Posted on 19 Jun 2024

The Chinese economy is gradually changing, shifting from export expansion to domestic demand. Accordingly, economic growth is slowing down, negatively affecting steel demand. The Chinese real estate market is facing a systemic crisis: new housing sales are steadily declining. Thus, in 2021, this indicator decreased by 19%, in 2022 – by 31%, in 2023 – by 26%, in 2 months. 2024 – by 28% y/y. This is a serious problem, as China’s construction sector accounts for 50-60% of the country’s steel consumption. The decline in housing construction is not offset by infrastructure projects, although it has been a significant driver of steel demand for many years.

According to the latest decisions of the political leadership, China’s economy has received a new vector of development – mechanical engineering. We see evidence of this in the statistics: the dynamics of industrial production in 2Q2024 2024 increased by 7.2% y/y. In fact, the dynamics of construction and industrial production in China are diverging, but the positive trend in engineering will not be able to cover the decline in construction.

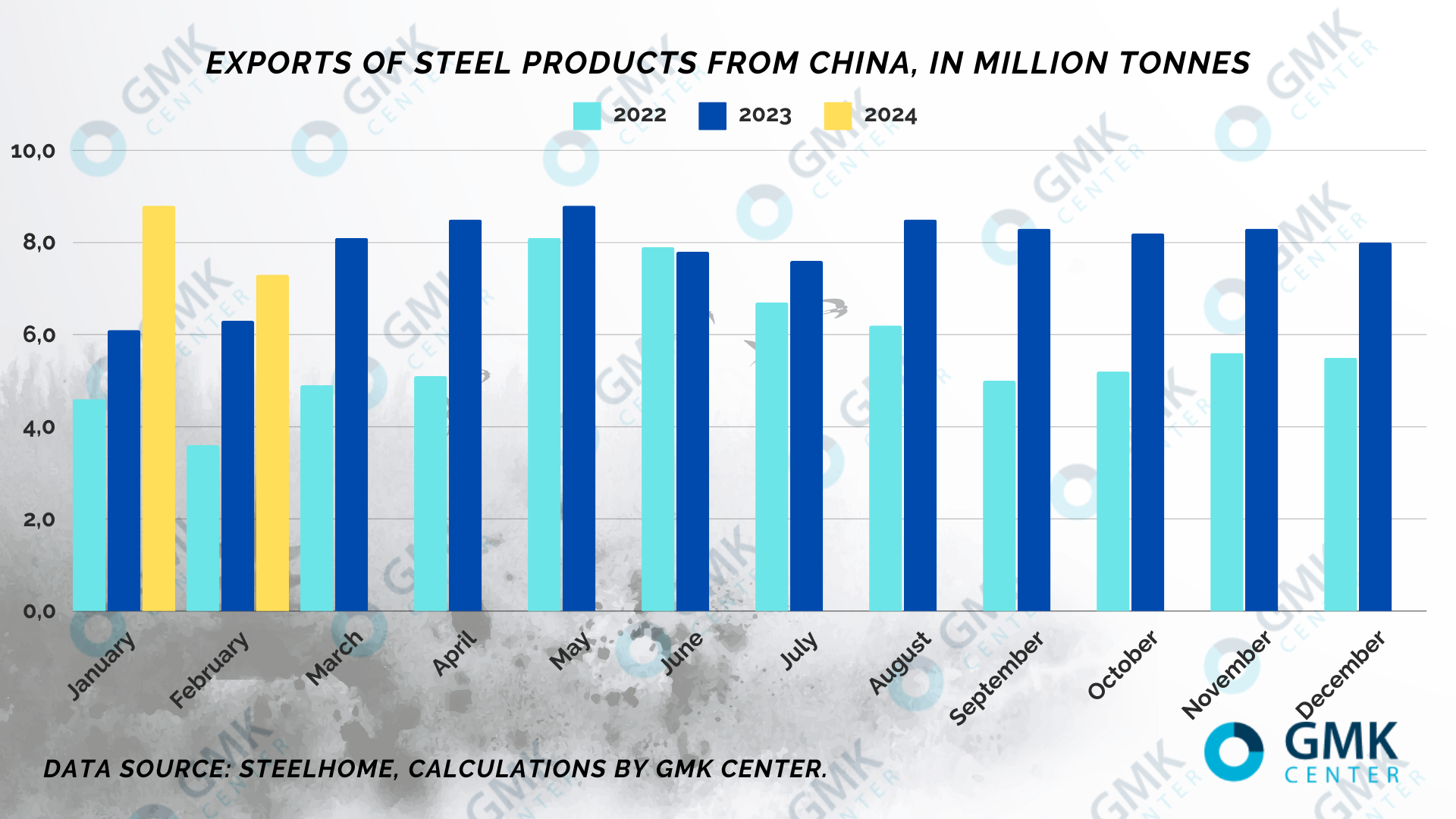

China’s steel companies are trying to reduce production, but historically they have been poor at matching supply to demand. As a result, there is a surplus of steel products that are exported and put pressure on global prices. In 2023, average monthly exports of semi-finished and finished steel products from China were 36.2% higher than in 2022. Chinese producers can even afford to operate at a loss for some time, which is not possible for companies in other regions. What are the implications for other markets?

Demand for steel in the EU is stable despite high interest rates. Business expectations are improving, with the ZEW index of expectations rising for the sixth month in a row. There are signals that the ECB will start cutting interest rates as early as June, which will lead to an increase in economic activity.

However, the problem for the steel industry is that imports from the Asian region will continue to come at low prices. European steel companies cannot take advantage of the favorable market situation. On the contrary, they are forced to stop production and reorganize their businesses. In particular, the Spanish group Celsa is considering the sale of its steel plants in Poland, Norway and the UK. The total market value of the assets reaches €1.3 billion.

Thyssenkrupp announced plans to reduce its steel capacity by 1.5-2.0 million tons. Earlier, the company closed the Galmed plant in Spain, which specialized in the production of galvanized steel for the automotive industry.

Liberty Ostrava (Czech Republic) has shut down its blast furnace since the end of December 2023 due to a lack of power supply, which was cut off for debts. The plant is close to bankruptcy, and the possibility of restarting production directly depends on reaching an agreement with the energy supplier.

Acciaierie d’Italia (Ilva) is at risk of shutting down due to liquidity problems, and a special administration has been introduced at the company. The company’s net debt is about €700 million. The situation is further complicated by a dispute between the plant’s shareholders (ArcelorMittal and state-owned Invitalia), who cannot agree on its future.

Turkish steelmakers also fail to benefit from the growth in domestic steel consumption, as imports from China are increasing in parallel. In 8 months. 2023, China became the leading exporter of hot-rolled coils to Turkey with a total volume of 1.15 million tons. After that, Turkey launched an anti-dumping investigation against hot-rolled steel products from China, as well as India, Japan and the Russian Federation (supplies from these countries accounted for a significant share of imports).

In addition, in November 2023, the Turkish government extended anti-dumping duties on heavy plates imported from China. The country’s Ministry of Commerce found that the abolition of these duties could lead to continued or increased dumping. The current rates are 16.89% for Jiangyin Xingcheng Special Steel Works and 22.55% for other Chinese producers in terms of CIF prices.

The Indian steel market is facing a strange situation. On the one hand, the local Ministry of Steel claims to be developing domestic steel production to meet local demand. However, on the other hand, the growth in domestic demand is being met by increasing imports (mainly from China), while local producers are increasing exports.

Large volumes of steel are exported not only by India but also by other countries close to China, including Japan, South Korea, Indonesia, and Vietnam. Chinese products are the first to enter the markets of these countries, causing local prices to be low. Accordingly, local producers export their products with a focus on the same price level. Moreover, Chinese companies are expanding their presence in the markets of neighboring countries, creating new steel capacities there that cannot be launched in China due to existing production restrictions.

The growth of imports from China will lead to more and more countries imposing duties on Chinese products. Countries that do not have trade restrictions against Chinese products will have to bear the burden of excess exports from China. It will be very difficult for local producers, as they do not have the same government support as in China.

U.S. President J. Biden has put forward the idea of raising import tariffs on steel products imported from China. While currently imports of certain products are subject to duties ranging from 0.0% to 7.5%, the new rate should be 25.0%. At the same time, duties for products that are already subject to the 25 percent tariff will not change. The rationale for the increase in duties is the need to protect American production from import inflows associated with overcapacity in China.

European companies also support the need for similar steps. In particular, the CEO of Acerinox, a Spanish stainless steel company, believes that current tools to protect against Chinese imports are insufficient, so more import tariffs should be introduced to level the playing field. China increased its stainless steel production by almost 13% y/y last year, while the rest of the world decreased it due to weaker demand. According to Acerinox, the European market shows no signs of recovery, even though the company’s plant in Cadiz (Spain) was shut down for three months due to a strike and the supply of stainless steel on the market has decreased.

In April 2024, Ukraine confirmed its final anti-dumping measures against imports of steel fasteners originating in China. The Interdepartmental Commission on International Trade approved the following final anti-dumping duty rates: 32.47% for Haining Hisener Trade in respect of exports of goods manufactured by Hisener Industrial, 38.37% for Ningbo Jinding Fastening Piece, and 67.4% for other producers and exporters. The duties apply to ferrous steel products with threads, namely screws, bolts and nuts originating in the PRC, classified under codes 7318 15 69 90, 7318 15 81 90, 7318 15 89 90, 7318 15 90 90, 7318 16 91 90, 7318 16 99 90 according to the Ukrainian Classification of Goods for Foreign Economic Activity.

China was also an active supplier of high value-added products to Ukraine, namely coated pipes and rolled products, which raised suspicions of dumping practices. The investigations resulted in the imposition of anti-dumping duties. Now, not only China but also other Asian countries are active in exporting downstream products, such as hot-rolled coils or wire rod.

According to market operators, the steel market in Ukraine returned to 80% of its pre-war level in Q1. Several European producers have already turned their attention to the Ukrainian market. But the share of imports in the market has grown significantly. In some segments, this is objective, due to the loss of relevant capacities during the hostilities. For example, in the shapes and plates segment. But products such as rebar and wire rod can be produced in Ukraine. And not only can, but should, as most of the production capacity is currently idle.

It is advisable to monitor the negative impact of cheap imports on the market and make appropriate decisions promptly. Ukraine has enough negative experience in this area. An example is the case of the supply of the same pipes from China. Ukraine was a major market for pipes for the oil and gas industry for a short time – just a couple of years, when Naftogaz set out to develop. It was during this time that there was an influx of Chinese pipe imports. The anti-dumping investigation lasted more than a year. And when the decision was made, there was no market anymore, as Naftogaz had changed its policy on drilling development. In other words, Ukraine was late with the decision to protect its own market. At present, Chinese suppliers continue to expand into the Ukrainian market by winning government tenders, making it increasingly difficult for Ukrainian producers to maintain their share of the domestic market.

It should be understood that market growth during the war is driven by government construction projects. The surge in demand for long products may also be temporary, as the post-war economy’s prospects do not foresee high investment, which is the basis for steel consumption. It is important to keep our finger on the pulse and not be late again – the policy of protecting the domestic market must be prompt. Otherwise, budget expenditures will stimulate the consumption of imports rather than domestic goods. This, in turn, will not help the economy recover from the war.

Source:GMK Center