Posted on 01 Jul 2024

The number of profitable steel mills in China fell fast this week, as domestic finished steel prices continued to lose ground, while the mills' production costs stayed at a relatively high level, Mysteel Global learned.

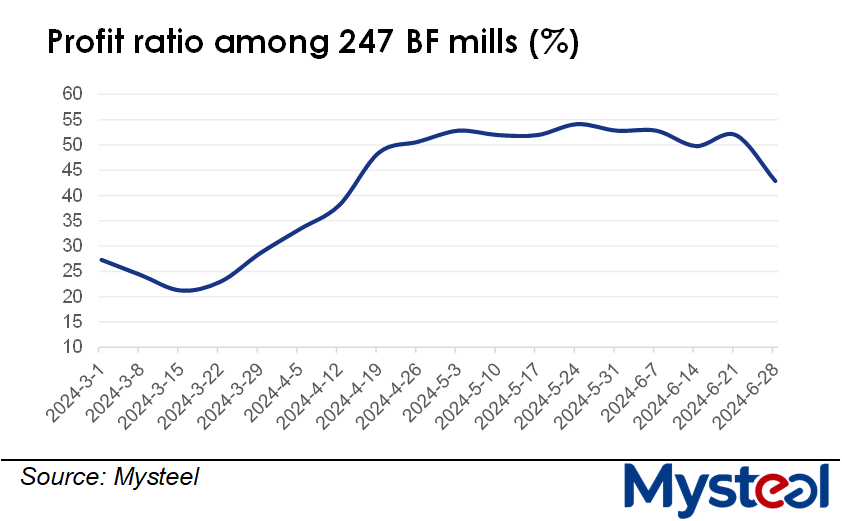

Mysteel's latest weekly survey showed that as of June 27, the profit ratio among the 247 blast furnace mills nationwide under its regular tracking had slipped to a 2.5-month low of 42.86%, falling by 9.09 percentage points from the prior week.

Chinese finished steel prices have softened markedly of late in tandem with the weakening domestic-market sentiment. The high temperatures in northern China and frequent rains in the country's southern and eastern areas have meant that steel end-users are not in the mood to buy, market watchers say.

For example, the national price of HRB400E 20mm dia rebar, a pointer to domestic steel-market sentiment, was assessed by Mysteel at Yuan 3,632/tonne ($500/t) including the 13% VAT as of June 27, lower by another Yuan 63/t on week.

However, the decrease in the mills' production costs has been limited, as the prices of major steelmaking raw materials such as iron ore and coke have hovered high, undermining their profit margins, Mysteel Global noted.

Over June 21-27, the average cost of making hot metal among the 114 Chinese mills monitored by Mysteel was assessed at Yuan 2,743/t excluding the 13% VAT, only down Yuan 13/t compared with the previous week.

On Thursday, Mysteel's SEADEX 62% Australian Fines came in at $105.35/dmt CFR Qingdao, dipping by $1.35/dmt on week, while the national composite coke price under Mysteel's assessment had increased by Yuan 43/t during the same period to reach Yuan 1,961/t including the 13% VAT.

Market participants predict that the thinning profit margins may persuade more Chinese mills to halt operations and conduct maintenance on their steelmaking facilities or slow their production pace.

Mysteel's other survey showed that the average capacity utilization rates of the 247 BF steel mills under its regular tracking registered 89.13% during June 21-27, lower by 0.63 percentage point on week.

Source:Mysteel Global