Posted on 19 Apr 2024

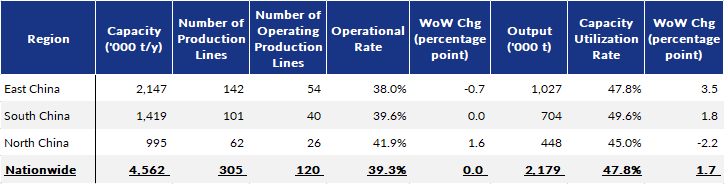

Rebar production among the 137 Chinese steelmakers regularly tracked by Mysteel bounced back over April 11-17, rising by 3.8% or 79,200 tonnes on week to reach 2.18 million tonnes, the latest weekly survey showed. The tonnage was still lower by a substantial 26% than the same period last year, the data found.

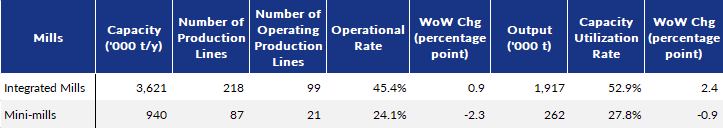

The rebound in rebar output during the recent survey period mainly reflected in integrated mills as they either resumed operations or extended production time after their profit margins had improved, and those located in East China witnessed significant production rises in the past week, according to survey respondents.

Over the survey week, the rebar rolling capacity utilization rate among these surveyed mills climbed by 1.7 percentage points on week to 47.8%, while their operational rate stayed unchanged on week at 39.3%, Mysteel's data showed.

On the demand side, the daily trading volume of construction steel including rebar, wire rod and bar-in-coil among the 237 trading houses nationwide under Mysteel's other tracking saw a slight uptick of 2.2% or 3,605 tonnes/day on week to average 163,910 t/d over April 12-18.

Meanwhile, China's national price of the HRB400E 20mm dia rebar, under Mysteel's assessment, leapt by Yuan 124/tonne ($17.1/t) on week to hit a one-month high of Yuan 3,805/t and including the 13% VAT as of April 18. The spot rebar prices were partly propped up by rising raw material costs, sources said.

For example, Mysteel SEADEX 62% Australian Fines for imported iron ore had gained by $8.75/dmt on week to $117.25/dmt CFR Qingdao by April 18, refreshing a one-month high.

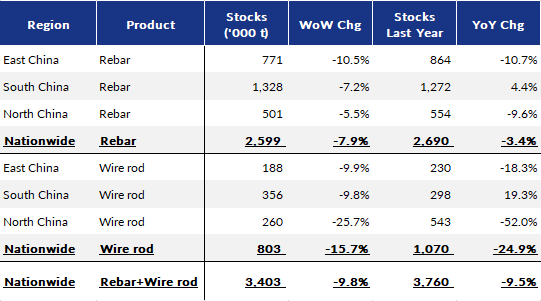

As for rebar stocks, the tonnage at the 137 steel mills declined for the fifth successive week, down 7.9% or 221,800 tonnes on week to 2.6 million tonnes as of April 17, while the volume held at commercial warehouses in the 35 Chinese cities Mysteel monitors also thinned for the sixth week, down 5.2% or 415,300 tonnes on week to 7.5 million tonnes as of April 18.

"As a whole, the steel market fundamentals are resilient currently, and the destocking pace of steel inventories appears steady," said a survey respondent.

Table 1: Rebar Production Survey by Region by Apr 17

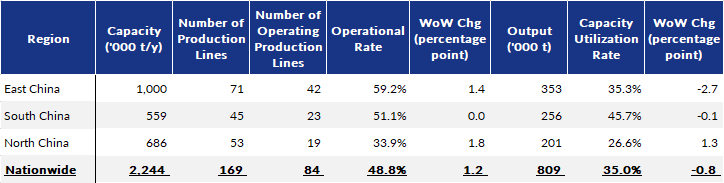

Table 2: Wire Rod Production Survey by Region by Apr 17

Table 3: Rebar Production Survey by Process by Apr 17

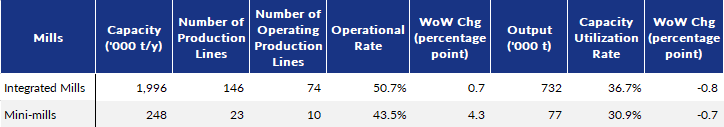

Table 4: Wire Rod Production Survey by Process by Apr 17

Table 5: Mills' Rebar and Wire Rod Stocks by Region by Apr 17

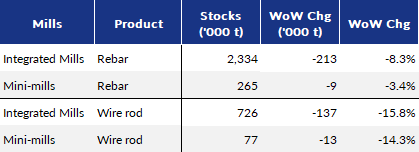

Table 6: Rebar and Wire Rod Stocks Survey by Process by Apr 17

Source:Mysteel Global