Posted on 20 Mar 2024

China's property sector is grappling with tight financial liquidity, and the woes now have a chilling effect on new project investment and drag the national economic growth in the big picture, according to Mysteel's report. The ongoing fund crunch within this struggling sector will exert sustained pressure on domestic steel demand, particularly for long steel items, throughout 2024, the report predicts.

Despite China's concerted efforts to revitalize the real estate market, its home sales growth has remained sluggish and improvements in the financing of domestic real estate developers have been limited. These challenges may see cash-strapped developers in China continue to suffer this year, Mysteel elaborates.

Data from the country's National Bureau of Statistics (NBS) show a continuous downturn in China's property sales by floor area, with a 20.5% on-year tumble to 113.7 million sq m over January-February.

Data from the country's National Bureau of Statistics (NBS) show a continuous downturn in China's property sales by floor area, with a 20.5% on-year tumble to 113.7 million sq m over January-February.

In 2024, the primary objective for Chinese real estate developers will remain ensuring the smooth delivery of both new and ongoing housing projects, as indicated in the report. The NBS data suggest that last year, the total area of completed property projects in China rose by 17% on year to 998.3 million sq m.

The report estimates the floor area of completed property projects in China for this year to largely mirror that of 2023, reaching 1.001 billion sq m, provided the rate of home delivery rises to 75%.

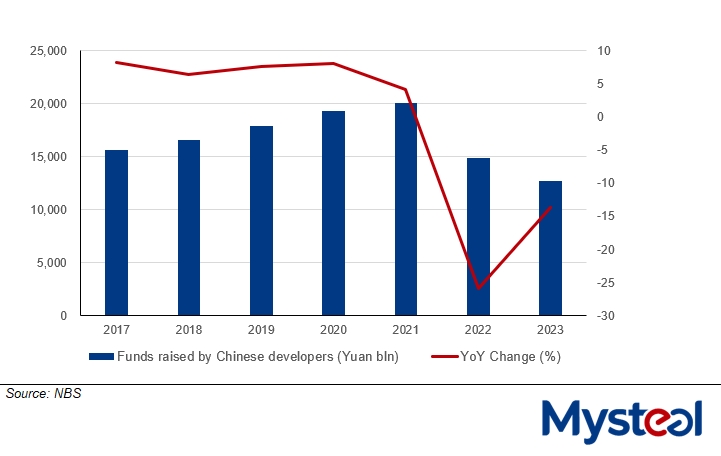

On the other hand, the continual decline in funds raised by property firms has led to a slowdown in investment activities. Total funds raised by Chinese property developers slipped by 13.6% on year to Yuan 12.7 trillion ($1.8 trillion) in 2023, and their investments dropped by 16.5% on year to Yuan 1.11 trillion in tandem, NBS data show. The decline in investments enlarged by 6.5 percentage points compared to the previous year, Mysteel notes.

So far this year, both the demand and supply sides of the domestic property sector have shown lackluster performance. Despite the relaxation of home purchase restrictions in many Chinese cities, the central bank's further cut in long-term lending rates, and lowered thresholds for first-home buying, most customers remain unswayed considering the fragile industry, the report observes.

Citing the latest statistics from China Real Estate Information Corp (CRIC), a leading provider of real estate information in China, the report notes that both home sales and housing supplies witnessed a decline of more than 40% on month in February this year.

The prevailing lack of confidence among domestic developers has stifled their motivation to launch new projects, while sluggish home sales indicate a feeble response from buyers to stimulus measures, according to the report.

To prop up the financing of property developers, Chinese authorities have rolled out a range of supportive policies since the second half of last year, including the implementation of a so-called "project whitelist" mechanism. This mechanism aims to direct funds from banks into local residential projects eligible for financial support.

By end-February, 276 cities nationwide had established the "project whitelist" mechanism, with approximately 6,000 home projects deemed eligible for financing support, according to the Ministry of Housing and Urban-Rural Development.

The liquidity squeeze in the property market has moderated somewhat, with total bond financing reaching Yuan 87.98 billion over January-February, as cited in the report by China Index Academy. Additionally, the average interest rate for bond financing in February stood at 3.29%, marking a decline of 0.84 percentage point on year and indicating a downward trend in financing costs.

China's property financing over Jan-Feb

| Yuan bln | YoY Change |

Credit bonds | 59.64 | -9.3% |

Foreign bonds | 1.16 | -86.8% |

ABS | 27.18 | 11.3% |

Totals | 87.98 | -11.1% |

Source: CREIS

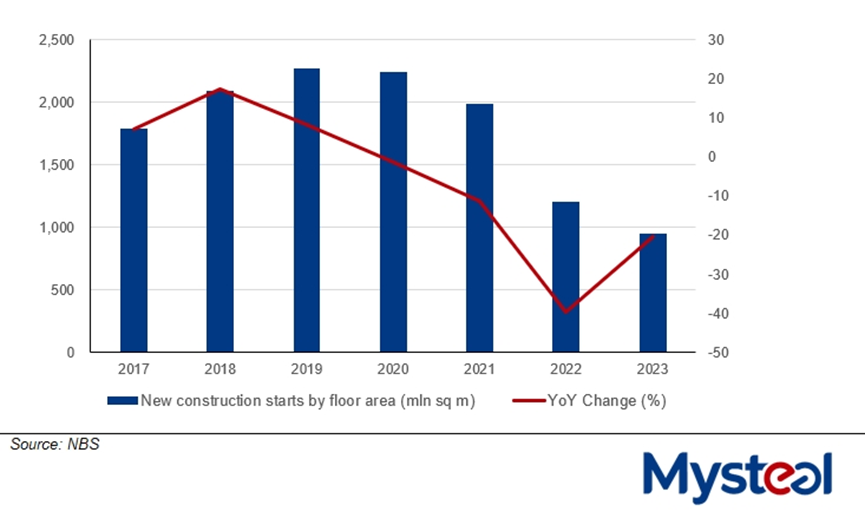

In view of all these, the report forecasts that new construction starts and buildings under construction in China this year are likely to remain subdued. Consequently, demand for long steel products in the beleaguered housing sector is expected to remain sluggish, persisting at a low level.

Source:Mysteel Global