Posted on 15 Oct 2024

|

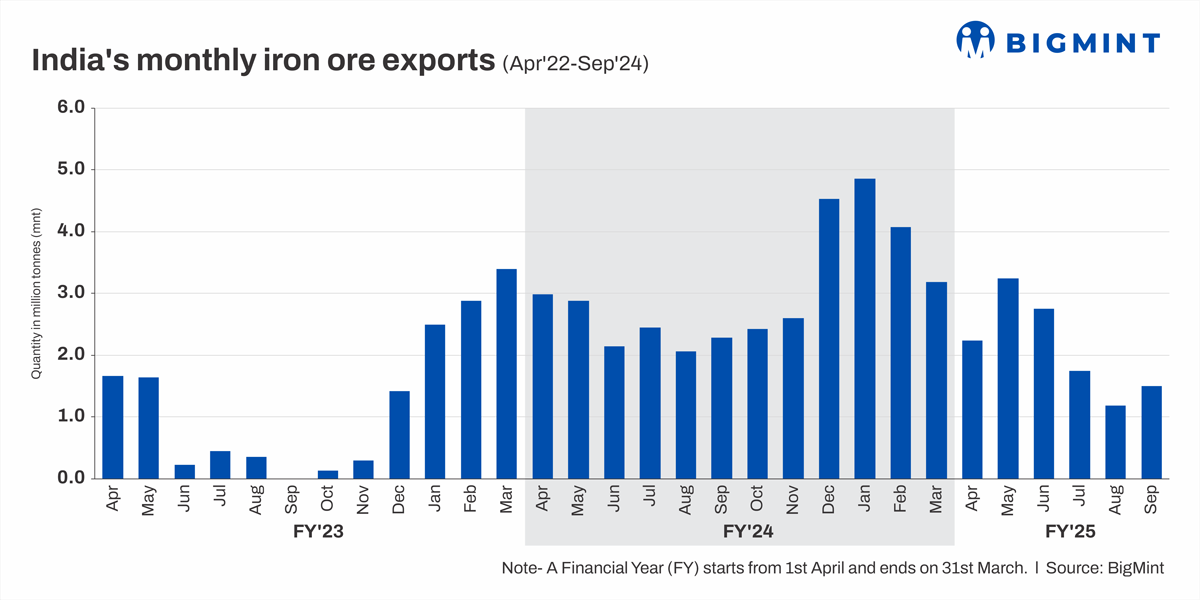

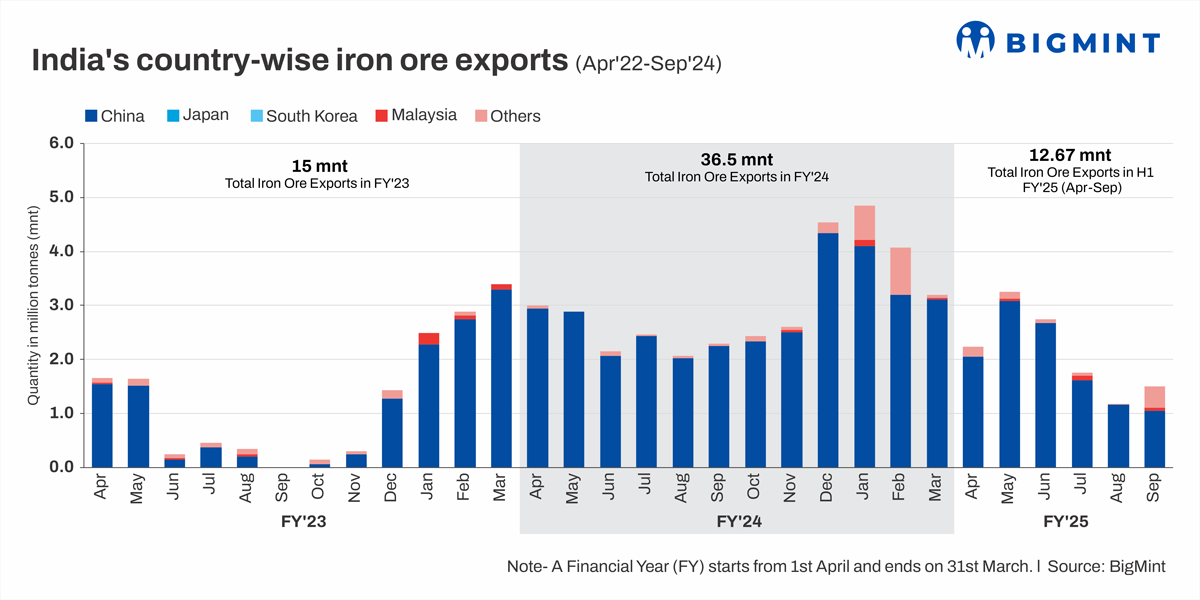

Morning Brief: India's iron ore exports, minus pellets, during the April-September 2024 (H1FY'25) period were approximately 12.68 million tonnes (mnt), as per data collated by BigMint. Iron ore exports declined nearly 15% y-o-y compared with 14.8 mnt in H1FY'24.

Iron ore exports are predominantly to China, the world's leading steel manufacturing country, which accounts for over 90% of shipments from India. Notably, shipments to China in H1FY'25 were recorded at around 11.6 mnt, a decline of over 20% y-o-y as against 14.6 mnt in the corresponding period of last fiscal. Still, China accounted for over 91% of Indian exports of iron ore during the period under review.

The country's top exporting companies recorded sharp increases in shipment volumes in H1, as per data. Among the leading exporters, Rungta Mines recorded the highest volumes in H1FY'25 at 4 mnt compared with 2.76 mnt in H1 of the previous fiscal.

Similarly, JSW Steel ramped up exports to 2.7 mnt from 1.1 mnt in H1FY'24. However, Vedanta recorded exports at around 700,000 t in H1 of this fiscal, down from 2.9 mnt in the same period of the previous fiscal.

|

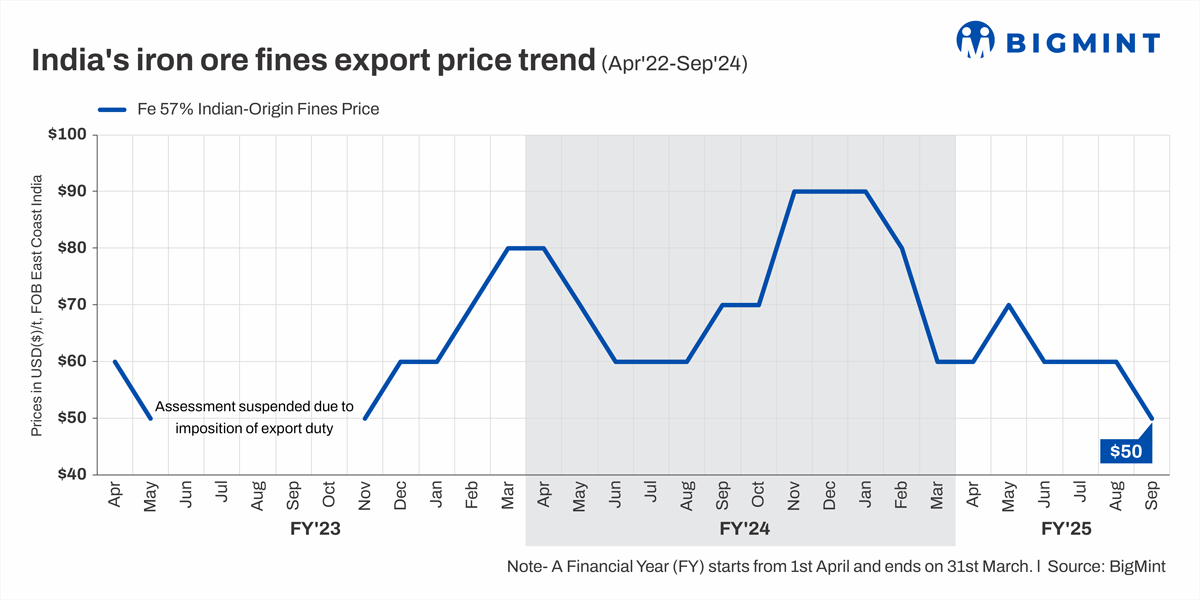

$60-70/t FOB in H1FY'24. The decline in global iron ore prices dampened India's export prices. Indian suppliers are on the higher end of the cost curve globally due largely to higher mineral transportation and logistics costs in India as well as higher royalties and embedded taxes. So, rapid decline in export prices naturally dampens the market.

In October, a number of deals have been heard concluded following the partial rebound in global iron ore prices post stimulus announcements in China. As per data furnished by the China Steel Logistics Committee (CSLC), which is part of the China Federation of Logistics and Purchasing, the country's production index for the steel sector in September stood at 54.9%, up nearly 20 percentage points compared to August, while the raw material purchasing volume index also reflected an over 10% m-o-m growth in September. This momentum is expected to build further and continue beyond October even as port inventory keeps edging down.

As the Chinese steel market gets into full gear post the Golden Week holidays (banking on property sector stimulus announced by the People's Bank of China), and if global iron ore prices firm up as expected, Indian export market sentiments might witness a decent recovery.

Source:BigMint