Posted on 25 Jul 2024

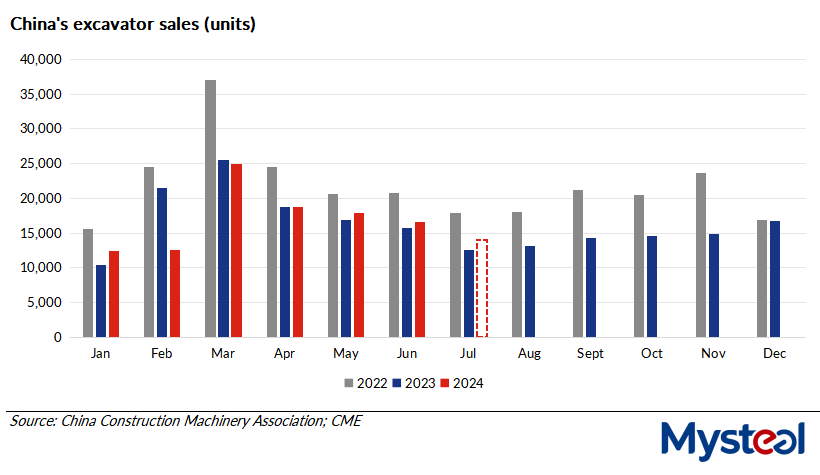

Total sales of Chinese excavators to both domestic and overseas markets this month may climb by 11.06% on year to reach 14,000 units, according to the latest forecast released on July 23 by Beijing-based industry magazine Construction Machinery and Equipment (CME).

Specifically, domestic excavator sales are expected to jump by around 17% on year to reach 6,000 units in July, while exports might also move higher by 7% on year to 8,000 units.

The lower base volume of sales during the same period last year, plus the modest rebound in demand in some overseas markets, partly contributed to the on-year increases in excavator sales this month, CME explained.

Over January-July, the country's total excavator sales inside and outside China are estimated to slip by about 3% on year, among which, domestic sales may gain 6% on year, while export sales may decline by 11% from last year's first seven months, according to CME.

As a major end-use sector for excavators, China's infrastructure industry has continued to improve this year, the release noted. China's fixed asset investment increased by 3.9% on year to reach Yuan 24.54 trillion ($3.38 trillion) over the first half of this year, with the funding for infrastructure construction rising by 5.4% on year, according to the country's National Bureau of Statistics (NBS).

As a major end-use sector for excavators, China's infrastructure industry has continued to improve this year, the release noted. China's fixed asset investment increased by 3.9% on year to reach Yuan 24.54 trillion ($3.38 trillion) over the first half of this year, with the funding for infrastructure construction rising by 5.4% on year, according to the country's National Bureau of Statistics (NBS).

But the country's property market – another crucial sector for yellow goods sales – is still struggling, CME warned.

Over January-June, China's investment in the property market dropped by 10.1% on year to Yuan 5.25 trillion. Meanwhile, the total area of newly-launched property projects during the six months also declined by a large 23.7% on year to sit at 380.23 million sq m, NBS data showed.

Excavators are mostly used in the early stages of real estate construction projects, where domestic sales of equipment are largely dependent on the vitality of the country's property-project starts, Mysteel Global notes. On the other hand, China's recent supportive packages for the housing market were mainly aimed at ensuring timely deliveries of presold homes and to reduce inventory, rather than encourage new builds.

Source:Mysteel Global