Posted on 10 Jul 2024

Message from the Secretary General: ASEAN-6 GDP Q4 2023 and Full Year Macroeconomic Results

ASEAN-6 Macroeconomics Results

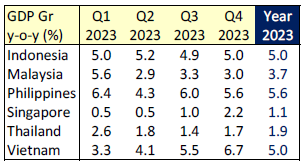

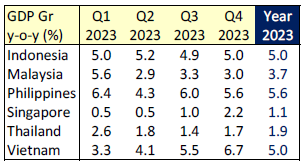

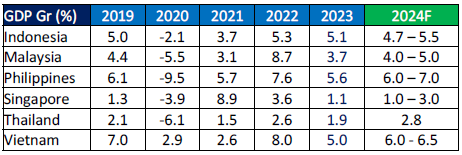

Q4 2023 was another growth year for all ASEAN-6 countries. Indonesia, Singapore, Thailand and Vietnam registered stronger growths (year on year) compared to Q3 2023. On the other hand, growth in Malaysia and Philippines slowed down from the quarter before.

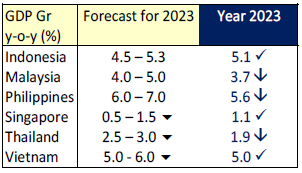

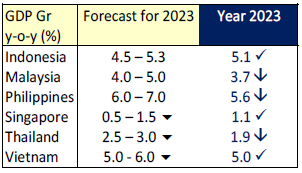

For the full year, while all ASEAN-6 countries registered positive growth in 2023, Indonesia, Singapore and Vietnam met their forecasts while Malaysia, Philippines and Thailand growths were below forecast.

ASEAN-6 by Countries

Indonesia’s economy held steady at 5% in Q4 2023, growing at a similar pace over the four quarters of 2023.

For the whole year, GDP held steady at 5.05%. On the industry side, growth came from:

- Construction (+4.9%)

- Manufacturing (+4.6%)

- Base metal (+14.2%)

- Metal goods (+13.7%)

- Transportation equipment (+7.6%)

- Transport & Storage (+14.0%)

- Mining & Quarrying (+6.1%)

- Coal & lignite (+10.0%)

- Metal ore mining (+8.5%)

- Oil & Gas (+0.7%)

2023 growth was supported by:

- Household consumption growth (+4.8%).

- Government spending increase (+3.0%), reversing a contraction

(-4.5%) from a year ago. - Investments (+4.4%), expanding slightly from +3.9% a year ago.

- Vehicles (+15.7%)

- Buildings (+4.0%)

- Machinery & equipment (+3.1%)

- Exports grew marginally at +1.3%, mainly from services (+38.9), while exports of goods contracted (-1.1%).

However, imports weakened (-1.7%), dragged down by imports of goods (-3.4%), while imports of services grew (+11.6%).

Malaysia’s economy moderated (+3.0%) in Q4 2023, from Q3 2023 (+3.3%). Growth has slowed down to 3.0% over the last 3 quarters after a 5.6% growth in Q1 2023.

For 2023, Malaysia’s growth was 3.7%, missing the country’s forecast of 4.0 – 5.0% for the year. On the industry side, growth came from:

- Construction (+6.1%), higher than a year ago (+2.0%) from:

- Civil engineering works (+14.4%)

- Specialised construction (+6.4%)

- Residential buildings (+2.4%)

- Manufacturing (+0.7%), a large decline from growth in 2022 (+8.1%)

- Base metal (+2.9%)

- Fabricated metals (+7.0%)

- Electrical equipment (+2.0%)

- Machinery & equipment (-2.0%)

- Transport & Storage (+13.8%)

- Mining & Quarrying (+1.0%)

- Natural Gas (-0.1%)

- Crude oil and condensate (+2.0%)

- Others (+3.9%)

2023 growth was supported by:

- Private consumption growth (+4.7%).

- Government spending increase (+3.9%), slowing sightly (+4.5%) from a year ago.

- Investments (+5.5%), slowing from +6.8% a year ago.

- Building structure (+6.2%)

- Machinery & equipment (+5.2%)

Exports declined (-7.9%) in 2023, reversing the growth (+14.5%) from a year ago, mainly due to contraction of export of goods (-13.0%). Export of goods form 84.4% of total exports.

Similarly, imports contracted (-7.6%) compared to a year ago (+15.9%), again mainly due to decline in import of goods (-11.9%). Import of goods form 79.6% of total imports.

In Philippines, the economy moderated (+5.6%) in Q4 2023, from Q3 2023 (+6.0%).

For 2023, Philippines’ growth was 5.6%, slightly below the country’s forecast of 6.0 – 7.0% for the year. On the industry side, growth came from:

- Construction (+8.8%), slightly slower than a year ago (+12.1%)

- Manufacturing (+1.3%), a large decline from growth in 2022 (+4.9%)

- Base metal (+5.1%)

- Electrical equipment (+5.9%)

- Transport equipment (+13.1%)

- Machinery & equipment (-6.2%)

- Fabricated metals (-7.8%)

- Transport & Storage (+13.1%)

- Mining & Quarrying (+1.9%)

- Nickel ores (+18.7%)

- Gold and other precious metals (+7.2%)

- Coal mining (+1.2%)

- Crude oil and condensate (-24.2%)

2023 growth was supported by:

- Private consumption growth (+5.6%).

- Government spending increase (+0.4%), slowing (+4.9%) from a year ago.

- Investments (+5.4%), slowing from +6.8% a year ago.

- Construction (+9.0%)

- Durable equipment (+8.7%)

Exports grew marginally (+1.3%) in 2023, slowing down significantly from the previous year’s growth (+10.9%), mainly due to contraction of export of goods (-7.3%). Export of goods form 51.1% of total exports.

Similarly, imports also grew marginally (1.6%) compared to a year ago (+13.9%), again mainly due to decline in import of goods (-3.9%). Import of goods form 79.9% of total imports.

Singapore’s economy was estimated to grow at +2.2%, the highest growth quarter in 2023.

For 2023, Singapore’s growth was +1.1%, within its forecast of 0.5 – 1.5% for the year. On the industry side, growth came from:

- Construction (+5.2%), slightly slower than a year ago (+6.2%):

- Construction output grew (+15.4%), extending growth from last year (+15.8+)

- Public construction grew (+14.3%) driven by:

- Public residential (+22.6%)

- Institutional & others (+21.4%)

- Industrial buildings (+13.0%)

- Private construction expanded (+16.4%) due to:

- Private commercial (+39.4%)

- Industrial (+19.3%)

- Private residential (+10.7%)

- Construction demand grew (+13.5%) from

- Public construction (+12.8%) driven by:

- Institutional & others (+64.4%)

- Industrial buildings (+55.0%)

- Public residential (+43.0%)

- Private construction (+14.4%) due to:

- Private commercial (+120.0%)

- Private residential (+39.9%)

- Manufacturing contracted (-4.3%) in 2023 due to four quarters of contraction before a marginal growth in Q4 (+1.4%). All manufacturing clusters shrank except for transport engineering (+15%)

- Transport & Storage (+2.3%)

2023 growth was supported by:

- Private consumption growth (+8.6%).

- Government spending increase (+6.1%), extending expansion (+5.0%) from a year ago.

- Investments (+4.9%), slowing from +9.7% a year ago.

- Transport equipment (+9.1%)

- Non-residential buildings (+7.8%)

- Other construction works (+2.8%)

- Machinery & equipment (-11.0%)

Exports grew marginally (+2.4%) in 2023, slowing slightly from the previous year’s growth (+3.0%). Export of domestic goods grew (+1.7%) while re-exports grew (+2.5%).

Similarly, imports also grew marginally (+1.0%) compared to a year ago (+3.3%).

Thailand’s economy expanded +1.7% in Q4 2023, expanding from +1.4% in Q3 2023.

In 2023, economic growth was +1.9%, below its forecast of 2.5 – 3.0% for the year. On the industry side, the performance of the steel related sectors are:

- Construction shrank (-0.6%), better than a year ago (-2.4%). The reason for the contraction was the delay of the budget approval process for fiscal year 2024 resulting in decreased government disbursement for projects.

- Manufacturing (-3.2%), a reversal from growth in 2022 (+0.7%)

- Light industries (-5.2%)

- Raw materials (-1.1%)

- Capital goods (-3.9%)

- Transport & Storage (+8.4%)

- Mining & Quarrying (-0.9%)

2023 growth was supported by:

- Private consumption growth (+7.1%), expanding from a year ago (+6.2%).

- Government spending declined (-4.6%), slowing (+0.1%) from a year ago. This is mainly due to the delay in the budget process.

- Investments (+1.2%), slowing from +2.3% a year ago.

- Dwellings (+2.0%)

- Non Dwellings (+4.7%)

- Other construction (+3.4%)

- Dwellings (+11.2%)

- Non Dwellings (+1.5%)

- Other construction (-4.7%)

Exports grew marginally (+2.1%) in 2023, slowing slightly from the previous year’s growth (+6.1%). Export of domestic goods shrank (-2.8%). Export of goods form 83.2% of total exports.

Imports also shrank (-2.2%) compared to a year ago (+3.6%), mainly due to decline in import of goods (-3.8%). Import of goods form about 80.2% of total imports.

Vietnam’s economy expanded +6.7% in Q4 2023, expanding from +5.5% in Q3 2023.

In 2023, Vietnam registered an economic growth of +5.0%, at the lower end of its forecast of 5.0 – 6.0% for the year. On the industry side, growth is supported by:

- Construction grew (+7.1%), slowing from growth a year ago (+9.3%).

- Manufacturing (+3.6%), also slowing from a growth in 2022 (+8.0%)

- Basic metals (+7.6%), of which crude steel grew +4.4%

- Fabricated metals (+8.3%)

- Electrical equipment (+3.8%)

- Machinery & equipment (-0.9%)

- Motor vehicles (-2.4%)

- Transport & Storage (+9.2%)

- Mining & Quarrying (-3.2%)

- Metal ores (+9.5)

- Other mining (+1.4%)

- Crude petroleum (-5.7%)

Export of goods shrank (-4.4%) in 2023 compared to 2022. Export of iron and steel according to the following categories are:

- Iron and steel (+4.4%) – likely to be semi finished steel

- Iron and steel products (-13.9%)

Import of goods also shrank (-8.9%) compared to a year ago. Import of iron and steel are:

- Iron and steel (-11.6%)

- Iron and steel products (-0.4%)

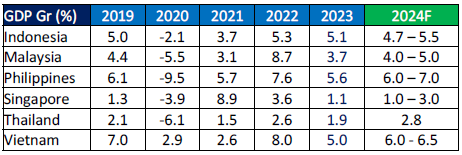

Outlook for ASEAN-6

To summarise, ASEAN-6 economies continue to grow strongly. However, global challenges are also growing.

Geopolitical tensions continue to spread from Ukraine to the Middle East, negatively affecting global growth.

The aftermath of COVID is keenly felt as countries grapple with low reserves and higher debts due to billion-dollar support to overcome COVID and boost weakened economies. While inflation is down to acceptable levels, interest rates remain high and slowing global growth.

Climate change impacts continue to intensify with natural disasters, unpredictable weather, storms, flood, heatwaves like never before.

ASEAN governments have these GDP forecast for 2024:

- Indonesia: 4.7 – 5.5% with inflation around 2.5%±1%

- Malaysia: 4.0 – 5.0%

- Philippines: 6.0 – 7.0%

- Singapore: 1.0 – 2.0%

- Thailand: 2.8%

- Vietnam: 6.0 – 6.5% and inflation of 4.0 – 4.5%

Source:SEAISI