emerged as the top supplier with nearly 95,000 t, followed by Sweden. The processing cost of producing long products from billets is lower than that from scrap. Yet, only a few manufacturers have been importing billets. Interestingly, most of the imported volume is concentrated in the hands of only one or two mills, which may explain the rise in stainless steel long product imports, despite an increase in semi- finished arrivals.

Imports of stainless steel finished products are expected to remain range-bound for the remaining period of calendar 2024. The second half (September-December) of the year will usher in a series of festivals in India, as well as global ones like Christmas and New Year. These events are likely to result in a slowdown in demand and transactions within the Indian market, a scenario that will likely keep imports of finished SS products stable.

Source:BigMint