Posted on 26 Feb 2024

Finished steel stocks held by traders across China under Mysteel's survey increased further during the first week after the Chinese New Year (CNY) holiday, with the tonnage rising by 11.4% on week to a near two-year high of 27 million tonnes as of February 22, the latest survey data show. Actual demand has yet to show signs of picking up, survey respondents indicated.

A market source attributed the slow recovery in steel demand to the fact that most construction sites remain idle as labourers usually resume work after the Chinese Lantern Festival on February 24. Meanwhile, the pace of operations among enterprises in the manufacturing sector has yet to quicken.

In addition, the cold wave hitting many parts of the country – characterised by with steep temperature drops, heavy rains and blizzards – will be causing delays to the restart of operations among end-users, the source added.

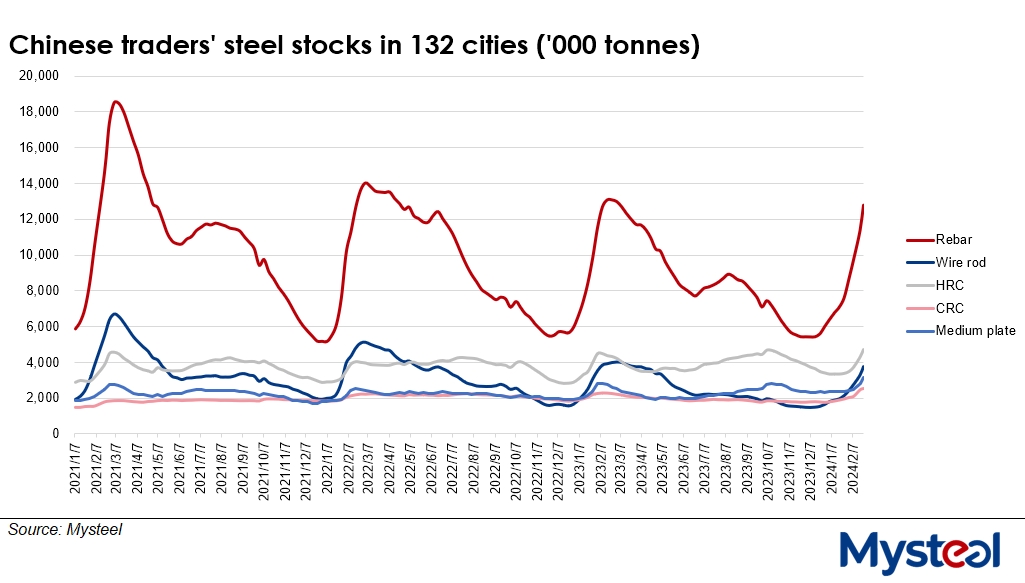

As of Thursday, retail inventories of rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate held by traders in the 132 cities tracked by Mysteel had grown by 2.8 million tonnes on week to reach the highest since late December last year.

Stocks of rebar and wire rod mounted the most, swelling by 1.4 million tonnes and 469,100 tonnes on week to 12.8 million tonnes and 3.8 million tonnes respectively by February 22, the survey showed.

On the other hand, domestic steel mills showed no enthusiasm for ramping up output due to low demand and profit losses on steel sales. In fact, over February 15-21, the total output of the five steel items at the 184 Chinese steel mills Mysteel checks declined by 1% or 83,600 tonnes on week to 7.96 million tonnes and making for the fourth straight on-week fall.

China's national price of HRB400E 20mm dia rebar was assessed by Mysteel at Yuan 4,024/tonne ($560/t) and including the 13% VAT on February 21, down by Yuan 7/t from February 9, the last working day before the CNY holiday.

Meanwhile, the inventories of five finished steel products in Mysteel's former smaller sample across just 35 cities moved up further by 11.9% or 1.7 million tonnes on week to 16.2 million tonnes as of February 22.

Source:Mysteel Global