Posted on 02 Apr 2024

The continuous weakeningof futures prices of China's major ferrous commodities last week saw pessimistic sentiment pervadein the country's market for hot-rolled coils, with downstream buying stagnating and spot prices of the flat product dropping, new Mysteel data show.

The most-traded HRC futures contract for May delivery on the Shanghai Futures Exchange closed at Yuan 3,625/tonne ($501.4/t) when the daytime trading session ended on March 29, down by Yuan 197/t or 5.2% from the March 22 settlement price and making for the fifth trading-day slide.

In tandem, China's spot price of Q235 4.75mm hot-rolled coil under Mysteel's assessment had dropped by Yuan 122/t or 3.2% on week to Yuan 3,743/t including the VAT on March 29, its lowest since early June 2020.

After noting that hot coil prices were steadily softening last week, buyers responded by purchasing just as much as needed to meet their immediate demand. Consequently, as of March 28 HRC stocks at commercial warehouses in the 33 Chinese cities under Mysteel's tracking had inched up again by 0.6% on week to 3.41 million tonnes and ending the previous week's short-lived decline.

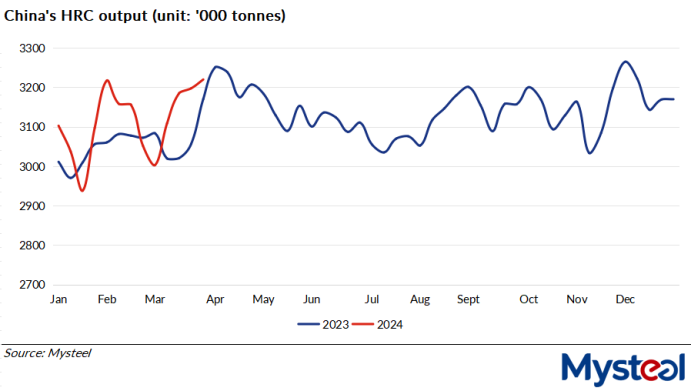

On the other hand, some steel producers in North, East and Central China resumed operations after completing maintenance stoppages last week, resulting in an on-week rise in HRC output, with the tonnage produced by the 37 Chinese flat steelmakers Mysteel regularly monitors edging up by 0.7% on week during March 25-29 to 3.22 million tonnes.

Accordingly, the hot-rolling capacity utilization rate among the 37 mills also ticked up for 0.57 percentage points on week to average 82.26% last week, the survey found.

Meanwhile, mills in North and East China maintained their normal delivery pace of HRC last week, causing HRC stocks at the 37 surveyed mills to fall to 900,300 tonnes as of March 28, lower by 2.7% on week.

Source:Mysteel Global