Posted on 22 Jul 2024

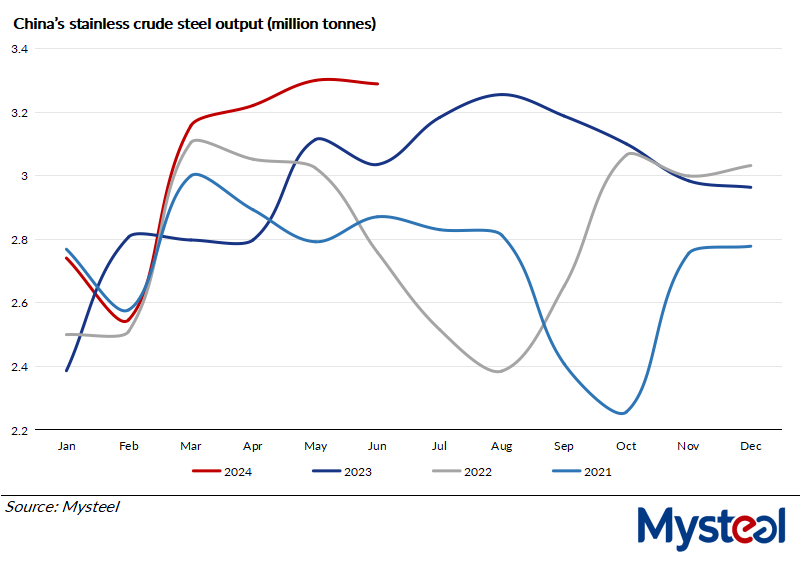

During the first half of this year, China's production of crude stainless steel registered a notable 7.78% uptick compared with the first six months of last year, with the total volume swelling by 1.32 million tonnes to reach 18.25 million tonnes, according to Mysteel's latest monthly survey among the country's 43 stainless producers. Market watchers note that stainless supply in China is likely to stay high during the July-December period, given the buoyant demand from both domestic and overseas markets.

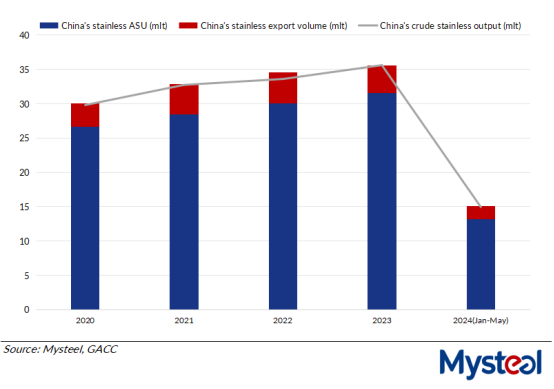

In the domestic market, Mysteel's assessment of China's apparent stainless steel use reached 13.19 million tonnes over January-May, 6.6% higher than the same period last year.

Simultaneously, from January to May, China's total stainless exports reached approximately 1.91 million tonnes, higher by a large 12.8% compared with the first five months of last year, according to data from the General Administration of Customs (GACC).

The robust demand has lifted production interest among domestic stainless manufacturers, especially as most were still enjoying profits despite increasing costs, Mysteel Global observes.

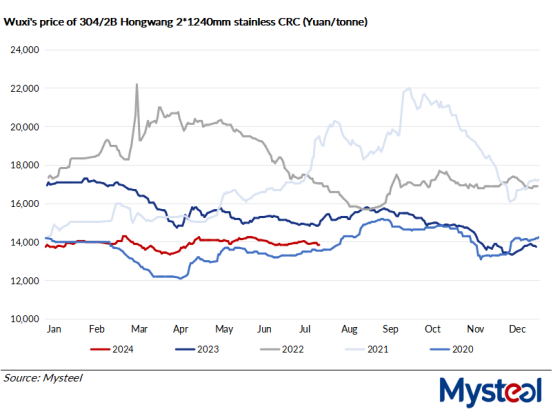

For example, Mysteel assessed the average margin for mills producing 304-grade cold-rolled coil (CRC) with nickel pig iron (NPI) as the key raw material at 1.43% as of June 28, down from 3.59% at the end of 2023, while those mills producing the same grade CRC with a higher percentage of stainless scrap enjoyed an average margin of 3.1%, down from 4.66% at the end of December 2023.

The declining profit margins among domestic stainless steelmakers were mainly attributed to rising prices of key raw materials for stainless production. For example, during the first six months of this year, the price of 8-15% grade NPI in East China's Jiangsu province increased by Yuan 50/mtu ($6.9/mtu) to Yuan 980/mtu including delivery and 13% VAT on June 28, according to Mysteel's assessment.

China's NPI prices are likely to stay firm in the long term, as the nickel RKAB (work plan and budget) approval issues in Indonesia, the world's largest producer and exporter of nickel, will likely cause a lingering global shortage of nickel ore, which could underpin NPI prices to some extent, a nickel analyst based in Shanghai told Mysteel Global.

"Producing stainless steel is still profitable for now despite higher costs," a Zhejiang-based steelmaker in East China's said. Plus, negotiable spot resources at domestic commercial warehouses are not excessively high, he added.

A Foshan-based analyst agreed with the view, also remarking that the high stockpiles at warehouses are actually placing limited downward pressure on spot stainless prices, especially those of 304-grade stainless CRC. This is mainly because nearly 40% of the 304-grade stainless steel inventory in domestic warehouses consists of non-negotiable warehouse receipts used to settle expiring futures contracts.

Standard deliverables for stainless futures on the Shanghai Futures Exchange are cold-rolled austenitic 304 stainless steel coils that are 2.0 mm thick and 1,219 mm wide with a 2B surface finish and trimmed sides, Mysteel Global learned.

Over January-June, total inventories at the 89 commercial warehouses that Mysteel tracks in East China's Wuxi and South China's Foshan, two core stainless trading hubs, witnessed a sharp jump by some 262,600 tonnes or 31.9% from January 5 to reach 1.09 million tonnes as of June 28.

Although the high inventories aren't particularly worrying stainless manufacturers, some mills have shown an intention to slightly cut their production this month in response to the slowdown in domestic stainless consumption during summer, Mysteel Global notes. Spot stainless prices may experience dips during November-December with another off-season for stainless consumption coming in winter, the analyst predicted.

Source:Mysteel Global