Posted on 02 Aug 2024

Rebar production among the 137 Chinese steelmakers tracked by Mysteel nationwide decreased for the fifth consecutive week to refresh a five-month low of 1.98 million tonnes over July 25-31, with the pace of decline quickening to 8.7% on week as compared to the 3% drop seen in the previous week, the latest survey data show. The survey week's production volume was also 26.7% lower than the corresponding period last year.

Survey respondents attributed the on-week fall in rebar output to the fact that many Chinese mills scaled back production in a bid to digest the existing stockpiles of old-standard bars before the new rules of rebar national standards take effect in late September and in response to mills' deepening losses on sales as well.

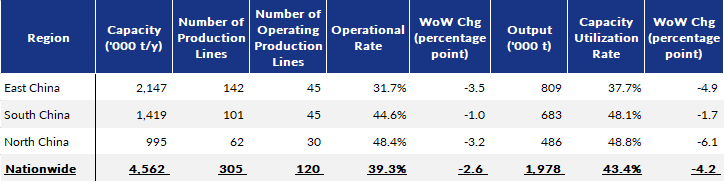

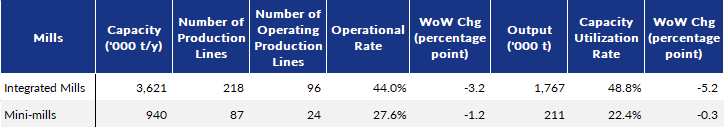

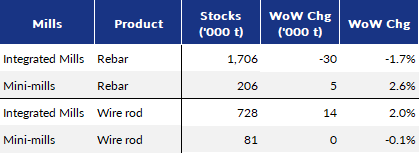

Integrated mills were mostly responsible for the slide in rebar output, and mills located in East and Northwest China posted significant on-week declines, with their reduction volume down 104,700 tonnes and 50,000 tonnes respectively, Mysteel Global noted.

During the survey period, the rebar rolling capacity utilization rate among the surveyed steel producers slipped by 4.2 percentage points on week to 43.4%, and the operational rate among these mills eased by 2.6 percentage points on week at 39.3%, Mysteel's data indicated.

Meanwhile, domestic spot rebar prices had been weighed down by low demand in the summer dull season and weak market sentiment. As of August 1, the country's national HRB400E 20mm dia rebar price, a bellwether of the country's steel-market sentiment, was assessed by Mysteel at Yuan 3,390/tonne ($468/t) including the 13% VAT, shrinking by Yuan 32/t on week.

Spot trading of construction steel including rebar, wire rod and bar-in-coil among the 237 Chinese steel trading houses under Mysteel's tracking hovered low at 112,782 tonnes/day on average over July 26-August 1, despite a 12.6% on-week rise. Some building contractors told Mysteel that their cashflow conditions stayed tight.

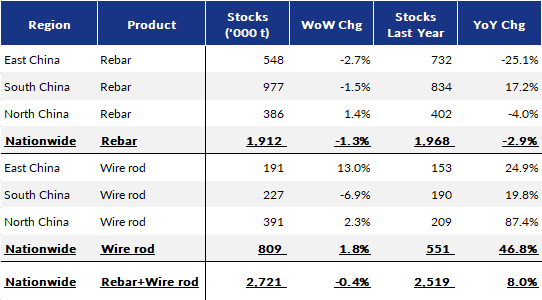

On the other hand, rebar stocks at both steel mills and traders thinned last week, with the tonnage at the 137 sampled steelmakers having emptied by 1.3% or 25,000 tonnes on week to 1.9 million tonnes as of July 31, and the volume at commercial warehouses in the 35 Chinese cities Mysteel checks shed by 2.7% or 153,700 tonnes on week to 5.5 million tonnes as of August 1.

Table 1: Rebar Production Survey by Region by Jul 31

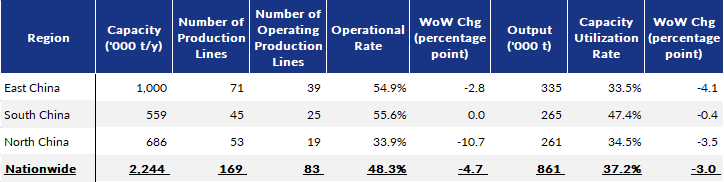

Table 2: Wire Rod Production Survey by Region by Jul 31

Table 3: Rebar Production Survey by Process by Jul 31

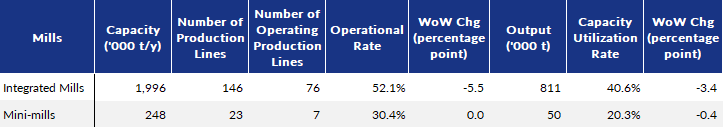

Table 4: Wire Rod Production Survey by Process by Jul 31

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Jul 31

Table 6: Rebar and Wire Rod Stocks Survey by Process by Jul 31

Source:Mysteel Global