Posted on 17 Sep 2024

Rebar production among the 137 Chinese steel producers Mysteel samples rose for the third week over September 5-11 to reach a one-month high of 1.88 million tonnes, climbing by 5.3% or 93,900 tonnes on week, according to the latest weekly survey.

Survey respondents pointed out that steel mills in East China posted a substantial rise in output during the survey period due to improved profitability on rebar sales and mills ending their practice of only operating during off-peak periods for electricity demand. Meanwhile, most mills in Southwest China increased production after power restrictions had been lifted, while a few mills in South China also switched from producing hot-rolled coils to rebar for better returns.

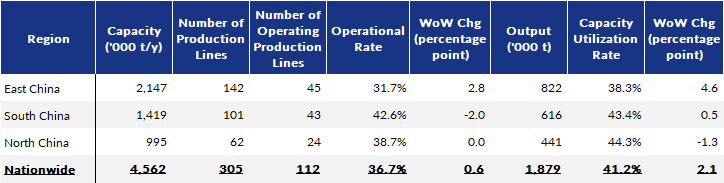

During the survey week, the rebar rolling capacity utilization rate among the surveyed producers moved up by 2.1 percentage points on week to 41.2%, and their operational rate edged up 0.6 percentage point on week to 36.7%, Mysteel's data showed.

In parallel, rebar inventories at the 137 steelmakers and among commercial warehouses in 35 cities had decreased further and at a faster pace as of September 12. Stocks held by the former had declined for a seventh straight week by another 6% or 88,100 tonnes to 1.38 million tonnes, while those held by the latter dropped for the tenth week in a row, tumbling 13% or 531,900 tonnes on week to 3.56 million tonnes.

Behind the quickening pace of rebar destocking was a fast on-week recovery in demand from end-users last week, according to the survey. Over September 6-12, spot trading volume of rebar, wire rod and bar-in-coil among the 237 steel trading houses under Mysteel's tracking surged by 23.8% or 23,509 tonnes/day on week to average 122,214 t/d. Pre-holiday stocking among users was suggested as the reason.

The survey predicted long steel consumption would show some resilience in the short term, underpinned by seasonal factors and replenishment needs ahead of China's National Day holiday week commencing on October 1.

As of September 12, the country's national price of HRB400E 20mm dia rebar was assessed by Mysteel at Yuan 3,337/tonne ($469/t) including the 13% VAT, reversing up Yuan 77/t from a week earlier.

Table 1: Rebar Production Survey by Region by Sept 11

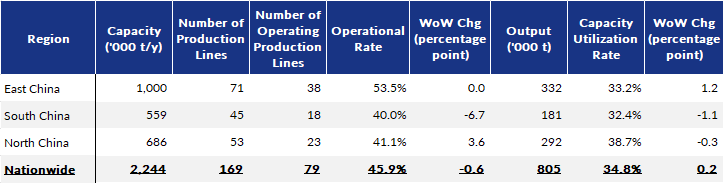

Table 2: Wire Rod Production Survey by Region by Sept 11

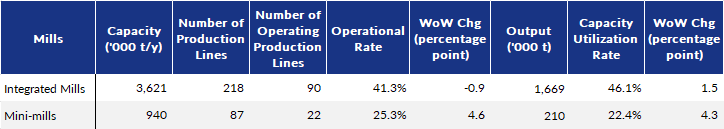

Table 3: Rebar Production Survey by Process by Sept 11

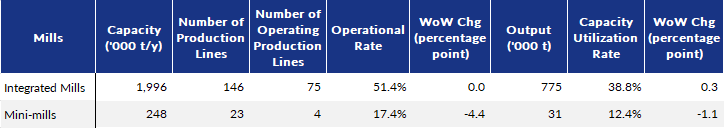

Table 4: Wire Rod Production Survey by Process by Sept 11

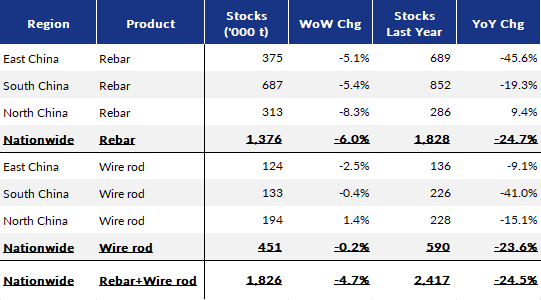

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Sept 11

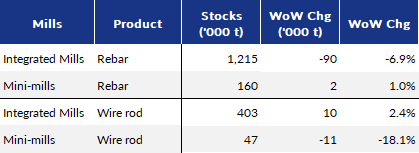

Table 6: Rebar and Wire Rod Stocks Survey by Process by Sept 11

Source:Mysteel Global