Posted on 05 Mar 2024

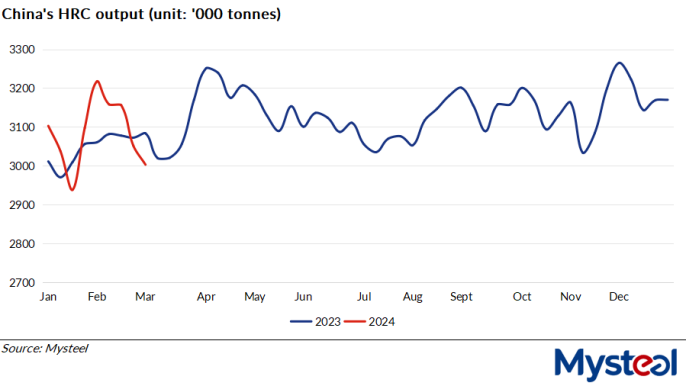

Production of hot-rolled coils (HRC) among 37 Chinese flat steel producers under Mysteel's survey reached 3 million tonnes over February 26 - March 1, down for the second week by another 48,900 tonnes or 1.6% on week. And the hot-rolling capacity utilization rate among these mills also decreased by 1.25 percentage points on week to average 76.72% last week.

Behind the decline in HRC output was the fact that some steel producers in Northeast China conducted maintenance on their steelmaking facilities during the period, survey respondents said.

Behind the decline in HRC output was the fact that some steel producers in Northeast China conducted maintenance on their steelmaking facilities during the period, survey respondents said.

In parallel, logistics services across China were continuing to recover after the Lantern Festival ended on February 24, prompting many mills to resume their HRC deliveries last week, market watchers observed.

Lower output and faster delivery paces led HRC stocks at 37 surveyed mills to fall during the latest survey week, with the tonnage losing 2.3% on week to reach 963,900 tonnes as of February 29, ending the previous four weeks' rises.

However, inventories of the flat product at commercial warehouses in 33 cities under Mysteel's tracking continued to mount on week, though at a slower pace of 3.1% to 3.4 million tonnes as of February 29. This indicated the gradual recovery in downstream demand for hot coils across China following the holidays.

On the other hand, Chinese prices of hot coils in both spot and futures markets declined further last week. As of March 1, the spot price of Q235 4.75mm hot-rolled coil under Mysteel's assessment was at Yuan 4,038/t ($560.9/t) including the VAT, lower by Yuan 18/t or 0.44% on week.

Also on March 1, the most-traded HRC futures contract for May delivery on Shanghai Futures Exchange closed the daytime trading session at Yuan 3,885/t, losing Yuan 26/t or 0.66% from the settlement price on February 23.

Source:Mysteel Global