Posted on 18 Jun 2024

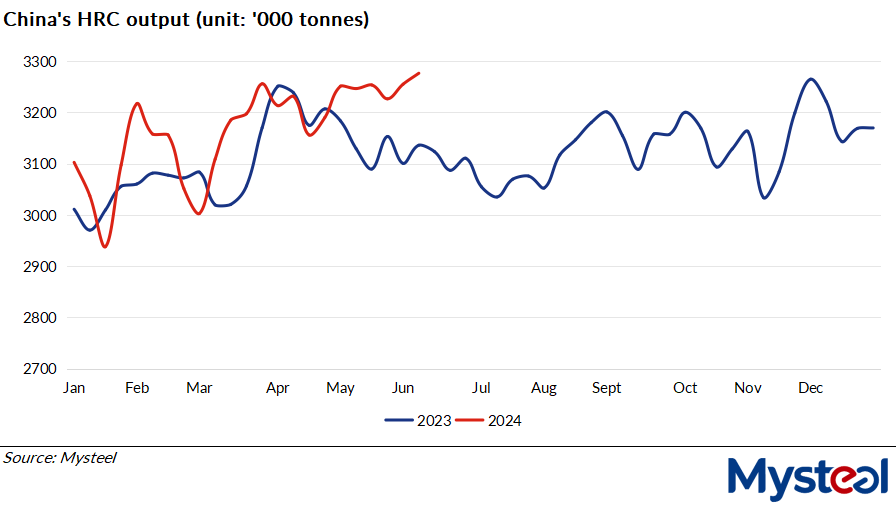

Production of hot-rolled coil (HRC) among the 37 Chinese flat steel producers Mysteel regularly monitors rose again by 21,300 tonnes or 0.65% on week to 3.28 million tonnes during June 10-14, the highest weekly total since mid-June 2022, the results of Mysteel's latest production survey show.

The hot-rolling capacity utilization rate among the 37 mills also increased further by 0.55 percentage point on week to average 83.71% last week, the survey found.

The hot-rolling capacity utilization rate among the 37 mills also increased further by 0.55 percentage point on week to average 83.71% last week, the survey found.

In North China, some steel mills had resumed hot coil production last week after completing maintenance stoppages, resulting in the on-week rise in HRC output, survey respondents explained.

Indeed, while China's market for construction steel long products has recently been hurt by high temperatures and frequent rainfalls disrupting building projects, the seasonal impact on the flat product market has been less and steel suppliers could maintain profitability, market sources said. This in turn has buoyed the production enthusiasm of coils makers.

Regarding hot coil transactions last week, buyers still chose to procure for immediate use and keenly sought lower-priced offers, respondents noted. This trend, combined with the high run-rates that the flat product makers were observing, caused HRC inventories to rise in tandem, Mysteel Global observed.

As of June 13, HRC inventories at commercial warehouses in the 33 Chinese cities regularly monitored by Mysteel had inched down by just 0.11% on week to reach 3.25 million tonnes, a much slower decline than the prior week's 1.96% fall.

By the same day, total stocks of hot coils at the 37 surveyed mills had edged down by 0.73% on week to 892,400 tonnes, according to Mysteel's tracking.

As for prices, softer metallurgical coke prices and the fluctuations in iron ore prices last week gave little support to finished steel prices including those of hot coils, market watchers noted.

On June 14, China's spot price of Q235 4.75mm HRC under Mysteel's assessment had declined by Yuan 17/tonne ($2.3/t) or 0.45% on week to Yuan 3,791/t including the VAT.

Meanwhile, the Shanghai Futures Exchange's most-traded HRC futures contract for October delivery also closed the daytime trading session lower at Yuan 3,806/t on June 14, down by Yuan 22/t or 0.6% from the June 7 settlement price.

Source:Mysteel Global