Posted on 16 Apr 2024

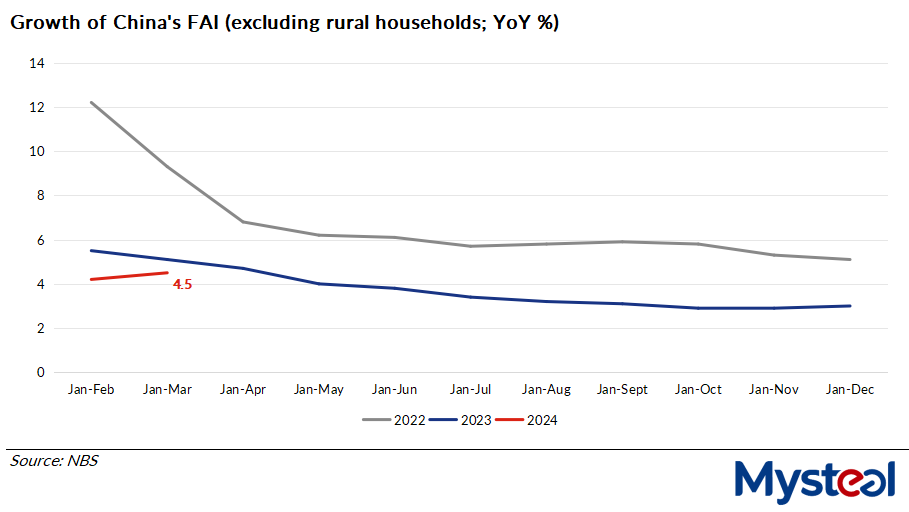

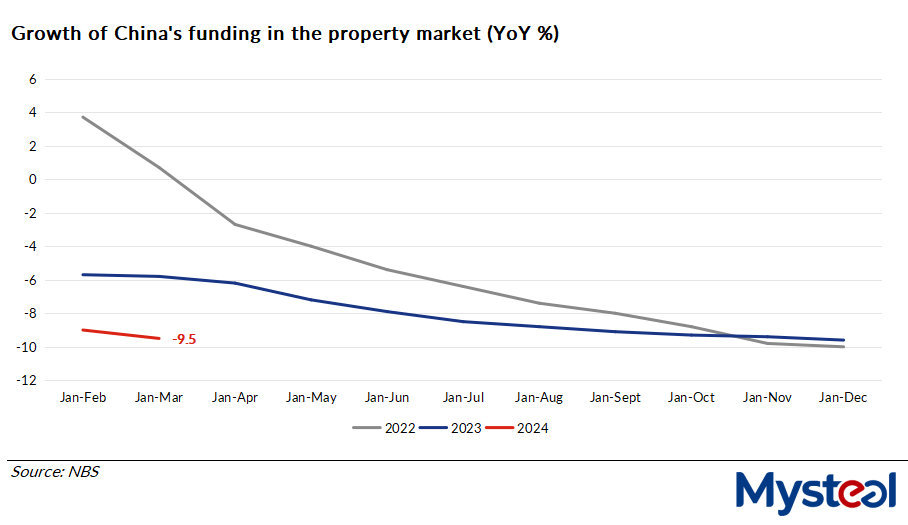

China's fixed asset investment (FAI) increased by 4.5% on year to total Yuan 10 trillion ($1.38 trillion) over January-March, according to the latest release by the country's National Bureau of Statistics (NBS) on Tuesday morning. Within the total, the funding in the domestic property market declined by 9.5% on year to Yuan 2.21 trillion.

In the first quarter, China's privately-owned enterprises contributed Yuan 5.16 trillion or 51.58% of the country's total FAI, gaining 0.5% from the same period last year. The tertiary industry attracted the most funding among the three economic sectors, with the amount higher by 0.8% on year to reach Yuan 6.5 trillion. Meanwhile, the funding in infrastructure construction also rose by 6.5% on year, according to the NBS data.

As for the property sector, about Yuan 1.66 trillion in the country's total funding in it went into residential housing projects in Q1, or 10.5% lower on year.

Over January-March, the total area of China's newly-launched property projects slumped by 27.8% on year to 172.83 million sq m, with residential housing projects losing 28.7% on year to 125.34 million sq m.

Meanwhile, China's property sales by floor area amounted to 226.68 million sq m in Q1, down by 19.4% from the same period last year, among which residential housing sales also dropped by 23.4% on year.

By region, East China ranked the top with property sales of 101.92 million sq m in the past three months, but its sales volume moved lower too by 17.1% on year, the NBS data showed.

By end-March, inventories in the Chinese property market climbed by 15.6% on year to 748.33 million sq m, and the country's property market climate index remained in the negative zone at 92.07, as against 92.13 by end-February.

Source:Mysteel Global