Posted on 17 Jun 2024

Since late May, the lackluster demand from steel end-users in China has led finished steel prices to steadily decline, undermining the profitability of domestic steel producers, Mysteel Global learned.

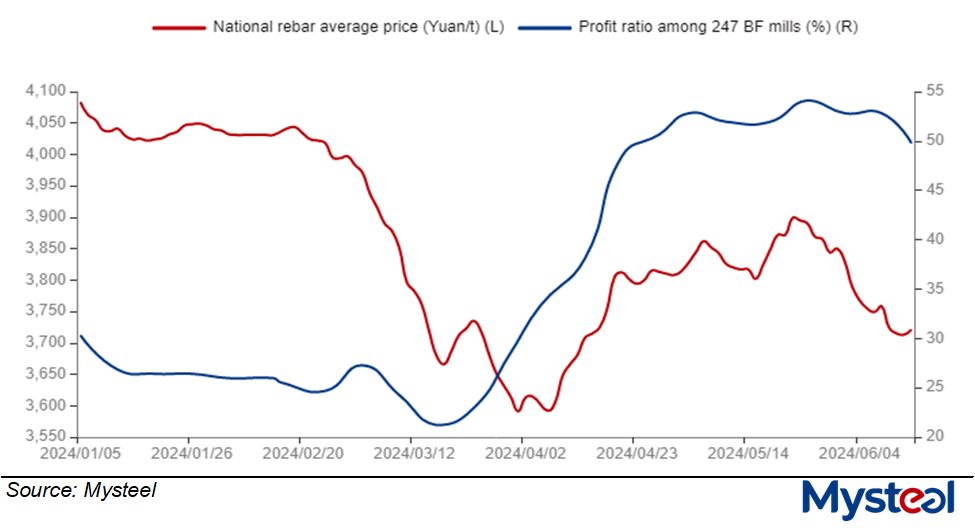

For example, the national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, was assessed by Mysteel at Yuan 3,713/tonne ($512/t) including the 13% VAT as of June 13, lower by another Yuan 36/t on week and down by a total of Yuan 186/t from the recent high recorded on May 22.

The weakness in domestic steel prices reflects the fact that steel demand from end-users has become depressed with the arrival of summer. China has entered the traditional slow season for steel consumption, especially that of long steel, as high temperatures in northern China and frequent rainfalls in southern China are disrupting outdoor construction activity.

Mysteel's other survey showed that domestic consumption of construction steel may slip by 4% this month compared with that for May.

Transactions involving construction steel in the country's physical market have shown signs of slowing. Over June 1-13, the daily trading volume of rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's regular tracking averaged 122,128 tonnes/day, falling by 10,683 t/d compared with last month's average.

With the weakness in finished steel prices, the number of profitable steel mills in China has decreased. The results of the latest weekly survey show that as of June 13, the profit ratio among the 247 blast furnace mills nationwide under Mysteel's regular tracking averaged 49.78%, down by 3.03 percentage points from the prior week.

Considering the market pressure they face from weakening demand and thinning profit margins, more Chinese mills will opt to idle steelmaking facilities and conduct maintenance in the not-too-distant future, market participants predict.

Considering the market pressure they face from weakening demand and thinning profit margins, more Chinese mills will opt to idle steelmaking facilities and conduct maintenance in the not-too-distant future, market participants predict.

Source:Mysteel Global