Posted on 11 Jul 2024

Prices of construction steel products in China, principally rebars, are expected to remain low initially this month and then trend higher as the rest of the half-year progresses, with a rebound likely starting around the end of the third quarter, according to Mysteel's recent market outlook report.

The supply-demand mismatch is anticipated to ease in the months ahead due to an expected improvement in demand for construction steel, while production levels may fluctuate largely, Mysteel predicted.

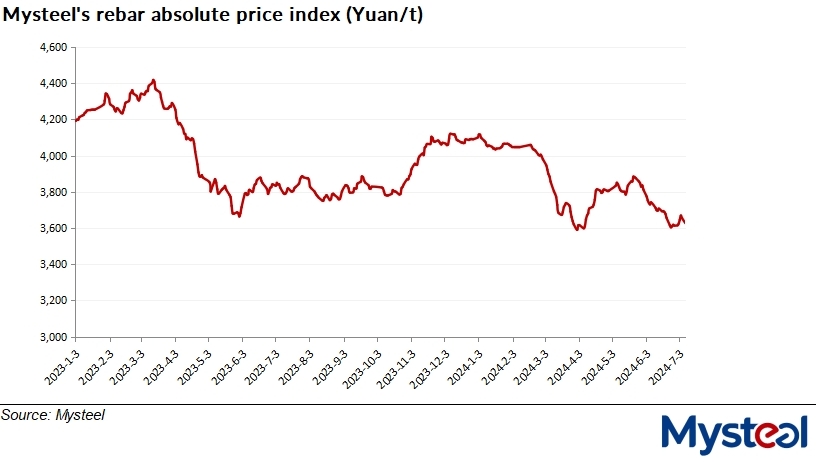

In the first half of this year, domestic construction steel prices softened markedly. For example, Mysteel's absolute price index for rebar dropped by some Yuan 477/tonne ($66/t) from the end of 2023 to reach Yuan 3,613/t as of June 28.

"Construction steel prices will likely remain rangebound during July-August, as more steel mills may halt production for maintenance due to low steel margins," the report suggested. "Prices will also stabilize because demand will weaken as work on construction sites slows down in the sweltering summer weather," it noted.

As of July 3, the weekly output of rebars among the 137 Chinese steelmakers tracked nationwide by Mysteel stood at 2.37 million tonnes, down 80,100 tonnes on week and by a significant 404,520 tonnes compared with the same week last year, Mysteel's data indicated.

"There will be a significant seasonal demand pick-up for construction steel from building contractors over September-October when autumn arrives, which is generally a robust season for steel consumption," Mysteel notes. On the other hand, production among steelmakers will likely continue to be restrained by low steel margins and Beijing-mandated output control measures.

Consequently, domestic construction steel prices are expected to trend upward during September-October due to higher demand and falling production volume. However, prices may experience volatility over November-December as many building projects wind down with year's end approaching and traders focus on collecting payments to improve cash flow, according to Mysteel's projection.

The report estimates that Mysteel's rebar absolute price index will average around Yuan 3,800/t in this year's second half, fluctuating in the range of Yuan 3,600-4,000/t.

Source:Mysteel Global