Posted on 06 Aug 2024

For China's integrated steel producers, August is shaping up to be a very challenging month, with most reeling from severe blow to their profitability and their margins on domestic steel sales hitting a recent record low, Mysteel's latest weekly survey results show.

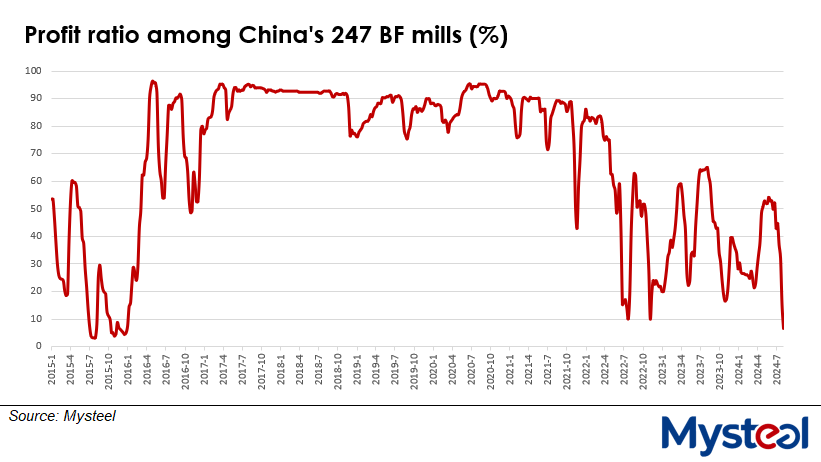

As of August 2, the average profit ratio enjoyed by the 247 blast-furnace (BF) steel mills across China under Mysteel's regular tracking had plummeted to just 6.49% (pictured below) – half that of the previous week's already poor 15.15% average and the lowest level in a decade. The BF mills' poor returns were largely attributed to the rapid decline in domestic steel prices recently, Mysteel Global noted.

On August 1, the national price of HRB400E 20mm dia rebar, a bellwether of China's steel market sentiment, was assessed by Mysteel at Yuan 3,390/tonne ($473.5/t) including the 13% VAT, down by a large Yuan 239/t from a month earlier.

On August 1, the national price of HRB400E 20mm dia rebar, a bellwether of China's steel market sentiment, was assessed by Mysteel at Yuan 3,390/tonne ($473.5/t) including the 13% VAT, down by a large Yuan 239/t from a month earlier.

In parallel, Chinese prices of hot-rolled coil (HRC) and billet, two other major steel items China produces, had also tumbled during July.

According to Mysteel's assessment, as of August 1, the national price of Q235 4.75mm HRC had declined by Yuan 234/t on month to reach Yuan 3,498/t including the 13% VAT, while the Tangshan Q235 150mm square billet price had lost Yuan 180/t on month to Yuan 3,150/t EXW and including the 13% VAT.

The trigger of the extensive price downturn

Surprisingly, the extensive downturn in Chinese steel prices was triggered by the pending introduction of new standards for rebars that are due to come into force late next month, Mysteel Global notes.

On June 25, China's State Administration for Market Regulation had approved two new mandatory national standards for hot-rolled plain and ribbed rebar, GB1499.1-2024 and GB1499.2-2024, under which rebars are required to meet stricter tolerances regarding production accuracy, fatigue performance, smelting processes and testing methods, as Mysteel Global reported (https://www.mysteel.net/article-preview/b4e0d15cb18eab1b84d3b24b31992889).

With these new standards set to take effect on September 25, Chinese rebar producers and traders find themselves with a very small window of time in which to find buyers for rebar stocks made to the existing specifications. Adding insult to injury, the traditional summer lull in construction activity is posing additional challenges for rebar consumption.

Against this backdrop, Chinese rebar producers and traders began to sell off their existing rebar stockpiles shortly after the new requirements were announced and circulated in the market in late June.

"The sell-off is believed to have been first observed in Xinjiang Uygur autonomous region (in Northwest China), with some mills' rebar list prices in the region being discounted by Yuan 100-200/t to fall below the psychological threshold of Yuan 3,000/t in mid-July," a market source told Mysteel Global.

The market panic quickly spread, with more rebar producers and traders across the country rushing to slash their selling prices in a desperate attempt to attract buyers and empty their warehouses.

In November 2018 when similar changes to rebar quality requirements became effective including alloy content and performance, some building contractors had refused to accept rebars meeting the previous standards, even though these had been perfectly acceptable only weeks before. Hence the urgency with which mills and traders are hurrying to clear inventory this time, Mysteel Global notes.

The wave of panic selling among rebar producers and traders inevitably led to a plunge in rebar prices, with the drop extending to other steel products as well.

A classic prisoner's dilemma

"The current situation resembles a classic prisoner's dilemma for many steelmakers and traders. The more they cut prices, the greater their losses, yet it appears to be the only way for them to clear their rebar stocks," a market watcher in Shanghai remarked.

On the other hand, some steelmakers have chosen to scale back supply to alleviate the mounting pressure they face on sales, Mysteel Global noted. As of July 31, a total of 38 steel mills nationwide had initiated maintenance stoppages on their steelmaking facilities, leading to an estimated reduction of 3.36 million tonnes in construction steel output, according to Mysteel's latest survey.

Nevertheless, with most of the mills' scheduled overhauls set to commence this month, it's too soon to see any marked reduction in China's steel output.

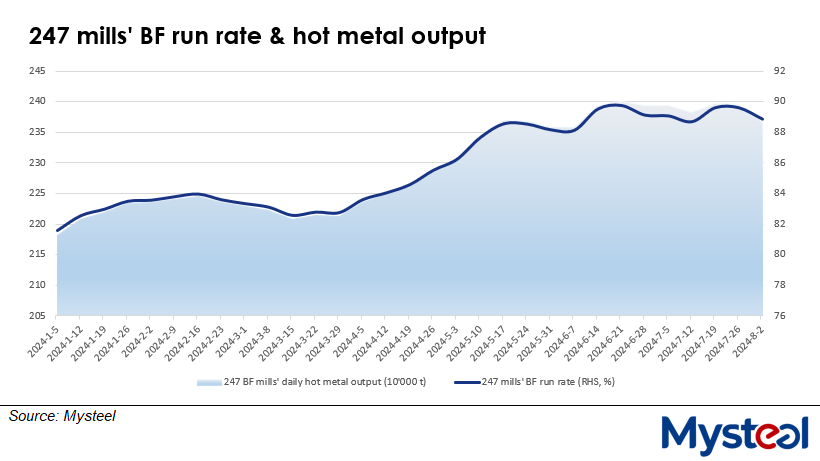

As of August 2, daily average hot metal output among the 247 BF mills under Mysteel's weekly survey was lower by only a mild 27,000 tonnes/day or 1.1% from the previous month at 2.37 million t/d, while the average BF run rate among these mills remained largely unchanged at 88.87%, compared to 89.08% in early July.

As of August 2, daily average hot metal output among the 247 BF mills under Mysteel's weekly survey was lower by only a mild 27,000 tonnes/day or 1.1% from the previous month at 2.37 million t/d, while the average BF run rate among these mills remained largely unchanged at 88.87%, compared to 89.08% in early July.

"There's still considerable room during the remainder of this year for Chinese mills to reduce their steel production, especially in light of the new rules on rebars and more importantly, the shrinking demand for steel," observed a senior ferrous analyst in Shanghai. "Only in this way can Chinese steelmakers achieve a better balance of supply and demand, which will help them secure healthier profits in the future," he told Mysteel Global.

Source:Mysteel Global