Posted on 15 Oct 2024

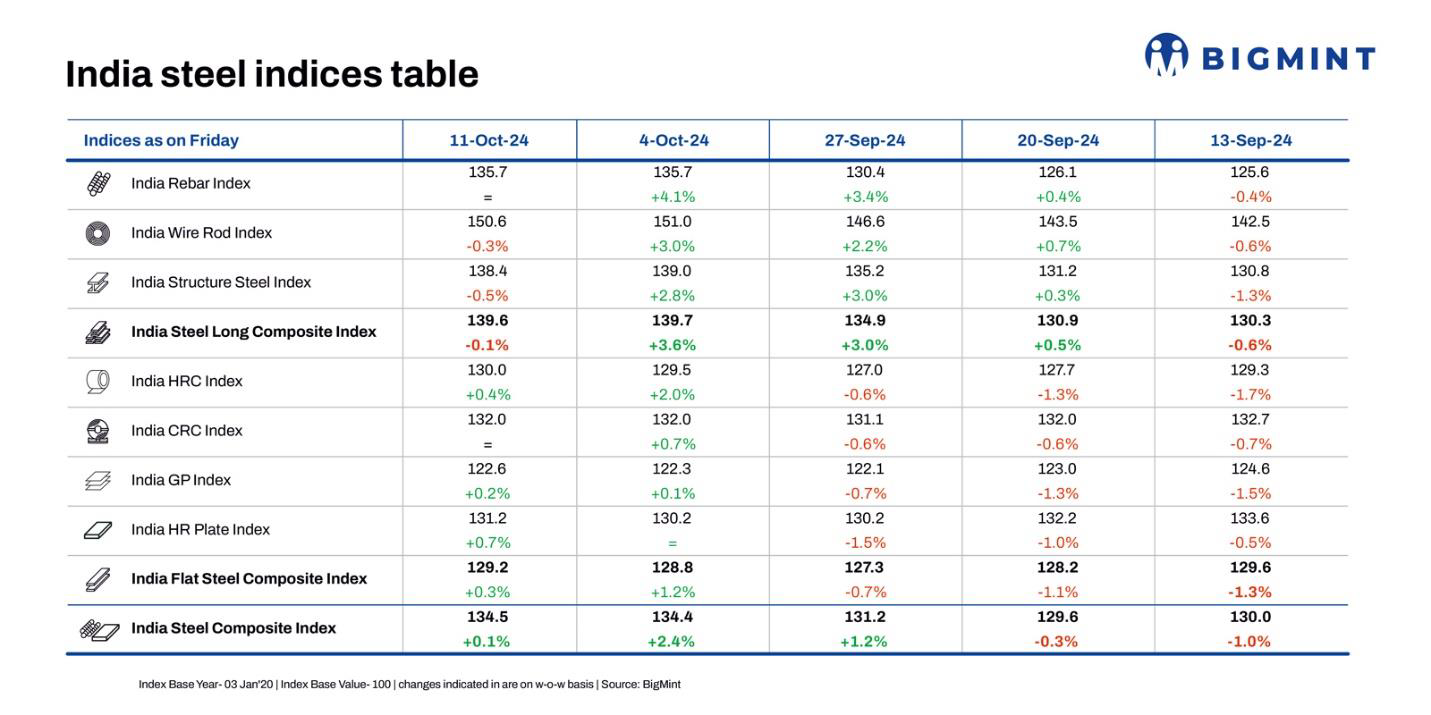

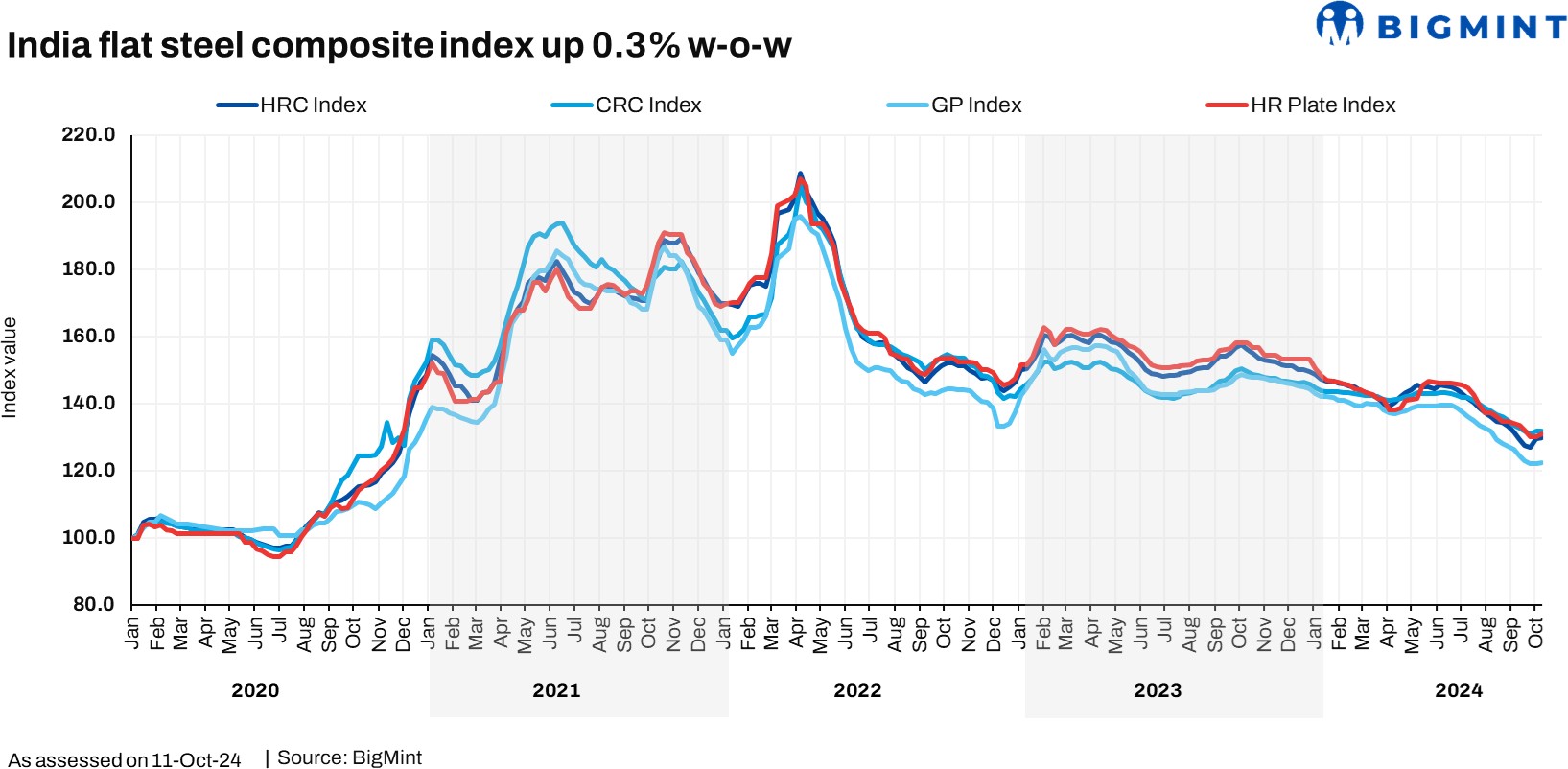

Morning Brief: Indian steel prices became range-bound yet again, closing up a minuscule 0.1% to 134.5 points on 11 October, after staging a smart rally in the preceding week.

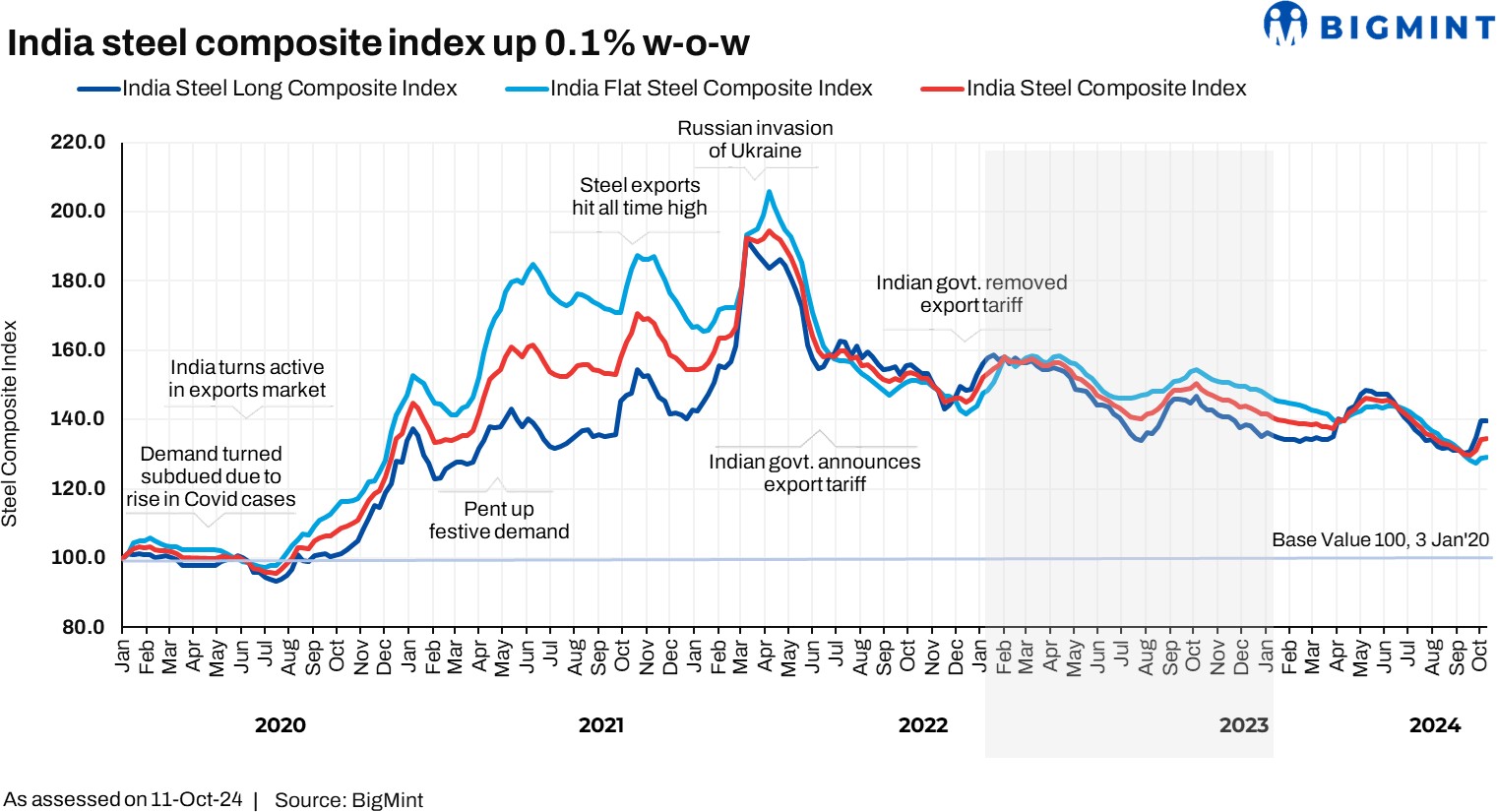

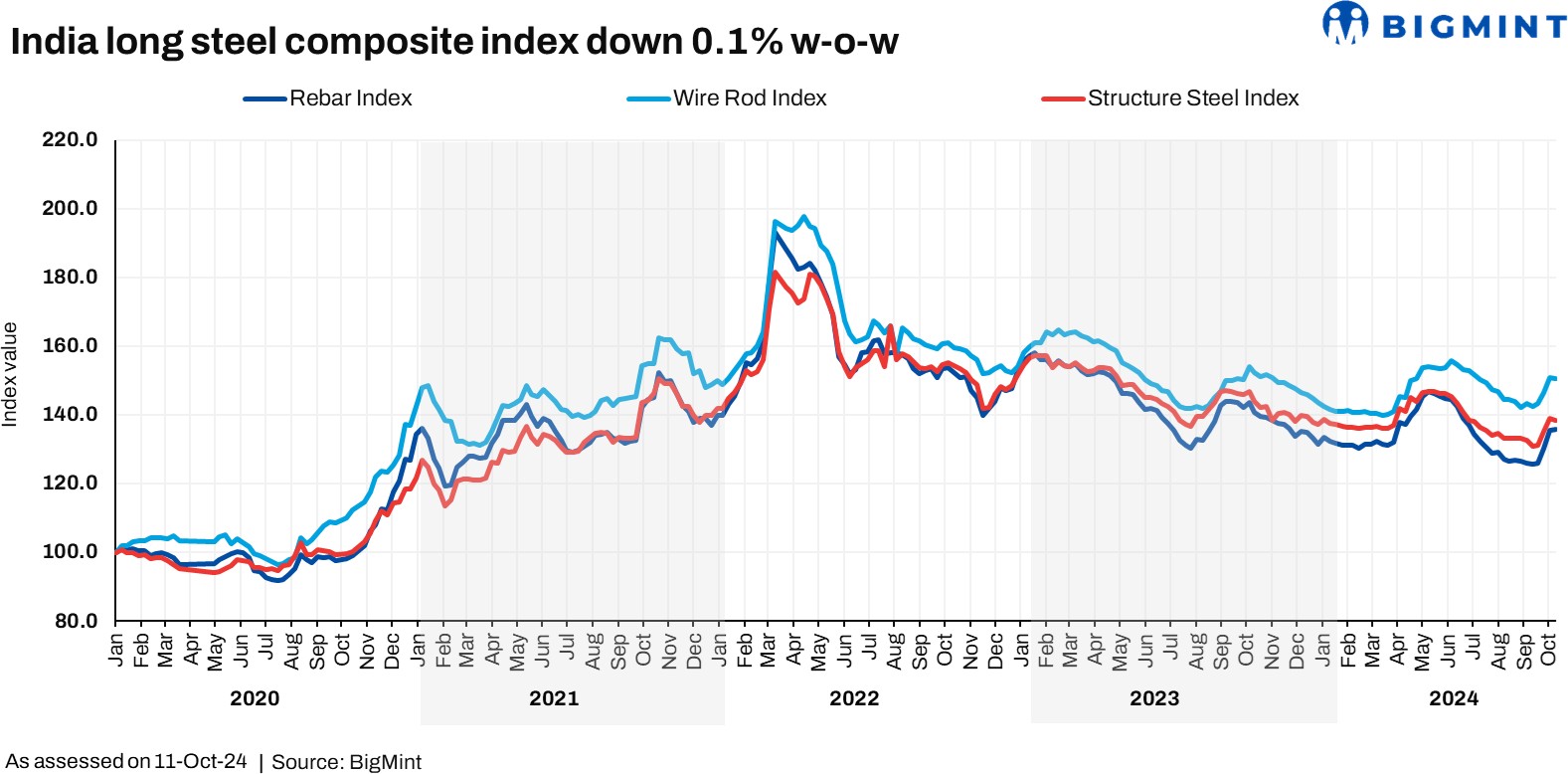

The longs index also lost fizz. Although rebars were stable, wire rods and structurals fell w-o-w. However, flats somewhat kept up the tempo for a second week, rising a marginal 0.31% after a prolonged bear grip.

Factors that impacted the index last week

Primary mills raise prices again: Indian primary mills raised rebar list prices for the second week in a row as tags went up by INR 1,000/tonne (t) ($12/t) to INR 53,500- 54,000/t ($636-642/t) on landed basis. It may be recalled, prices had been hiked by up to INR 2,000/t ($24/t) for the week ended 4 October.

Following the hike, trade-level blast furnace (BF) rebar increased further by INR 1,200/t ($14/t) w-o-w to INR 53,600/t ($637/t) exy-Mumbai, excluding 18% GST. Buying interest in the trader's market improved slightly because of the price uptrend and supply shortage from major PSU steelmakers. Buyers, wary that prices may rise further, did some bookings.

In the project segment, prices rose by INR 1,000/t ($12/t) w-o-w to INR 52,000- 53,000/t ($618-630/t) FOR Mumbai.

IF rebars flat w-o-w in mixed market: Induction furnace (IF) rebar remained flat w-o- w at INR 48,600/t ($578/t) exw-Mumbai. Overall, IF rebars exhibited mixed trends.

New IF segment bookings slowed at the higher end of the price spectrum as downstream buyers were stocked up from the previous week. With inventory levels down to 7-10 days, mills were under no inventory pressure either. As a result, they maintained their list prices, leading to a disparity in trader- and mill-level prices.

The price gap between BF-IF rebar stood around INR 4,000-4,500/t ($48-54/t) in the Mumbai market.

Trade-level flats prices rise for 2nd week in a row: Trade-level hot rolled coil (HR) prices witnessed an uptick of INR 200-800/ ($2-10/t). Benchmark HRC was up a modest INR 200/t ($2/t) to INR 48,600/t ($578/t). However, cold rolled coil (CRC) prices remained stable w-o-w with the benchmark assessment falling by INR 200/t ($2/t) to INR 55,600/t ($661/t).

Overall, the market recovered slightly with a moderate increase in orders ahead of the onset of the festive period of Navratri and Durga Puja followed by Diwali.

Last week, there were rumours that tier-1 mills had raised prices by INR 500-1,500/t ($6-18/t) for October 2024 sales which pushed up trade-level prices by INR 700- 1,400/t ($8-17/t).

Export offers to Middle East resume: Indian steel mills resumed their export offers to the Middle East (ME) after a five-month gap, spurred by the recent surge in global prices. This resurgence possibly coincided with increased Chinese export offers and restocking ahead of the National Day holidays (1-7 October 2024). Chinese SHFE futures recently spurted by RMB 140/t ($20/t) compared to end-September levels.

Vietnamese mills hiked HRC offers for December sales by $35/t m-o-m.

Indian HRC export offers to the ME were at $530-540/t CFR UAE, with a deal of approximately 10,000 t reportedly concluded at $530/t CFR UAE for November shipment and which influenced Indian domestic pricing to an extent. Indian mills' offers to the EU remained flat w-o-w at $606-610/t CFR Antwerp. Overall, though offers rose, global markets continued to remain sluggish.

Iron ore prices rise: Iron ore increased w-o-w, having a bearing on last week's finished prices. BigMint's Odisha iron ore fines Fe62% index rose by INR 300/t ($4/t) w-o-w to INR 4,800/t ($57/t) ex-mines as on 5 October, 2024 due to higher offers from miners because of reduced dispatches amid an extended monsoon, and stronger demand from pellet, sponge, and steel makers. Global iron ore fines index also rose ahead of China's Golden Week, influencing Indian ore prices.

Overall, longs buyers have entered a wait-and-watch mode, expecting further price clarity from mills after Dussehra.

Domestic flats may sustain the uptrend in the short term. However, it is to be seen if the market will absorb the price hikes across longs and flats post-Diwali.

The near-term view on exports is somewhat mixed with many Indian mills still holding back offers to the Middle East since global market fundamentals remain the same amid geopolitical issues, and higher freights.

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India

Source:BigMint