Posted on 04 Sep 2024

With China's steel market entering the traditional peak season in autumn, the country's steel prices in September are expected to continue the rising trajectory they've been following since late August, Mysteel's Chief analyst Wang Jianhua predicts in his latest monthly outlook.

"Last month's price rebound was gained through significant sacrifices by the steel market," Wang commented. "The previous price plunges caused nearly all steelmakers in China to suffer losses and led to wide-ranging maintenance stoppages among the mills," he explained. "The supply cuts finally laid the foundation for the price recovery," he added.

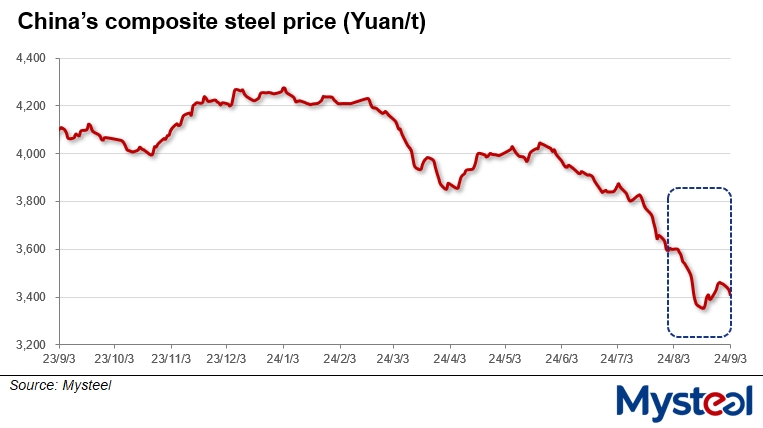

On August 19, Mysteel's assessment of China's composite steel price touched the lowest level since April 2017 at Yuan 3,351.47/tonne ($470.6/t) including the 13% VAT, before it rallied to Yuan 3,453.17/t by August 30, Mysteel Global notes. The price was still 3.9% lower than at the end of July, however.

Entering September, with steelmakers gradually resuming operations after completing maintenance stoppages, China's steel supply is likely to expand this month, Wang predicted.

Entering September, with steelmakers gradually resuming operations after completing maintenance stoppages, China's steel supply is likely to expand this month, Wang predicted.

Nonetheless, "as long as steel mills continue to keep their production under cautious control, the increase in steel output can be fully absorbed by the market," Wang maintained, noting that steel demand will strengthen in September as the end-users' production activity will grow with the arrival of cooler autumn weather.

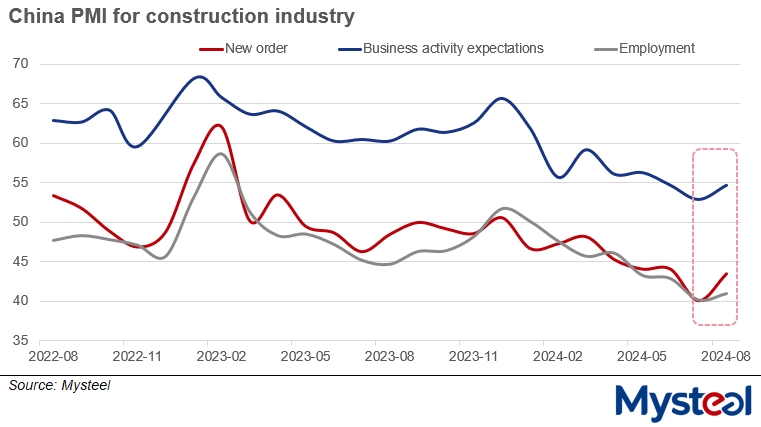

For example, under the recently released Purchasing Managers' Index (PMI) for China's construction industry, the indicators for new orders, business activity expectations, and employment all increased on month in August. This suggests that building contractors will expedite their work this month, and their consumption of construction steel will rise in tandem, according to Wang.

"As such, the inventories of old-standard rebar are expected to be fully consumed this month, and some regions may even witness shortages of rebar when the users restart their replenishment," Wang believed.

On the other hand, China's steel demand from the manufacturing industry remains resilient as the producers of automobiles, home appliances, and ships are all likely to keep their production robust this month, he pointed out.

Under such circumstances, Wang estimates that the total inventories of the five major steel products held by the 184 steelmakers and traders across the 35 domestic cities that Mysteel tracks will continue to drop by some 1 million tonnes overall to reach 14.6 million tonnes during September. Specifically, rebar stocks are likely to decline by around 600,000 tonnes this month, he stressed.

Source:Mysteel Global