Posted on 21 Mar 2024

After experiencing a sharp drop in the first half of March, Chinese spot prices for cold-rolled coil (CRC) are likely to gradually stabilize later this month and rebound in April, Mysteel predicts in its latest report on the steel type, noting that CRC fundamentals are being shored up by recovering downstream demand for the flat product and destocking by steelmakers and traders.

Usually, China's CRC market performs relatively strongly after the Chinese New Year (CNY) holiday, when market participants generally hope to make a good start for the new year.

However, the looseness of stocks and weak downstream demand this year have broken with that tradition and led CRC prices to keep trending south after the CNY holiday over February 10-17, Mysteel's report noted.

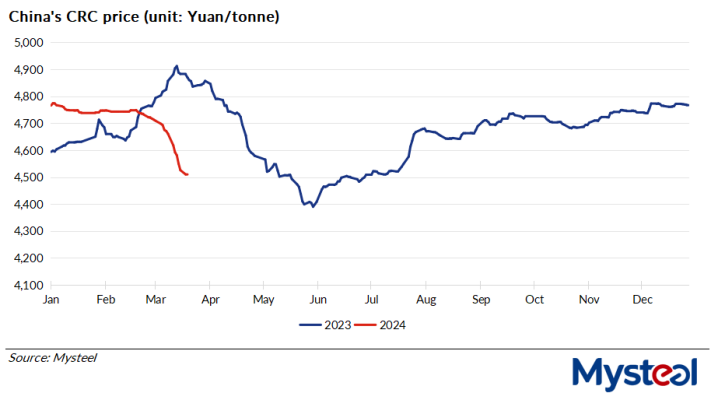

As of March 18, China's spot price of 1.0mm cold-rolled coil under Mysteel's assessment had declined for 20 consecutive working days to refresh a more-than-eight-month new low of Yuan 4,510/tonne ($626.5/t) including the VAT, dropping by Yuan 373/t or 7.6% on year.

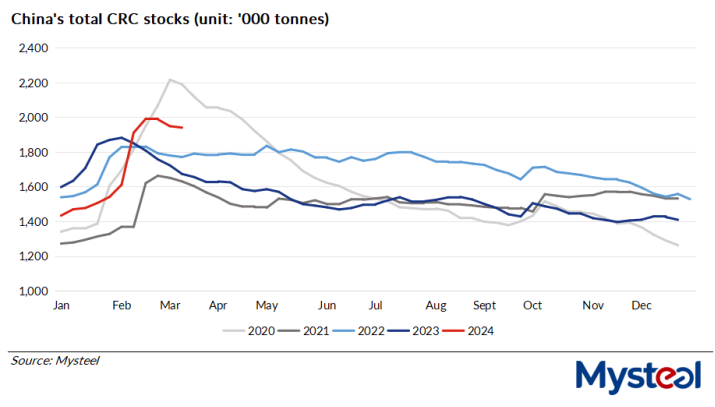

In fact, the two negative factors – swelling stocks and weak demand – continue to weigh on the cold coil market in March, usually a peak month for China's steel consumption including that for CRC, the report added.

For example, total CRC stocks at the 29 Chinese flat steel producers and commercial warehouses in the 26 Chinese cities Mysteel regularly monitors had climbed for eight straight weeks to reach 1.99 million tonnes as of February 23, touching nearly a four-year high.

But a price turning point seems to have come on March 19, when the futures prices of major ferrous commodities across China including rebar, hot-rolled coils and iron ore all rebounded from their previous declines.

The ferrous upswing saw China's spot price of 1.0mm cold-rolled coil end a steady downward slide and rise to Yuan 4,512/t on Tuesday, albeit by a tiny Yuan 2/t or 0.04% on day, according to Mysteel's tracking.

Entering April (another traditional peak month for China's steel consumption), the expected recovery in demand for cold coils from coated sheet producers and manufacturers may help maintain the positive price trend, Mysteel's report predicted.

China's automobile assembly and white goods manufacturing sectors were expected perform relatively strongly in the months ahead and give impetus to CRC consumption, the report explained.

Over January-February, nationwide sales of passenger vehicles totalled 3.13 million units, rising by 17% from the same period last year, the latest data from the China Passenger Car Association showed.

Meanwhile, total production of four major home appliances produced in China – air-conditioners, washing machines, refrigerators and televisions – topped 92.9 million units over January-February, higher from 9.5% on year, the latest data from China's National Bureau of Statistics show.

Moreover, the total scheduled production of the three major white goods – air-conditioners, washers and fridges – is estimated at 36.94 million units for March, higher by 17.3% from the actual output in March 2023, according to new data from ChinaIOL.com, a leading domestic information provider serving the home appliance and refrigeration industries.

Besides, sentiment in the automobile and home appliance industries has also been buoyed recently by the central government's action plan, announced in mid-March, to encourage large-scale equipment renewals and replacements of consumer goods including vehicles and household appliances, as reported. The upgrading campaign should also stimulate consumption of CRC, the report notes.

In parallel, the gradual drawdown of cold coil stocks held by steelmakers and traders may also help support CRC prices next month, Mysteel predicts in the report.

As of March 15, total CRC inventories at the sampled 29 mills and commercial warehouses in the 26 cities Mysteel regularly monitors had eased for three consecutive weeks to sit at 1.94 million tonnes, lower by 2.5% from its previous high in late February, Mysteel's tracking showed.

Source:Mysteel Global