Posted on 05 Jun 2024

Chinese steel prices are expected to remain rangebound this month, as the upward momentum still exists thanks to the stronger policy stimulus, while the improvement in market fundamentals shows signs of waning, Wang Jianhua, Mysteel's chief analyst, predicts in his latest monthly outlook.

In fact, such opposite forces had already kept domestic steel prices in check in May, though the prices ended up slightly higher on month, Wang noted. By May 31, China's national composite steel price was assessed by Mysteel at Yuan 3,997.52/tonne ($562.8/t), up by Yuan 4.39/t on month.

"On the macro front, the impact of bearish factors seems gradually fading away, and the supportive policies have been implemented in succession," Wang pointed out, adding that this may brighten the market sentiment this month.

"On the macro front, the impact of bearish factors seems gradually fading away, and the supportive policies have been implemented in succession," Wang pointed out, adding that this may brighten the market sentiment this month.

For example, local governments across China have sped up the issuance of special treasury bonds since last month, which means steel end-users will likely have more funds to make further progress in their projects in June, Wang illustrated.

During May, the total amount of newly issued special treasury bonds added up to more than Yuan 299 billion, significantly higher than the Yuan 88.3 billion issued in April, Mysteel Global learned.

As for the real estate sector that has become the heaviest drag on steel demand in China, a package of incentive policies has been introduced to boost the property market, including but not limited to reducing residential mortgage rates, cutting minimum down-payment ratios, and easing the property-purchasing limitations, as Mysteel Global reported.

"Judging from the effect of such policies in the past, property sales should recover in the coming three months, and steel demand from the real estate market will grow," Wang explained.

Besides, the government's announcement on continuing to control crude steel output for this year, as well as the progressing of the large-scale equipment renewals and replacements of consumer goods across the country, will keep supporting the steel prices, Wang noted.

The fundamentals, however, may weigh on steel prices this month, with the supply continuing to grow but the rise in demand being insignificant, Wang warned. "The country's total steel supply is likely to increase by some 1 million tonnes in June," he estimates.

Mysteel's survey also shows that the daily hot metal output among the 247 domestic blast-furnace steelmakers under Mysteel's survey may nudge up by around 0.8% on month to average 2.38 million tonnes/day.

On the other hand, the decline in the Purchasing Managers' Index of the country's manufacturing sector plus the slide in the Business Activity Index of the construction sector for May suggested that domestic steel demand may grow more slowly this month, Wang pointed out.

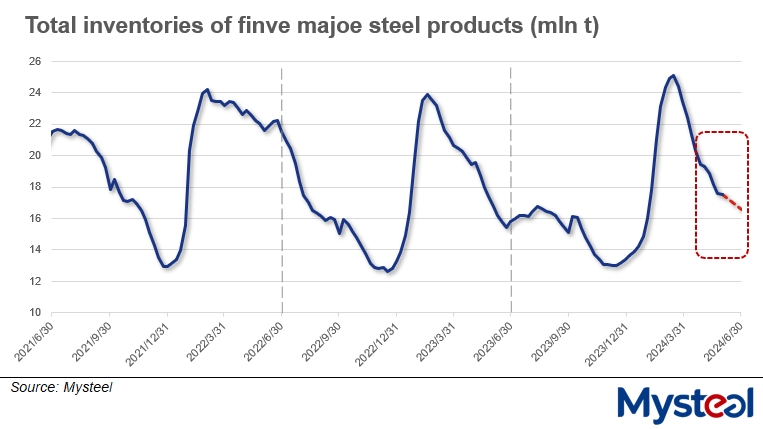

Under such circumstance, the total inventories of the five major carbon steel products held by the 184 steelmakers and traders in 35 Chinese cities are expected to decrease by some 1 million tonnes during June, with the reduction being much smaller than the 1.9 million tonnes recorded for last month, according to Wang. "For some steel items, the inventories may even increase this month," he said.

"The slowdown in the destocking of steel inventories will be considered by many market participants as bearish for the industry, which will exert heavier pressure on steel prices," Wang added.

"The slowdown in the destocking of steel inventories will be considered by many market participants as bearish for the industry, which will exert heavier pressure on steel prices," Wang added.

The weaker performance of steel consumption may cause the prices of steelmaking raw materials, such as iron ore and coke, to lose ground, which will in turn lead the cost support for steel prices to waver, Wang illustrated.

Source:Mysteel Global