Posted on 14 Aug 2024

After slipping for four straight weeks, Chinese export prices for commercial-grade hot-rolled coils (HRCs) managed to stabilize somewhat in the past week, though the downside risks remained given the still-weakening domestic steel market, Mysteel's weekly market roundup shows.

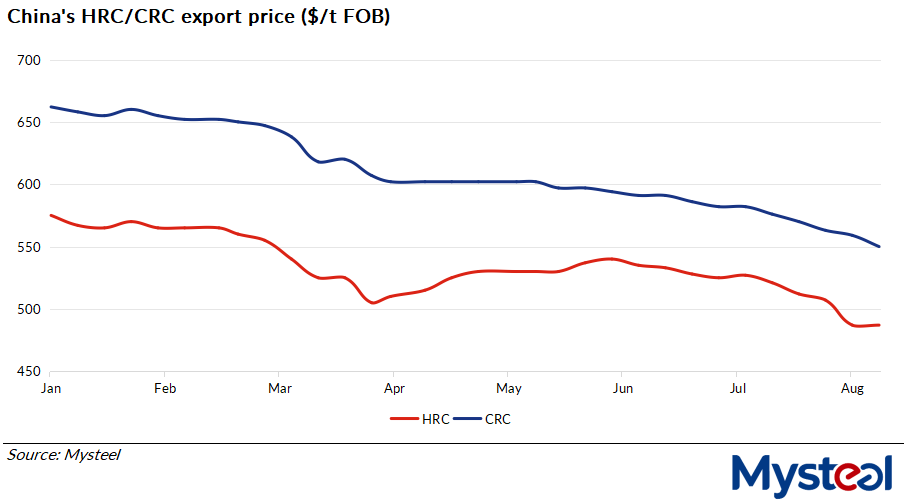

As of August 9, the export price of SS400 4.75mm HRC under Mysteel's assessment had stayed unchanged on week at $487/tonne FOB from North China's Tianjin port.

Despite the flat on-week result, the export prices of Chinese hot coils experienced a volatile week in response to changes in both domestic and foreign markets, Mysteel's survey observed.

At the beginning of the week, the weakening US dollar index prompted some Asian steelmakers, including Chinese mills, to raise their export HRC quotations. For example, the export offering prices for China-origin Q235B HRC rose to $493-520/t FOB, up from the prior week's prices of $483-490/t.

However, the further weakening of HRC prices in China's domestic market soon dragged down the export quotations for Chinese hot coils from mid-week.

Some Chinese steel mills lowered their export offers for Q235/Q195 HRC by about $5/t from early week to $493/t CFR Vietnam for October shipment, while local buyers in Vietnam inquired for a lower price of $490/t CFR, Mysteel heard.

Regarding transactions, Vietnamese buyers' appetite for China-origin hot coils picked up modestly last week, as some believed that the export quotations of Chinese HRC reached bottoms.

Mysteel heard that deals involving Chinese Q235 HRC were reached in Vietnam at $492/t CFR last week, and SAE1006 HRC from China were also concluded there at $505/t CFR.

By August 9, the export price of China-origin SPCC 1.0mm cold-rolled coil continued its downward trend, losing another $9/t on week to sit at $550/t on FOB Tianjin basis, according to Mysteel's assessment.

Source:Mysteel Global