Posted on 04 Jun 2024

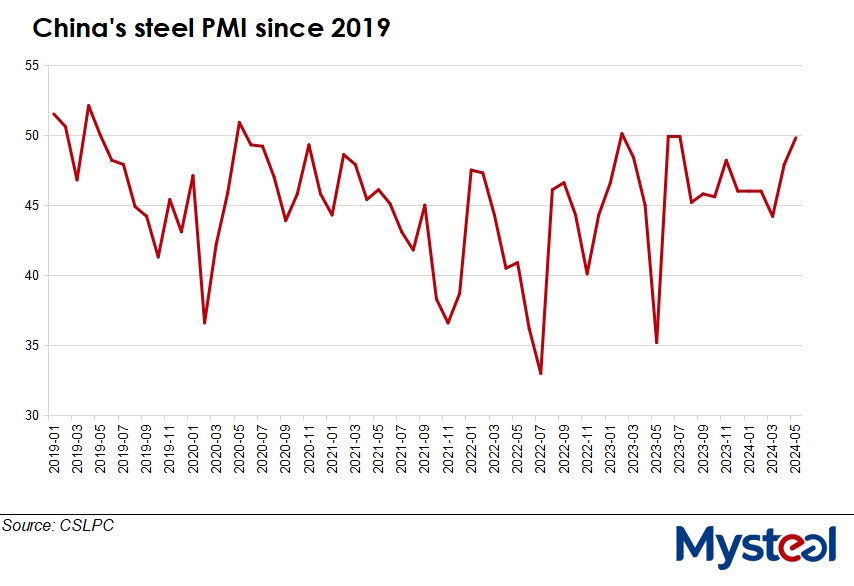

China's Purchasing Managers' Index (PMI) for the steel industry gained for the second month in May, rising by 1.9 points on month to score 49.8, hitting the highest since last August, the official index compiler CFLP Steel Logistics Professional Committee (CSLPC) shared in its latest release on May 31.

Both domestic steel demand and production picked up in May, CSLPC said, noting that raw materials prices trended upwards, while finished steel prices moved up in volatility this month.

Both domestic steel demand and production picked up in May, CSLPC said, noting that raw materials prices trended upwards, while finished steel prices moved up in volatility this month.

In May, the sub-index of new steel orders for both domestic sales and exports gained further by 2.2 points on month to 49.6, mainly as steel demand showed signs of improvement amid a slew of stimulus measures from the central government, such as optimized property policies, ultra-long-term special treasury bonds, large-scale equipment renewal and trade-in deals for consumer goods, CSLPC explained.

Meanwhile, the index of new steel export orders dipped by 0.8 point on month to 52.2 in May, maintaining expansion for the third straight month, according to the committee.

The sub-index of Chinese steel production rose by 0.9 point on month to 50.6 this month, back into the expansion zone again as domestic mills were enthusiastic about lifting production on the rising demand and better market expectations, the committee said.

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) over May 11-20 saw an uptick of 0.8% from the prior ten days to average 2.21 million tonnes/day, CSLPC quoted the data from CISA.

During May, the sub-index of Chinese steel mills' raw materials procurement prices jumped for the second month, soaring by 21.6 points on month to 77.5, mainly driven by higher steel production and positive market outlook, CSLPC remarked.

Prices of iron ore continued the upward momentum despite a slow pace, coke prices stayed largely stable, and steel scrap prices rose fast on tight supplies, the committee elaborated.

Looking towards June, "China's overall demand will source some support from intensifying pro-growth policies, while it may also be moderately constrained by hot and rainy weather," CSLPC suggested.

"Steel production may increase further, but raw materials prices may soften in general due to high iron ore stocks at ports," it warned, predating that finished steel prices would retreat next month on imbalanced demand and supply.

Source:Mysteel Global