Posted on 30 Sep 2024

China's steel market is set for a strong performance in October, fuelled by positive market sentiment and the positive impact of recent government stimulus measures, according to Wang Jianhua, chief analyst at Mysteel. In his latest monthly outlook, Wang forecasts a solid rebound in steel fundamentals following September's improvements, as prices have surged after months of stagnation.

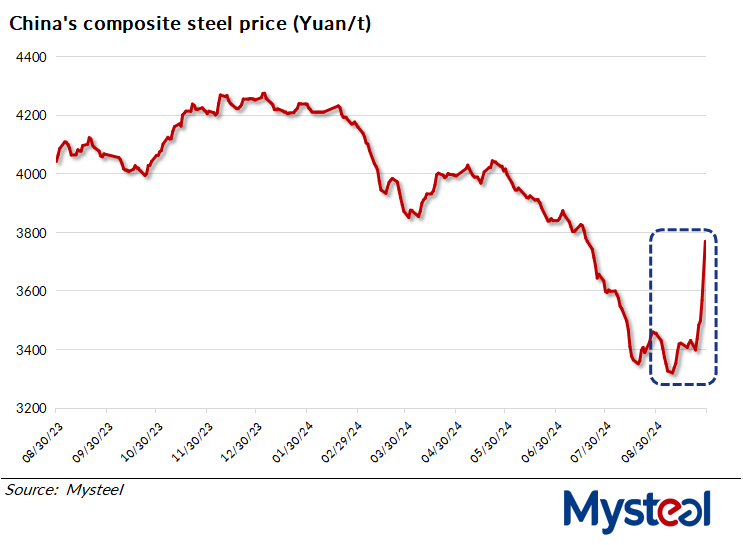

The steel market has rebounded as the end of September nears, with prices rising significantly. Mysteel has reported that by September 27, the national composite steel price had climbed by Yuan 114.8/tonne ($16.4/t) compared to August 30 and reached Yuan 3,567.9/t. This surge was largely driven by the central government's stimulus package introduced on September 24, which lifted market sentiment for all domestic ferrous commodities.

"The recent stimulus measures have not only exceeded expectations but have created a wave of optimism across the economy," Wang said. The policies have sparked recoveries in both the stock and property markets, boosting consumer confidence. This renewed confidence, he noted, is the key driver behind the rise in steel prices, the commodity's fundamentals being closely tied to macroeconomic policies.

Besides the pickup in consumer confidence, Wang pointed to the benefits of lower interest rates and the reduced required reserve ratio announced by the Peoples' Bank of China, which are supporting businesses on the supply side. This, combined with lower steel inventories and increased demand, is setting the stage for what could be a "golden month" for China's steel sector in October.

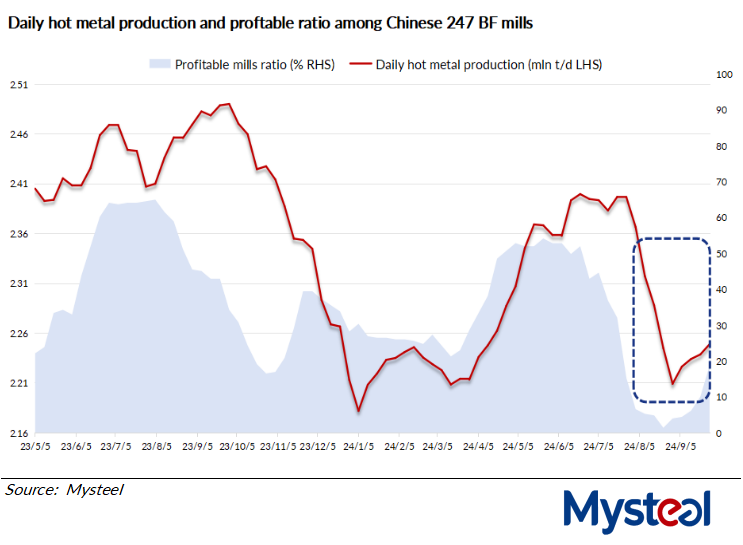

Mysteel's sentiment indices on major steel products reflect this optimism. For construction steel, market sentiment had risen sharply by 21.77 percentage points by September 27 to reach 83.65%, hitting a 20-month high. In addition, planned supply cuts have helped strengthen market fundamentals. Data from Mysteel's survey of 247 steel mills nationwide showed a decrease in daily hot metal output, which had averaged 2.23 million tonnes/day from August 30 to September 27.

China's steel inventory levels have also dropped significantly this month. By September 26, the total stocks of major carbon steel products held by steelmakers and traders in 35 Chinese cities Mysteel checks had fallen by 2.7 million tonnes since late August to reach their lowest point since December 2022.

Looking ahead, Wang predicts that inventories of construction steel at warehouses will fall by approximately 1 million tonnes in October, despite potential supply increases. After the National Day holiday (October 1-7), steelmakers are expected to ramp up production as higher prices will further bolster their profitability.

Looking ahead, Wang predicts that inventories of construction steel at warehouses will fall by approximately 1 million tonnes in October, despite potential supply increases. After the National Day holiday (October 1-7), steelmakers are expected to ramp up production as higher prices will further bolster their profitability.

Mysteel's data shows that by September 27, some 18.6% of all blast furnace mills tracked were turning a profit, up from just 3.9% on August 30. This suggests growing confidence in the industry as more producers return to profitability.

Wang also expects a post-holiday rise in raw material demand. This year, steelmakers have been less active in stocking up key materials like iron ore ahead of the holidays, he noted.

Wang also expects a post-holiday rise in raw material demand. This year, steelmakers have been less active in stocking up key materials like iron ore ahead of the holidays, he noted.

In contrast to last year's pre-holiday replenishment period which lasted for five weeks, this year only 6.51 million tonnes of iron ore were purchased in the lead up to National Day, down from 14.79 million tonnes this time last year. After the holiday, demand for raw materials is expected to increase, pushing prices higher and reinforcing cost support for the steel market, Wang suggested.

China's steel market appears poised for a strong October, driven by government stimulus, improved sentiment, and tightening supply-demand dynamics, Wang summarized.

Source:Mysteel Global