Posted on 26 Jan 2024

Finished steel inventories at trading warehouses across China under Mysteel's tracking increased for the sixth consecutive week over January 19-25 as the Chinese New Year break starting on February 10 is just two weeks away and more steel users are in holiday mode, according to the latest survey. The pace of stocks accumulation at the warehouses quickened to 4.8% from the 2.7% on-week rise in the prior period, the result showed.

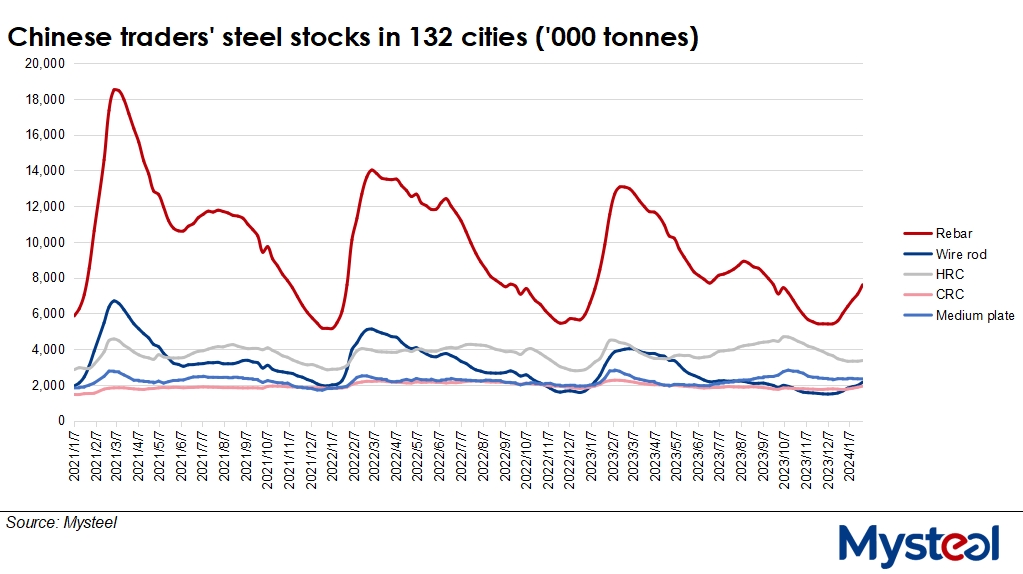

The total stocks of rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate among traders in 132 cities nationwide followed by Mysteel mounted further by 797,700 tonnes on week to hit a three-month high of 17.4 million tonnes as of January 25, the survey found.

Among the five steel items, the stocks of rebar and wire rod had the sharpest on-week gains, with those of the former soaring by 521,500 tonnes on week to a four-month high of 7.6 million tonnes by Thursday, while inventories of the latter had climbed by 179,200 tonnes on week to 2.2 million tonnes, a five-month high.

Behind the large build-up in retail stocks was also the weak demand in winter, the off-season for steel consumption, with the daily trading volume of construction steel including rebar, wire rod and bar-in-coil among the 237 trading houses Mysteel monitors slumping by 18.5% or 22,175 tonnes/day on week to average a small 97,447 t/d over January 18-24.

"At present, both domestic steel production and demand are weak, and the situation in the country's steel market has been impacted by macroeconomic factors and steelmakers' production costs," said a Shanghai-based source.

He said that domestic steel prices had shown signs of strengthening recently, resulting from a slight improvement in market sentiment and the rebound in raw materials prices. As of January 24, the country's national price of HRB400E 20mm dia rebar, for example, had moved up by Yuan 11/tonne ($1.5/t) on week to Yuan 4,036/t including the 13% VAT, according to Mysteel's assessment.

In tandem, Mysteel SEADEX 62% Australian Fines index for iron ore had climbed by $9.25/dmt to $135.95/dmt CFR Qingdao over the same period.

The inventories of finished steel products in Mysteel's former smaller sample in just 35 cities also surged for the fifth straight week, climbing for 5.2% or 512,400 tonnes on week to reach 10.4 million tonnes as of January 25, also a three-month high.

Source:Mysteel Global