Posted on 12 Jun 2024

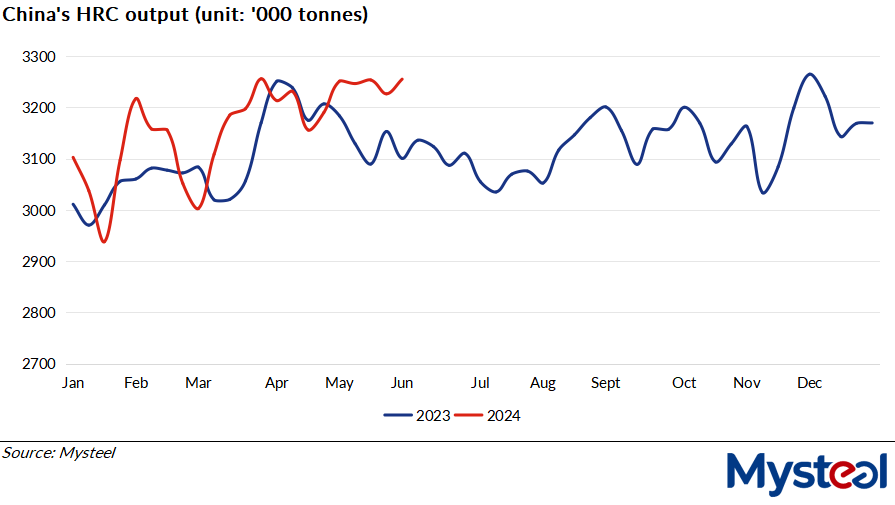

Production of hot-rolled coil (HRC) among the 37 Chinese flat steel producers Mysteel regularly monitors increased by a tiny 28,600 tonnes or 0.89% on week to reach 3.255 million tonnes during June 3-7, being very close to this year's peak of 3.26 million tonnes recorded in early April, the results of Mysteel's latest weekly production survey show.

The hot-rolling capacity utilization rate among the 37 mills also moved higher by 0.73 percentage point on week to average 83.16% last week, the survey found.

Behind the on-week rise in HRC output was the fact that some steel mills in North China had resumed their hot coil production during the sample period after completing maintenance stoppages, according to survey respondents.

Regarding hot coil consumption last week, end-users continued to purchase the flat product only to meet their immediate requirements, rather than letting their stocks mount, sources said.

As of June 6, HRC inventories at commercial warehouses in the 33 Chinese cities regularly monitored by Mysteel slipped by 1.96% on week at around 3.25 million tonnes.

Although business activity in China last week was affected by the imminent Dragon Boat Festival holiday weekend over June 8-10, downstream buyers' replenishment demand for hot coils was dull. Besides, China's annual college entrance exams held nationwide over June 7-10 also saw operations suspended at most construction sites near the exam venues to foster a quiet environment for students, Mysteel Global noted. This also impacted both steel deliveries and steel use last week.

Under such circumstances, many steel producers in South and East China slowed their HRC deliveries, survey respondents noted. By June 6, total stocks of hot coils at the 37 surveyed mills had risen by 2.39% on week to 899,000 tonnes, according to Mysteel's tracking.

By June 7, China's spot price of Q235 4.75mm HRC under Mysteel's assessment had lost Yuan 26/tonne ($3.6/t) or 0.68% on week to Yuan 3,808/t including the VAT.

On the same day, the Shanghai Futures Exchange's most-traded HRC futures contract for October delivery also closed the daytime trading session lower at Yuan 3,813/t, down by Yuan 27/t or 0.7% from the May 31 settlement price.

Source:Mysteel Global