Posted on 26 Apr 2024

Introduction

During the 2023 ASEAN Sustainability and Construction Forum, the SG’s presentation included a slide that highlighted the drive for the Steel industry to invest in a green future is only starting.

On the one hand, it is encouraging to see decarbonisation efforts moving forward. On the other hand, it also means that the technologies are still new and are not fully commercially viable yet. The viability of such projects depends on a myriad of factors, which may not be applicable in ASEAN.

If investments are not feasible yet, then what will come up first?

What is Carbon Pricing?

Carbon pricing is putting a price on carbon and this can be set in the following ways:

Carbon pricing is gaining interest in ASEAN and many other countries, which will see the introduction of Carbon Tax and Emissions Trading System over the next few years.

CBAM

One of the major influences on countries to introduce carbon is the European Carbon Border Adjustment Mechanism (CBAM). CBAM, currently in the transition phase, requires documentations of imports into Europe to declare embedded carbon in imported goods. Starting January 2026, importers in Europe will have to pay for embedded carbon in imported goods.

Rather than to have potential revenues being fully taxed by the European Union (EU), exporting countries would be considering how to introduce carbon tax to maximise tax collected instead allowing potential tax revenue to be charged by the EU.

State of Carbon Pricing in ASEAN?

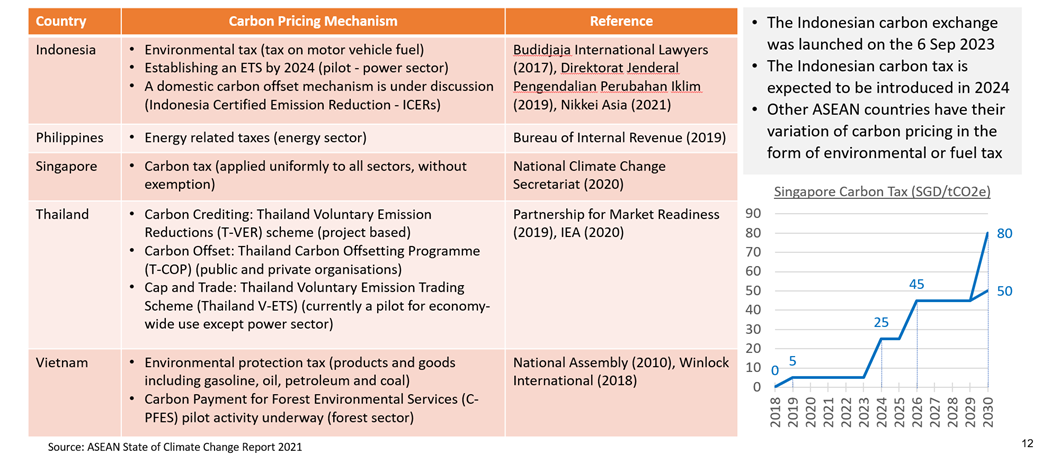

ASEAN countries already have some form of carbon pricing, in the form of fuel, environmental and energy tax and other mechanisms (Figure 1). Lately, there is a shift towards carbon tax and emissions trading.

So far only Singapore has introduced carbon tax for emissions. From SGD 5/tCO23 (USD 3.72) in 2019, it is now SGD 25/tCO2e (USD 18.6). It will reach SGD 45/tCO2e (USD 33.50) in 2026. By 2030, carbon tax in reach SGD 50-80/tCO2e (USD 37.22 - 59.56).

In June 2023, Singapore launched a carbon exchange. Climate Impact X (CIX) is a joint venture among Singapore Exchange (SGX), public investor Temasek Holdings and two financial institutions, DBS and Standard Chartered Bank.

Indonesia will start implementing their carbon tax this year (2024). The Indonesian carbon exchange has been officially launched on 26 September 2023.

Thailand has voluntary cap and trade emission systems in place, with various carbon crediting schemes.

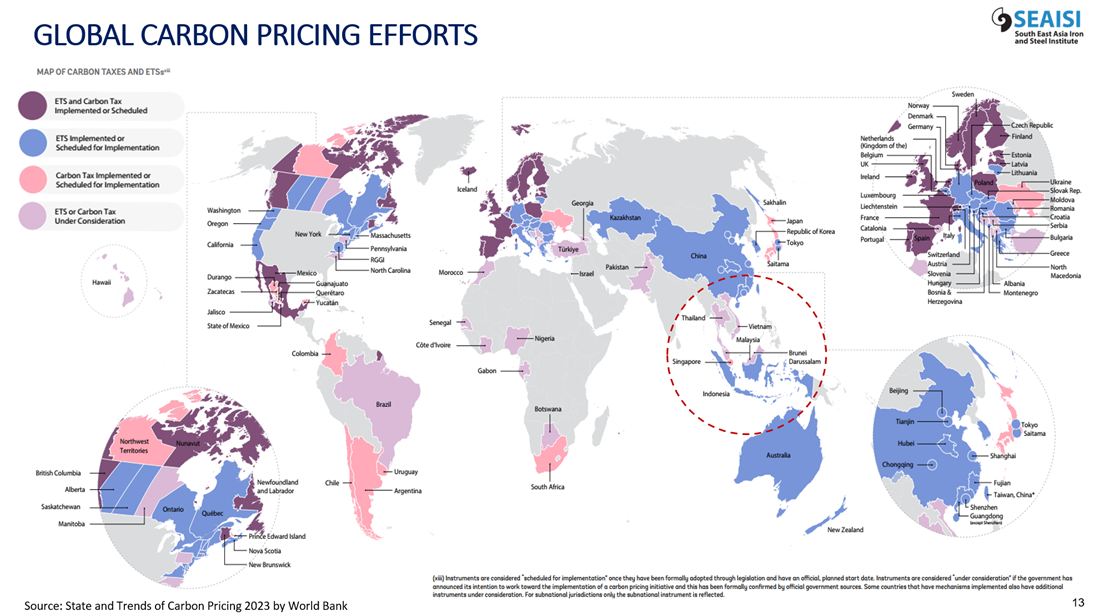

According to World Bank, Malaysia, Thailand and Vietnam are considering either carbon tax or an emission trading system or both (Figure 2).

Implications to the ASEAN Steel Industry

Carbon tax and emissions trading is expected to arrive in various ASEAN countries (if not yet introduced) around the time that the EU CBAM Starts.

1. Start Measurements with Detailed Breakdowns

To get ready for this, steel producers (and other high emitters), should start to measure their GHG emissions accordingly. Due to inconsistency in applications globally, there is a need to measure with more detail breakdowns, so that the measurements can fit into the requirements of various countries. Some of the details needed may include separate measurements for Scopes 1, 2 & 3 and carbon dioxide and other GHG.

For example, the EU ETS currently requires the measurement of Scope 1 emissions only. Carbon trading in CIX includes Scopes 1, 2 and 3. The EU ETS covers carbon dioxide emissions only for the steel industry, while both CIX and the Indonesian carbon exchange include all greenhouse gas (GHG) emissions.

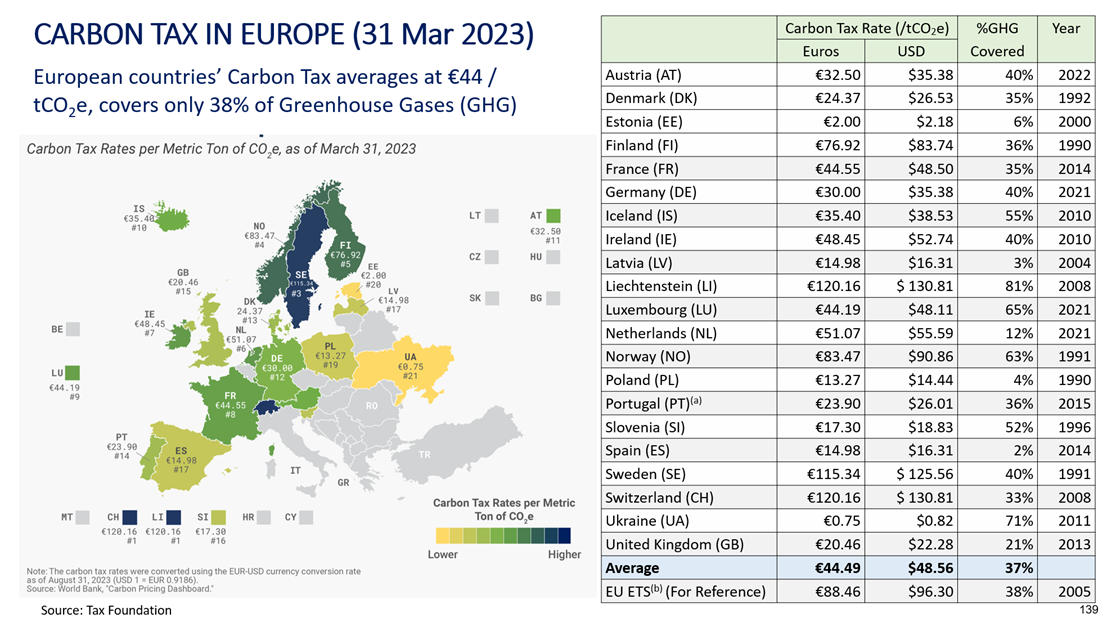

Carbon tax amount and GHG coverage also vary across the EU (Figure 3). Liechtenstein’s carbon tax is the highest in Europe at USD 130.81/tCO2e covering 81% of its GHG generated. On the other hand, Germany’s USD 35.38/tCO2e carbon covers only 40% of its GHG emissions and their carbon tax was only implemented in 2021. Spain’s carbon tax of USD 16.31/tCO2e only covers 2% of their total emissions.

2. Prepare a Decarbonisation Strategy

Set up a short, medium and long term plan to decarbonise operations, starting from improving internal operations (efficiency, energy savings, low carbon material inputs), to building strategic partnership (green energy, green materials, technology, R&D) and eventually investing in decarbonisation technology while phasing out high carbon processes and operations.

Decarbonisation is long journey, requiring the strategic plan to be flexible and adaptable to changing market conditions, technological advancements and regulatory landscapes.

3. Advocate for a Local CBAM

Among the reasons why it is not feasible to invest in new technologies is the danger of carbon leakage. A carbon tax or emissions trading regime renders the local company uncompetitive against imports that do not have to comply to carbon pricing. Without the protection against carbon leakage, investment for decarbonisation cannot happen. Investors should be wary when investing in countries that do not protect the investment from carbon leakage while imposing carbon pricing on the investment.

The United Kingdom will implement their CBAM in 2027. Australia will decide on a CBAM sometime Q3 2024.

*****

Stay Healthy. Stay Safe.

See You at SEAISI Events.

*****

FIGURE 1: CARBON PRICING IN ASEAN

FIGURE 2: GLOBAL CARBON PRICING EFFORTS

FIGURE 3: VARYING CARBON TAX AND GHG COVERAGE IN EUROPE

Source:SEAISI