Posted on 16 Aug 2024

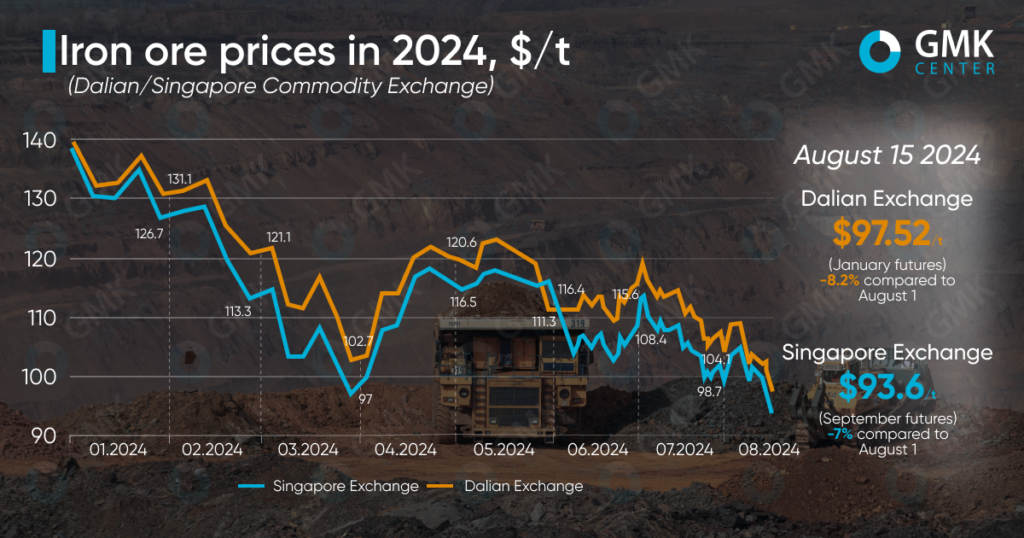

January iron ore futures, the most traded on the Dalian Commodity Exchange, fell by 8.2% to 698 yuan/t ($97.52/t) for the period August 1-15, 2024, according to Hellenic Shipping News.

On the Singapore Exchange, quotes for September benchmark futures as of August 15, 2024, decreased by 7% compared to the price as of August 1 – to $93.6/t.

During the first half of August, iron ore prices fell to a 14-month low as the continued weak performance of China’s real estate sector put negative pressure on steel demand expectations. In particular, in January-July, investment in Chinese real estate fell by 10.2% y/y. The number of new construction starts since the beginning of the year decreased by 23.2% y/y. The real estate market continues to be the main consumer of steel in China, despite the falling share of this sector amid the ongoing crisis since 2021, so the state of the construction industry directly affects steel companies, demand for steel and raw materials.

“We believe that ore prices have further room for decline, given that the psychological level of $100 per tonne has already been passed. The steel industry benchmarks on the Shanghai Futures Exchange showed further losses, and the sharp drop in prices worsened sentiment,” Shengda Futures analysts said.

At the same time, a significant drop in demand for raw materials is evidenced by data on steel production in China in July – by 9.5% m/m and 9% y/y, to 82.94 million tons. Amid weak demand and declining margins, many steel companies are shutting down production facilities for maintenance or limiting them. According to MySteel, about 95% of China’s steelmakers are operating at a loss. Against this backdrop, as of August 12, 79 steel mills were shut down for repairs, which is 41 more than in August 2023.

In addition to weak construction, the transition to new rebar standards is another factor depressing steel demand. In addition, many export markets, which have been flooded by cheap Chinese steel, have begun to implement anti-dumping measures against these imports. In the long run, this will significantly reduce the country’s export capabilities and, if the problems in the domestic market continue, will create a collapse for local steelmakers.

The British international commercial bank HSBC Holdings expects iron ore prices to reach $100 per tonne in 2024. Capital Economics predicts that quotations for this raw material will vary at $99-100/t. By the end of next year, iron ore prices will fall to $85/t.

Source:GMK Center