Posted on 26 Sep 2024

On September 24, China's National Development and Reform Commission (NDRC) released its latest survey on key wholesale steel markets across the country, including South China, Shanghai, and Tianjin, with the survey results showing that Chinese steel prices will likely continue their upward momentum throughout September.

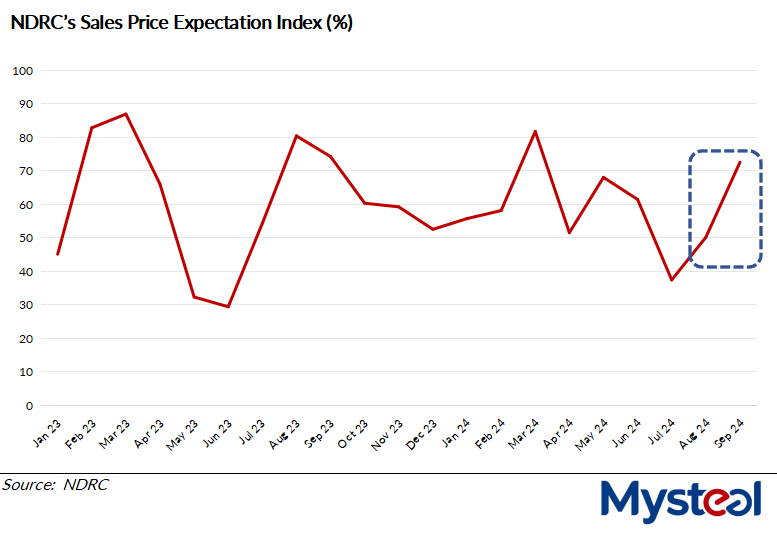

The survey, based on six key indices, revealed that the Sales Price Expectation Index and Purchase Price Expectation Index for the wholesale markets had reached 72.4% and 68.8%, respectively. Both figures show significant gains of 22.4 and 20.6 percentage points from August, signalling a clear upward trend in steel prices. The indices crossed the critical 50% threshold, reflecting strong market confidence.

Regarding demand expectations, the Sales Volume Expectation Index rose to 71.9%, marking a 10.8% increase from August. Meanwhile, the Inventory Expectation Index fell further to 41%, dropping 3.8 percentage points from the previous month. This points to tightening supply conditions, with stock levels at key wholesale markets declining, which further supports the likelihood of steel prices rising.

Regarding demand expectations, the Sales Volume Expectation Index rose to 71.9%, marking a 10.8% increase from August. Meanwhile, the Inventory Expectation Index fell further to 41%, dropping 3.8 percentage points from the previous month. This points to tightening supply conditions, with stock levels at key wholesale markets declining, which further supports the likelihood of steel prices rising.

The recent recovery in steel demand, which began in late August as the extreme summer heat subsided across the country, has also contributed to the positive outlook. Stocks of key steel products including rebar, have stayed relatively low, reinforcing the view that steel prices are likely to bottom out and rally through September.

In addition, the rise in prices is expected to bolster the profits of steelmakers, even though production costs may also increase slightly. This is supported by the Sales Cost Expectation Index and Sales Profit Margin Expectation Index, which climbed to 59.1% and 64.8%, respectively, reflecting increases of 4.2 and 12.8 percentage points compared to August.

However, the NDRC cautioned that the improved profitability could encourage more steelmakers to increase production. This could jeopardize the fragile recovery in the market, potentially putting downward pressure on domestic steel prices later in the month.

Source:Mysteel Global