Posted on 22 Jan 2024

The number of profitable steel mills in China declined further this week due to their high production costs and the persisting weakness of finished steel prices, Mysteel Global has learned.

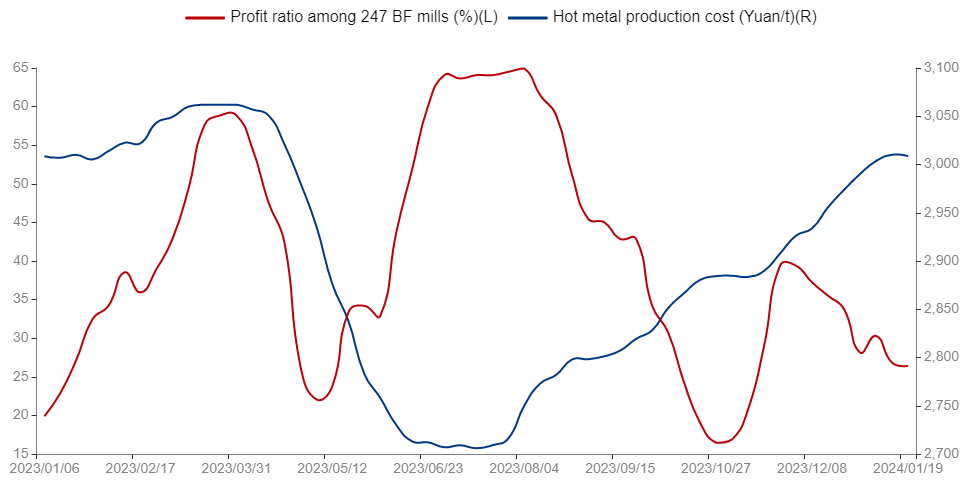

Mysteel's latest weekly survey showed that as of January 18, the profit ratio among the 247 blast furnace mills nationwide under its regular tracking had slipped to 26.41%, down another 0.43 percentage point on week and marking the lowest since mid-November.

Source: Mysteel

Domestic steelmakers' production costs have been hovering at a high level and squeezing their profit margins, survey respondents explained. Over January 12-18, the average cost of making hot metal among the 114 Chinese mills monitored by Mysteel was assessed at Yuan 3,009/tonne ($418/t) excluding the 13% VAT – still very high though costs had dipped by Yuan 1/t compared with the 9-month high the previous week.

However, another factor that respondents blamed for swallowing the profits of Chinese steel producers was that domestic steel prices have been heading south gradually with the slowing demand from users ahead of the Chinese New Year holiday in early February.

For example, the national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, was assessed by Mysteel at Yuan 4,022/t including the 13% VAT on January 18, lower by Yuan 15/t on week and touching the lowest since November 15.

Over January 12-18, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 traders under Mysteel's regular survey averaged 111,761 tonnes/day, sliding by 12,961 t/d or by a large 10.4% from the prior week.

Amid the shrinking profit margins and thin demand, many Chinese steel mills are slowing their production pace or conducting maintenance on their steelmaking facilities – both of which are leading to the continuous fall in their finished steel output, Mysteel Global noted.

Over January 11-17, total output of the five major steel products comprising rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate among the 184 Chinese steel mills under Mysteel's survey registered 8.55 million tonnes, down for the fifth straight week though at the faster pace of 1.6% on week, as against the dip of 0.8% over the previous week, as reported.

Source:Mysteel Global