Posted on 31 Jan 2024

China's domestic steel prices are likely to stay largely rangebound in February against the backdrop of improved market expectations and weak reality, Wang Jianhua, Mysteel's chief analyst, predicted in his latest monthly outlook published on January 31.

As of January 30, China's national composite steel price was assessed by Mysteel at Yuan 4,235.7/tonne ($590/t), falling by Yuan 16.2/t on month.

Wang cited positive indicators including a 16.8% on-year gain in profits of the country's sizable industrial firms last December, as reported by the National Bureau of Statistics. The rise in profits is expected to boost these industrial firms' enthusiasm for expanding economic activities in February, he said.

Wang cited positive indicators including a 16.8% on-year gain in profits of the country's sizable industrial firms last December, as reported by the National Bureau of Statistics. The rise in profits is expected to boost these industrial firms' enthusiasm for expanding economic activities in February, he said.

Another contributing factor to the market dynamics is the upcoming 0.5 percentage point reduction in the reserve requirement ratio by China's central bank on February 5, Wang highlighted. This move, which would inject Yuan 1 trillion into the market, is anticipated to alleviate liquidity pressure and provide support for the production and operations of Chinese enterprises.

With the support policies gradually taking effect, Wang expected concerns among market participants to subside, fostering a positive atmosphere for the rebound of domestic steel prices.

However, he cautioned that the eight-day Chinese New Year (CNY) holiday in February might lead to relatively subdued spot trading in the domestic steel market. Additionally, he advised vigilance against the potential rise of risk aversion sentiment during this period.

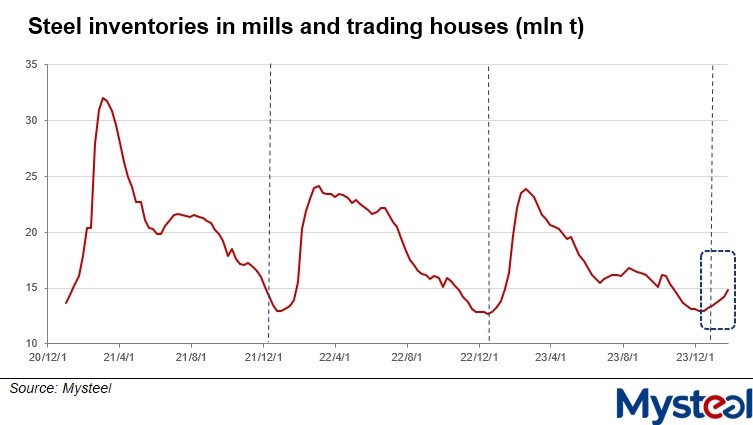

When addressing a critical issue concerning the build-up in steel stocks, Wang acknowledged that "many people hold the view that the steel inventories during and post the (CNY) holiday may keep accumulating at a fast pace, and they believe this has been a significant factor suppressing the rebound of spot steel prices recently."

Mysteel's tracking data showed as of January 25, inventories of the five major carbon steel products – rebar, wire rod, hot-rolled coil, cold-rolled coil, and medium plate - held by the 184 steelmakers nationwide and at the trading houses in 35 Chinese cities added up to 14.8 million tonnes, higher by a large 1.5 million tonnes on month and registering the sixth monthly rise in a row.

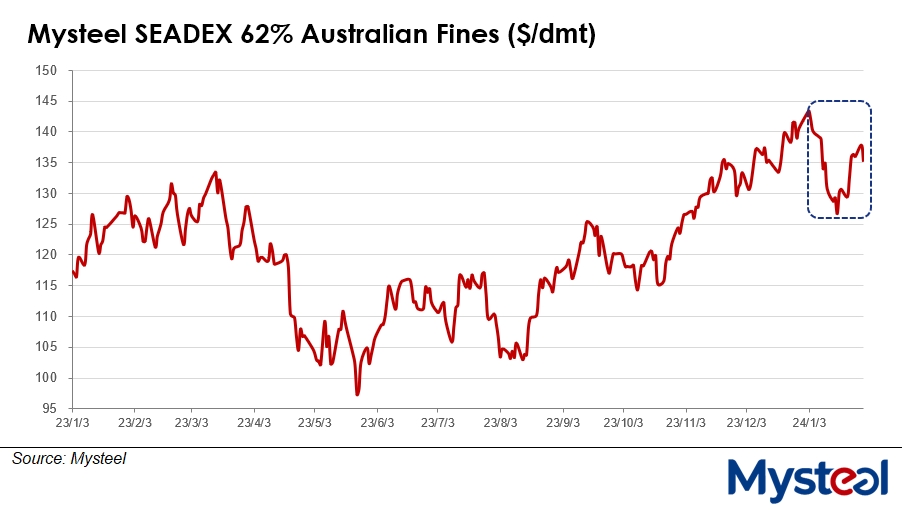

Moreover, the mismatch between the economic and the steel industry cycles, together with poor synergy within the steel industry, has led to prolonged iron ore premium prices. In particular, Chinese steel mills have been substantially replenishing their ore stocks at high price levels for an extended period, Wang emphasized.

Moreover, the mismatch between the economic and the steel industry cycles, together with poor synergy within the steel industry, has led to prolonged iron ore premium prices. In particular, Chinese steel mills have been substantially replenishing their ore stocks at high price levels for an extended period, Wang emphasized.

Mysteel SEADEX 62% Australian Fines for iron ore prices, for example, came in at a high level of $135.15/dmt CFR Qingdao on January 30, or rising by $5.7/dmt from a year earlier.

Wang expressed his hope that a return to rationality in steelmaking raw material prices, especially for overvalued iron ore, before the CNY holiday, could positively impact the post-holiday steel market.

Wang expressed his hope that a return to rationality in steelmaking raw material prices, especially for overvalued iron ore, before the CNY holiday, could positively impact the post-holiday steel market.

Source:Mysteel Global